YMYL Disclaimer: This content is for informational purposes only and not financial advice. Crypto investments involve risk. Do your own research before investing.

Blackrock ETHB ETF is becoming a big topic in crypto right now. BlackRock is preparing to launch its iShares Staked Ethereum Trust, which is expected to trade under the ticker ETHB. The idea behind this product is simple: instead of just holding Ethereum, investors may be able to earn staking rewards. This could change how institutions invest in ETH.

The ETHB ETF comes after the success of BlackRock’s spot Ethereum ETF, ETHA, which has already crossed $6 billion in assets. A filing in December showed that a seed investor bought 4,000 shares at $0.25 to help start the fund.

Source: X (formerly Twitter)

There is no official launch date yet, but the ETF is expected in the first half of 2026. This is possible because regulators are now more open to ETFs that include staking rewards, something that was not allowed before.

It aims to turn cryptocurrency's into a yield-generating asset. Based on filings, the fund plans to stake around 70% to 95% of the ETH it holds. A small portion will remain unstaked so the fund can manage withdrawals and liquidity.

Investors could receive about 82% of staking rewards, while the rest will go to BlackRock and execution partner Coinbase. The ETF will also charge a 0.25% sponsor fee.

This model introduces institutional yield to Ethereum investing and strengthens the connection between traditional finance and blockchain.

The Blackrock new ETHB ETF narrative is growing alongside institutional buying. BitMine recently bought 17,722 ETH worth about $34.7 million. Large purchases like this can help support price and improve sentiment.

Investors can track ETF-related wallet activity through platforms like Arkham, although on-chain movements usually appear a day later because of traditional finance settlement timelines.

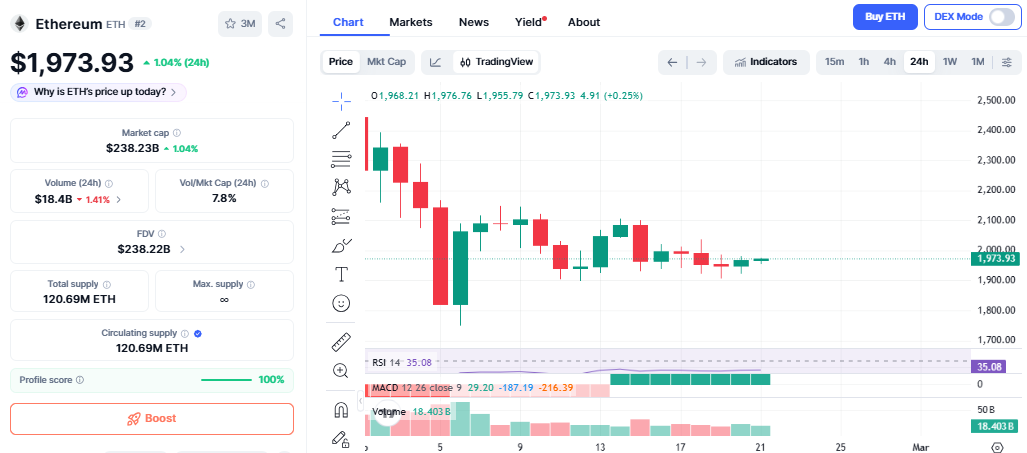

It is trading near $1,973 after a small rebound. The chart shows ETH recovering from oversold conditions, with RSI previously near the mid-30s. Volume remains important; stronger volume is needed to confirm the bounce.

Source: CoinMarketCap

The Blackrock new ETHB ETF story adds a long-term catalyst, but short-term price still depends on technical levels and overall market sentiment.

Resistance sits near $2,025 and the psychological $2,000 level. Support is around $1,900, with deeper support near $1,748. For now, ETH appears to be moving within a range.

If it holds above $1,900, the price could test the $2,000–$2,025 area. A breakout may push ETH toward $2,100. However, if $1,900 breaks, the price could revisit the $1,748 level before stabilizing.

This shows a clear shift toward yield-focused crypto products. Instead of simply buying ETH, institutions may start targeting staking returns through regulated investment vehicles.

This suggests deeper integration between traditional finance and decentralized infrastructure. If it launches successfully, it could influence how future crypto ETFs are designed.

The Blackrock new ETHB ETF represents an important step for Ethereum’s institutional story. While price recovery is not guaranteed, staking-based ETFs highlight how the market is evolving.

In the short term, ETH may remain range-bound unless more institutional demand appears. Over the long term, products like this could change how investors view this cryptocurrency from a passive asset to a yield-generating one.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.