BlackRock has taken a major leap into on-chain yield products by filing a Staked Ethereum ETF, marking a turning point in U.S. regulatory attitudes and expanding institutional access to Ethereum

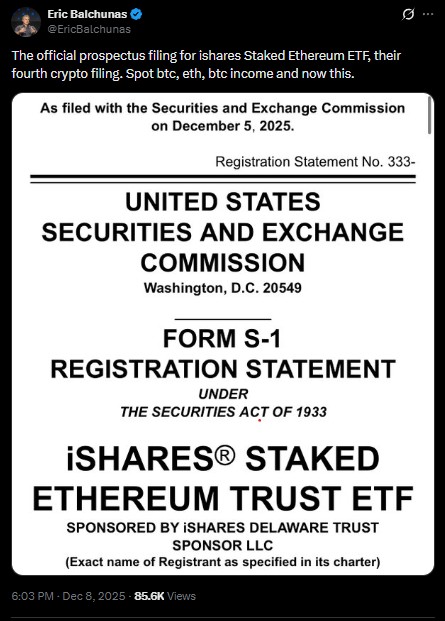

The world’s largest asset manager, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch the iShares Staked Ethereum Trust ETF (ETHB).

The new product aims to provide investors exposure not only to the price of ETH but also to staking rewards—Ethereum’s native yield-generating mechanism.

This marks BlackRock’s first ETFs focused specifically on staked ETH, even though the company already operates a successful spot Ethereum ETF, the iShares Ethereum Trust (ETHA), which manages roughly $11 billion in ETH.

Source: Official X

The filing reflects a notable change in the SEC’s previously rigid stance toward staking features in ETFs. Under former Chair Gary Gensler, issuers were instructed to remove staking components from ETF proposals, citing concerns that staking might resemble unregistered securities offerings—an issue highlighted in previous enforcement actions involving platforms like Kraken and Coinbase.

However, the arrival of new SEC Chair Paul Atkins appears to have opened the door to stakeholder-related financial products. Multiple issuers—including BlackRock and VanEck—have returned with updated or entirely new filings, taking advantage of what seems to be a more supportive regulatory environment.

A Passive Vehicle With Added Yield: According to the filing, ETHB will operate as a passive investment trust that tracks the ETH price while staking a significant portion of the assets it holds. It aims to stake 70% to 90% of its ETH “under normal market circumstances.”

Use of Third-Party Staking Providers: Rather than running its own validators, BlackRock will partner with external services. Custodians such as Coinbase Custody, BNY Mellon, and Anchorage are mentioned in the prospectus as potential partners. The selection will be based on factors including uptime, slashing history, reputation, and overall performance.

While ETHB’s fee structure has not yet been released, BlackRock confirmed that the ETF will include both management fees and service fees. For comparison, ETHA charges a minimal 0.25% annual fee, which is easily offset by current stakes yields of around 3–4%.

Despite earlier attempts to add staking to the ETHA ETF, the company has now opted for a standalone product.

The analysts say this gives investors more control, as some prefer price-only exposure, while others seek yield opportunities.

ETHB will be listed and traded on the Nasdaq exchange once approved.

ETH price reacted modestly to the announcement, rising to $3,122–$3,130, as investors welcomed another major step toward broader institutional stakes.

BlackRock’s move follows new listing standards for commodity-style crypto trusts and the recent launch of competing staked ETH ETFs from Grayscale and REX-Osprey.

The filing also expands BlackRock’s footprint in crypto ETFs, joining its spot Bitcoin Exchange Traded Fund (IBIT), spot Ethereum Exchange Traded Fund (ETHA), and BTC income ETFs.

The action by BlackRock is in line with new listing requirements of commodity-like crypto trusts and the recent introduction of rival staked ETFs of ETH by Grayscale and REX-Osprey.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.