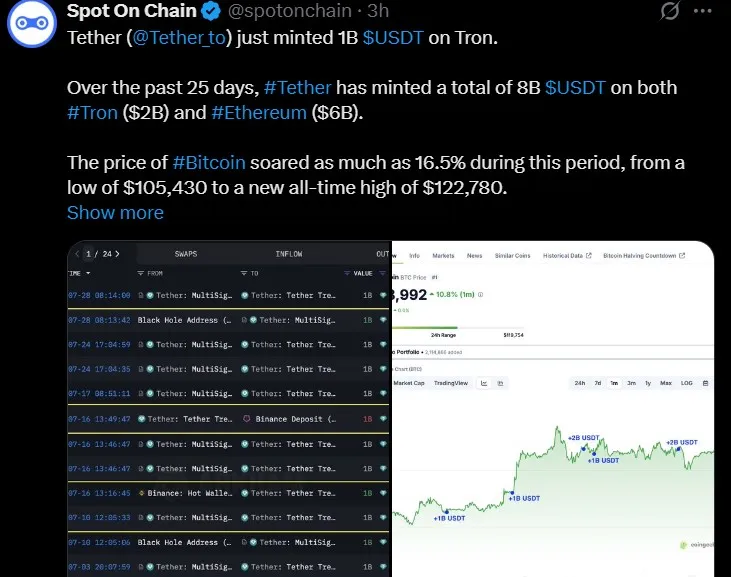

Tether is once again making headlines—minting another $1 billion USDT on Tron today, according to Spot On Chain. But this isn't one data. Over the past 25 days, Tether has minted USDT worth of $8 billion, including $6B on Ethereum and $2B on Tron.

This aggressive expansion in stablecoin supply has sparked intense speculation: Is this fueling the current Bitcoin rally and if yes then what’s the Tether mining impact on BTC?

Source: Spot On Chain

Historically, large-scale dollar-pegged token minting has been seen as an indicator to loaded Bitcoin price prediction $125K, especially when the new liquidity hits the market through exchanges or institutional desks.

During the exact same 25-day period of this massive USDT minting, token’s price jumped by 16.5%—from a low of $105,430 to an all-time high of $123,780.

In the latest bitcoin news today, this correlation doesn’t always mean causation, but this timing is hard to ignore.

From a crypto analyst’s perspective, when billions in fresh stablecoins enter circulation, they often act as “dry powder”—fuel that buyers (especially whales) use to accumulate this largest token and altcoins quickly without moving fiat.

Given that stablecoin’s issuance often aligns with major market moves, many believe this rally wasn't entirely organic. It might’ve been liquidity-fueled, with USDT as the launchpad. In fact this is exactly how a stablecoin like Tether mining affects btc.

As of writing, it trades around $118,000, up 1% in 24 hours. The 24h volume sits at $59.13B, up by 28.5%, showing renewed interest—but it’s not full-on FOMO yet.

Price analysis: Based on TradingView’s daily chart (OKX):

MACD: Bearish crossover — indicating short-term pressure

RSI: Cooling down from overbought (60.82)

Support: $117,200

Resistance: $120,000

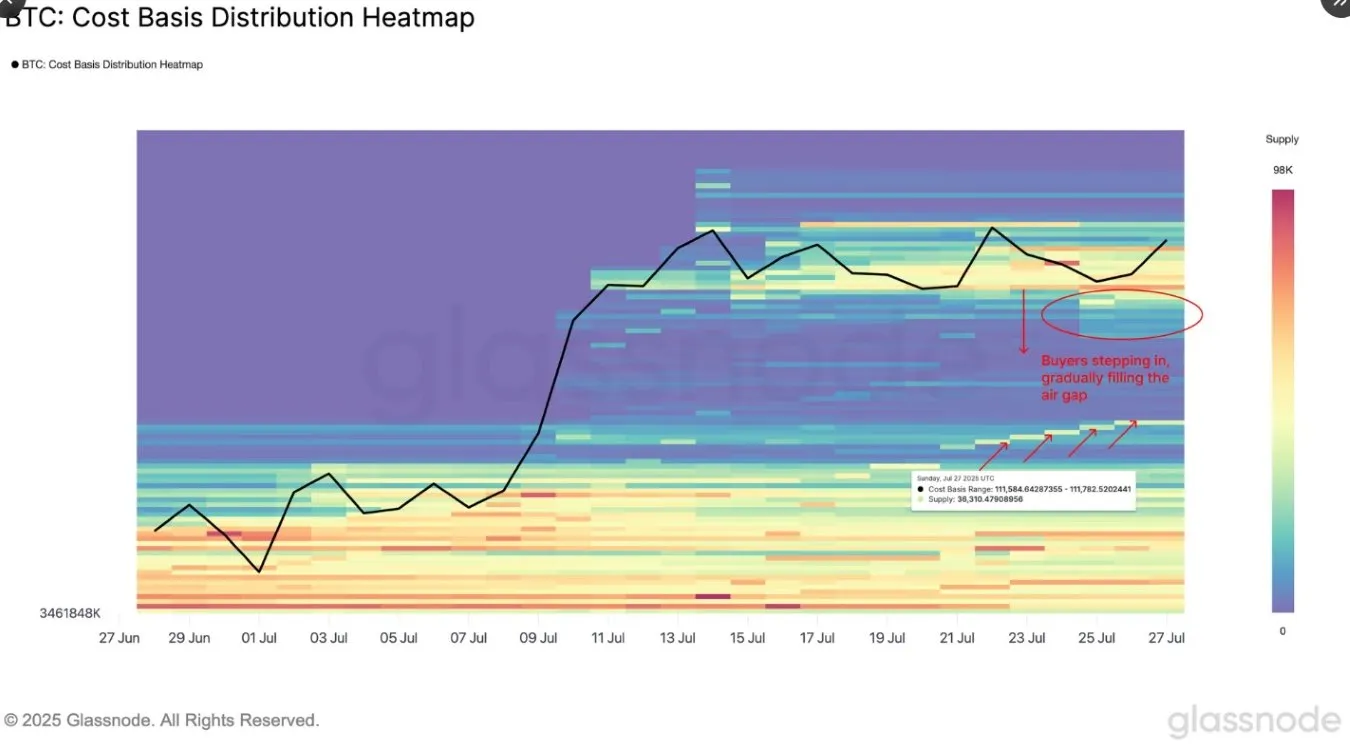

Glassnode data also confirms that it is being steadily accumulated. The $110K–$117K range is filling up like a cost-basis staircase—meaning investors are buying dips and holding strong for the bullish BTC next target.

If this trend continues and the resistance breaks, it will soon retest and even breach the Bitcoin price prediction $125K mark soon.

While this latest news stole the show today, $ETH price quietly surged 60% in the last month—now trading near $3,883.

Source: CoinMarketCap ETH 1 Month Chart

Why does this matter for BTC?

$6B in USDT was minted on Ethereum alone, injecting serious liquidity into altcoin markets.

Whale rotation is common—profits from ETH are often moved into this crypto king token once Ethereum consolidates.

Since ETH is the leading altcoin, its momentum usually triggers broader crypto market upswings, including the largest cryptocurrency.

So, ETH’s rally—backed by fresh Tether USDT—could very well be the underlying catalyst behind $BTC’s upward momentum.

Let’s connect the dots:

$8B in Tether minted = 16.5% BTC rally.

$1B more minted today—so what now?

If history is any guide, today’s USDT injection could continue pushing the world's largest cryptocurrency higher, especially if macro sentiment and exchange volume align.

With strong on-chain accumulation, steady support at $117K, and the Ethereum rally boosting confidence, Bitcoin price prediction $125K could be possible within weeks, not months.

Keep an eye on Tether’s minting wallet. Because in this market, where stablecoins go, Bitcoin often follows.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.