Ethereum price prediction has become a hot topic again after a brutal sell-off shook holders over the past month.

From the January highs, ETH lost nearly 50% of its value, sliding deep into fear territory.

The breakdown below the $1,800 psychological support, with prices briefly touching $1,746, triggered massive panic—with many traders whispering about a total market capitulation.

However, the tone shifted over the last 24 hours.

Ethereum price has recovered nearly 9% from the $1,800 zone, moving back toward $2,100, similar to the recent rebound seen in Bitcoin.

While this move has sparked instant optimism among retail traders rushing to "buy the bottom," experienced observers remain cautious.

The broader Ethereum price outlook remains fragile, as the recent bounce follows weeks of sustained selling pressure.

In this Ethereum Price Prediction, we analyze whether $2,100 is a new floor or a mega trap in an ongoing bearish cycle.

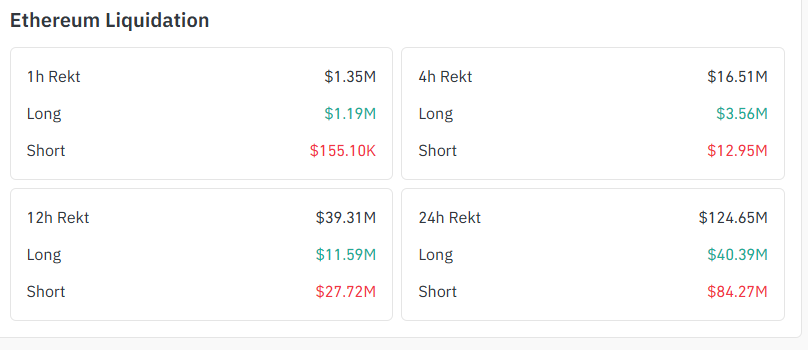

Recent liquidation data from Coinglass shows that Ethereum’s bounce from the $1,800 zone was largely driven by forced short exits.

Over the last 24 hours, more than $124 million worth of ETH positions were liquidated, with short liquidations dominating the move.

This imbalance explains the speed of the recovery.

As price pushed higher, short sellers were forced to cover, adding fuel to the rebound toward the $2,100 area.

Shorter timeframes show the same pattern, with liquidation pressure building first and price reacting after.

This kind of move is typical of an Ethereum short squeeze, where forced liquidations accelerate price recovery without strong spot demand.

Until ETH sees follow-through buying beyond liquidation-driven momentum, the risk of a pullback remains on the table.

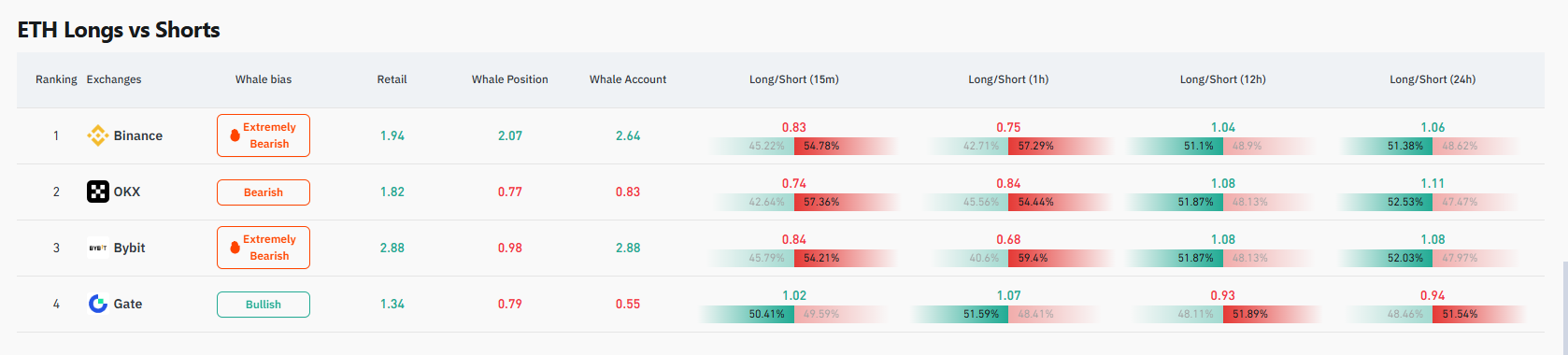

Data from Coinglass shows that ETh positioning remains cautious despite the recent bounce.

Across major exchanges like Binance, OKX, and Bybit, short positions still dominate on lower timeframes, keeping near-term sentiment fragile.

What stands out is the split between whales and retail traders.

Retail positioning leans more optimistic after the rebound, while whale accounts remain heavily skewed bearish, especially on Binance and Bybit.

Current ETH long/short ratio data suggests positioning has not fully reset in favor of bulls yet.

This mismatch often appears during corrective phases, where price recovers but smart money stays defensive.

Such divergence keeps volatility high.

While it leaves room for short squeezes, it also suggests that ETH has not yet earned broad conviction, reinforcing the need for confirmation before calling a sustained trend shift.

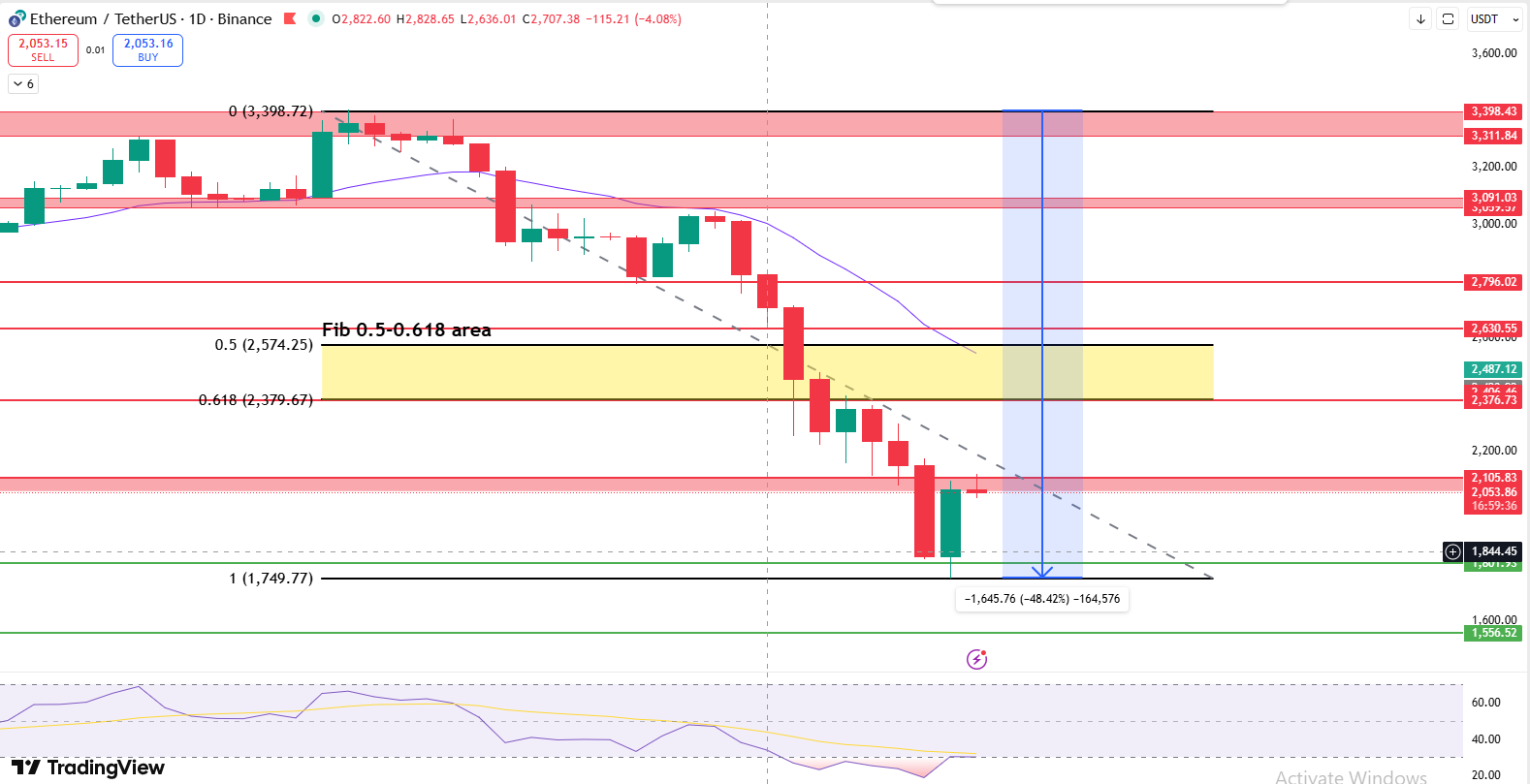

ETH has rebounded from the $1,750–$1,800 demand zone, which makes sense after the kind of selling pressure seen recently.

Oversold conditions and forced liquidations helped price bounce, but the recovery is already running into friction.

From an Ethereum technical analysis perspective, this area remains critical before any trend reversal can be considered.

The $2,050–$2,100 area is proving difficult to clear, a zone that earlier acted as support and is now behaving more like resistance.

On top of that, the 21 EMA is still sitting above price, adding another layer of pressure.

If ETH struggles to stay above the $2,100–$2,150 range, a move back toward $1,950–$1,900 would not be surprising.

Below that, $1,800 remains the level bulls need to defend.

Losing this zone again could reopen downside toward $1,650–$1,600, where buyers previously stepped in.

On the upside, the market is clearly watching the 0.5–0.618 Fibonacci retracement zone, roughly between $2,380 and $2,570.

Until ETH can move above this area and hold above the 21 EMA, the bounce still feels corrective.

A clean break and hold could shift momentum toward $2,750, with $3,000 coming into view later.

For now, ETH is still deciding.

The next sustained move will likely come only after these levels are tested properly.

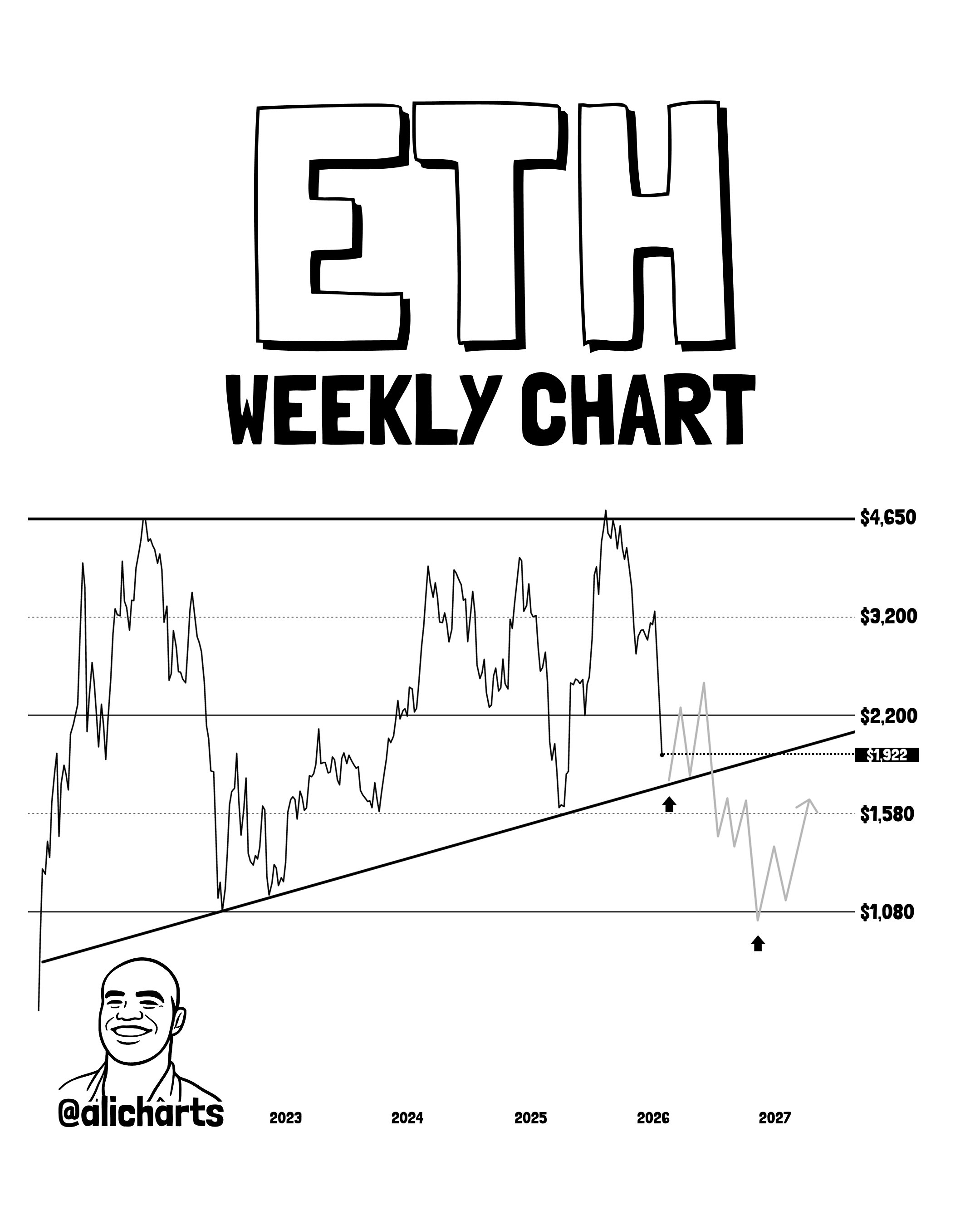

Renowned crypto analyst Ali Martinez has shared a staggered DCA approach for ETH, reflecting caution rather than outright bullish conviction.

The plan spreads exposure across deeper levels, starting with 20% near $1,800, followed by 20% around $1,580, 30% near $1,350, and a final 30% close to $1,080.

This approach reflects a cautious Ethereum long-term outlook, rather than confidence in a confirmed bottom.

The heavier allocations at lower levels indicate an expectation of volatility rather than a clean trend reversal.

From a market perspective, such a plan aligns with the current ETH structure, where long-term support zones matter more than short-term rebounds.

Overall, this DCA setup reads as a defensive way to stay involved, not a signal that the bottom is already confirmed.

This Ethereum price prediction suggests the rebound from $1,800 has improved sentiment, but the broader Ethereum price outlook still looks cautious.

The move higher appears driven more by liquidations than strong follow-through buying. As long as ETH struggles to hold above $2,100–$2,150, downside risks remain.

A dip toward $1,950–$1,900 is still possible, with $1,800 acting as the key support.

On the upside, only a sustained break above the $2,380–$2,570 Fibonacci zone would shift momentum toward $2,750 and $3,000.

For now, this bounce looks like strength under review, not a confirmed trend.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.