Why is this organisation buying so much ETH while markets remain cautious?

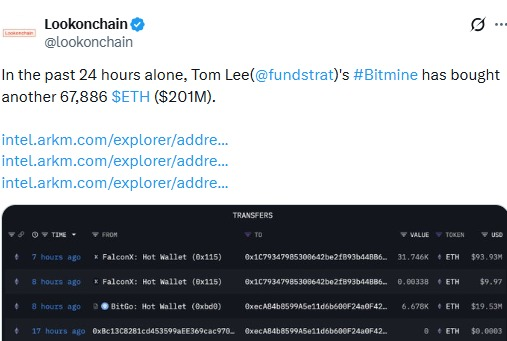

That question is gaining attention after Bitmine added $201 million worth of ether to its growing crypto reserves, pushing its holdings beyond 4.1 million ETH.

Chaired by Fundstrat co-founder Tom Lee, the firm is following a strategy similar to MicroStrategy’s bitcoin approach, but with Ethereum as its core asset.

As of December 22, the Bitmine Ethereum Treasury is valued at around $12.2 billion, even as ether prices remain under short-term pressure.

Source: X (formerly Twitter)

According to company disclosures and on-chain data, the organisation now holds 4,066,062 ETH, which equals roughly 3.37% of Ethereum’s total supply. Over just one week, the firm added 98,852 coins, including a notable purchase of 13,412 coins for $40.6 million on December 22.

The average purchase price for recent buys was around $2,991 per ether. These steady purchases have been tracked on-chain from platforms such as Kraken and BitGo, showing consistent accumulation rather than one-time buying.

Tom Lee said the company is making rapid progress toward its goal of owning 5% of all the supply of this token, a target he refers to as the “alchemy of 5%.”

Tom Lee remains strongly bullish on this digital asset’s long-term future. He has recently stated that this cryptocurrency could eventually reach $62,000, driven by institutional adoption, tokenization, and staking growth.

The Bitmine Ethereum Treasury plays a central role in this vision. The company began accumulating this crypto asset in June and became the world’s largest ETH treasury in less than six months. The company also plans to launch its staking infrastructure, called the Made in America Validator Network (MAVAN), in early 2026.

Lee believes the firm is helping bridge Wall Street and blockchain technology through Ethereum-based systems.

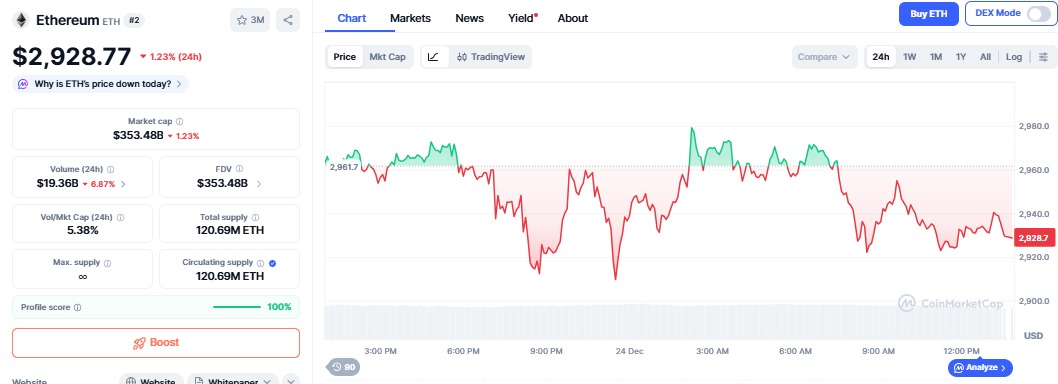

BMNR shares fell about 4%, closing near $29.78. The intraday chart shows a downward trend, suggesting short-term selling pressure as investors react cautiously to Ethereum price weakness, even as the organisation continues aggressive ETH accumulation.

According to CoinMarketCap, ETH fell more than 1% to $2,928, indicating that the market is still mixed on the notion of aggressive accumulation plans. The technical outlook indicates short-term dominance by sellers, despite mixed market fundamentals.

Source: CMC

The organisation has been supported by substantial institutional funding, such as ARK led by Cathie Wood, Pantera, Galaxy Digital, DCG, Kraken, and Founders Fund, and personal funding from Tom Lee himself.

As of December 21, Bitmine’s total crypto assets, cash, and “moonshot” assets were valued at $13.2 billion, of which $1 billion consisted of cash, smaller Bitcoin, and equity positions. The company will hold its annual shareholder meeting on January 15, 2026, in Las Vegas.

The huge increase in BMNR Treasury makes it clear that institutions are taking notices of and adopting the cryptocurrency on a serious level. Though market trends are fluctuating, Bitmine’s consistent buying pattern reconfirms that there is strong institutional conviction in holding Ether long-term.

Disclaimer: This article is for informational purposes only and does not constitute any financial advice, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.