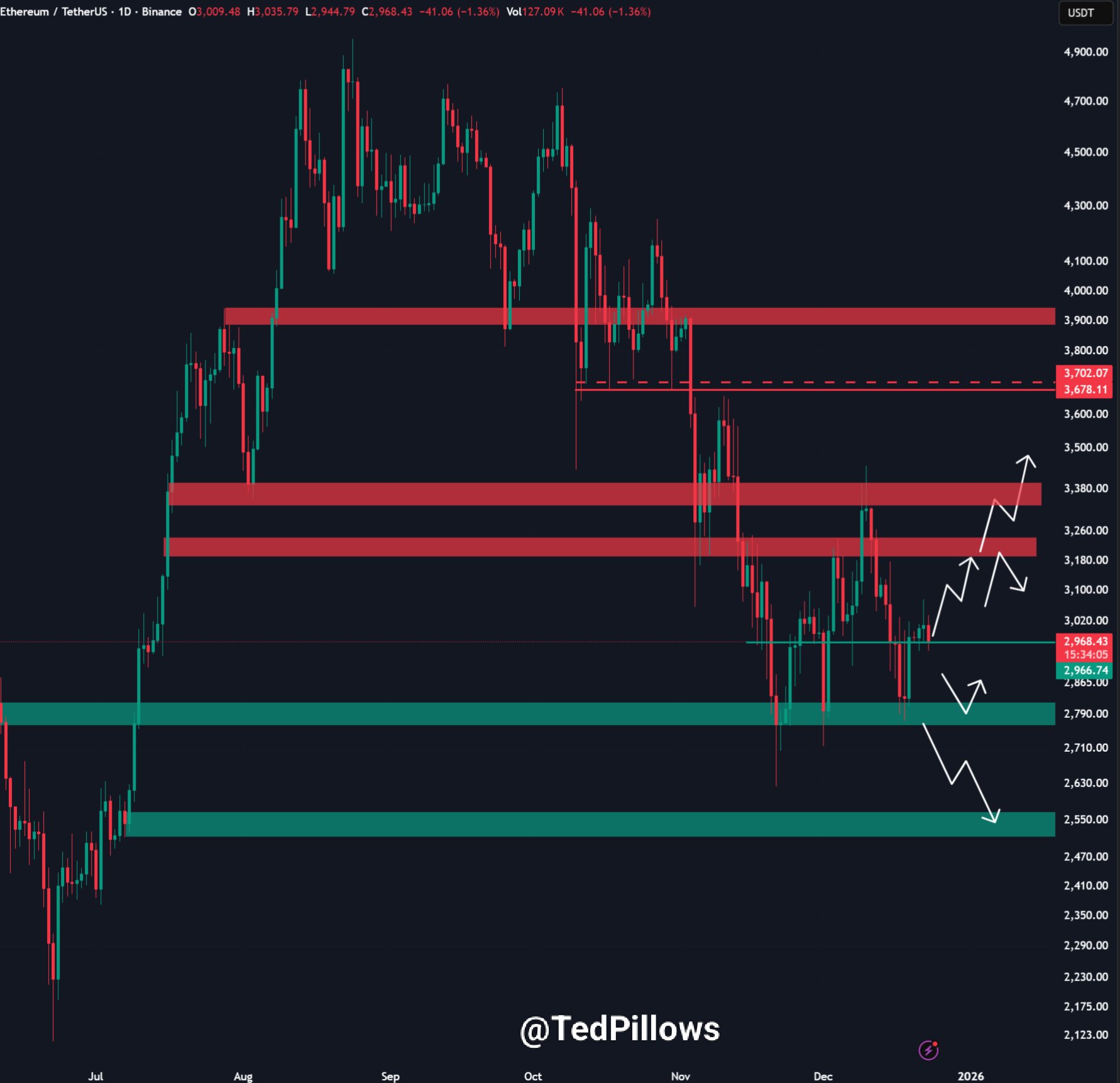

Ethereum price prediction remains cautious, as Ethereum has been under pressure for some time, and the chart clearly reflects that. Price tried to move up but could not hold and fell back again. While the aggressive selling has slowed recently, there is no clear sign that buyers have taken control.

On analyzing the ETH daily timeframe, Ethereum found support in an area it had taken support earlier, so a small upside movement is expected. The move is not strong enough to call it a reversal. Buyers are showing some interest near support, but the buying pressure is slow.

Ethereum price action shows that ETH tried to move back to the $3000 area but was unable to hold the levels. Price went up, faced resistance, and fell back again. The $3000 level is a strong resistance area, and buyers are having difficulty breaking through it.

Source: X@TedPillows

If the ETH price remains below this zone, the next area to watch sits around $2,700–$2,800. This zone has held before, so some reaction there would not be surprising. For now, price looks stuck in between, showing uncertainty rather than strength. As long as ETH stays above it, a bounce toward nearby resistance is possible. If this level breaks, however, the price could slide toward lower demand areas of $2500-$2400, as seen on the chart. According to an analyst, @TedPillows, “ETH tried to reclaim the $3,000 level but failed. If ETH doesn't reclaim this zone soon, it could drop towards the $2,700-$2,800 support zone.”

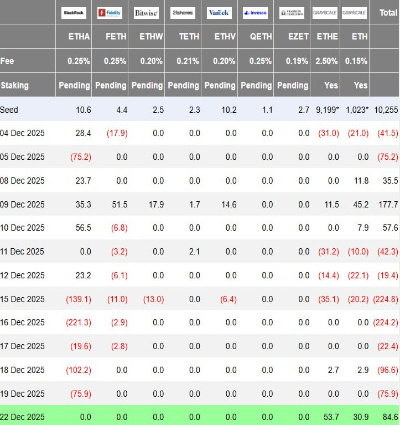

Ethereum saw an ETF inflow of about $84.6 million in the latest session, with Grayscale accounting for the entire amount. This shows that institutional activity has not disappeared, even while price action remains under pressure.

Still, one positive day does not change much by itself. After seeing mixed and mostly weak flows for weeks, this move feels more like short-term interest than a real change in direction. It may slow things down on the downside, but it is not enough to suddenly turn the mood positive.

Right now, price behavior matters more than ETF numbers. If inflows keep showing up and ETH starts holding above important resistance areas, confidence can slowly build again. Until that happens, most participants seem to be watching from the sidelines instead of taking bold positions.

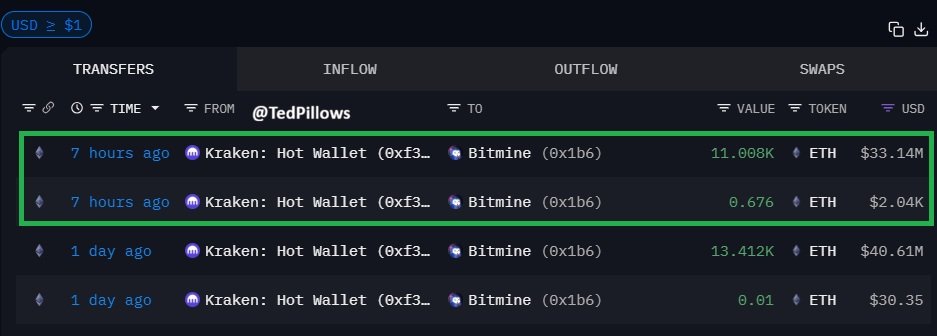

Along with ETF activity, some buying is also showing up on-chain. BitMine picked up around $88 million worth of Ethereum from BitGo and Kraken in a single day. What makes this news interesting is that the firm still has close to $1 billion in cash left. That does not mean the price will jump right away, but it does show that a few large players are quietly adding ETH while the market stays weak.

Right now, the Ethereum setup does not look strong or weak, just uncertain. A short relief bounce can happen if support holds and price moves up a bit, but upside may stay limited unless key levels are taken back. For now, rushing does not make much sense.

It is better to wait and see how the price reacts. Ethereum is trading near an important area, and the next movement around support and resistance should give a clearer idea of where the trend may go next.

Disclaimer: This article contains general information and is not to be considered financial advice. Cryptocurrency investments have proven to be highly volatile. You must therefore carry out your own personal research prior to making any investments.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.