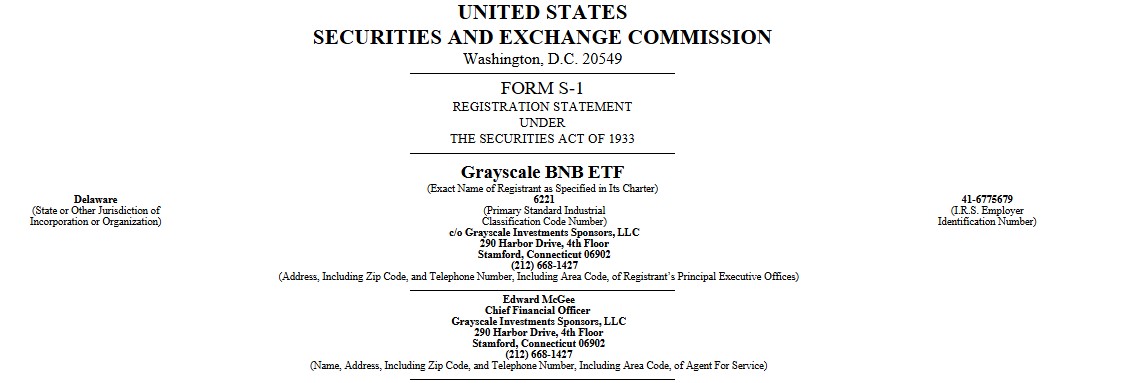

The idea of BNB price to $900 is gaining attention after Grayscale filed for a spot BNB ETF in the United States. On January 23, 2026, the investment firm officially submitted a Form S-1 to the U.S. Securities and Exchange Commission (SEC), seeking approval to launch a publicly traded ETF tracking Binance Coin (BNB).

Source: Official S-1 Filing

Grayscale’s move places BNBs among the next major altcoins aiming for regulated U.S. market access, after its recent $NEAR filing. While approval is not guaranteed, the filing itself is seen as a major confidence signal for the token and the broader crypto market.

The development alone surged the Binance Coin price by 0.11% in 24 hours to $891, so with confirmation and upcoming updates in the Binance's roadmap can put the token even higher.

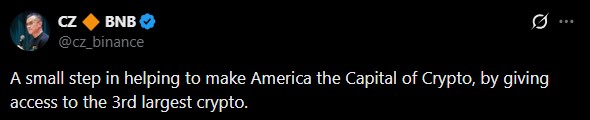

Binance’s former CEO CZ described the development as a positive step for the crypto landscape, stating that regulated access helps position the U.S. as a global crypto hub.

Grayscale's filing with the SEC aims to convert the firm’s existing BNB-Trust into a publicly traded spot exchange-traded fund.

Unlike futures-based products, this BNB ETF crypto proposal would hold the actual tokens, giving investors direct price exposure. A key highlight is the inclusion of staking, which could allow the fund to earn yield from the coin's network rewards, making it more interactive.

In simple terms, if approved, the fund would allow traditional investors to gain exposure to Binance Coin without directly holding crypto.

This is important because U.S. spot ETFs have played a major role in boosting demand for Bitcoin and Ethereum.

When Grayscale’s Bitcoin Trust converted into a spot BTC ETF in January 2024, Bitcoin topped near $49,000 before correcting 15–20% as over $18 billion exited GBTC. During this phase, altcoins underperformed, with many major tokens falling 10–30% as capital rotated into newly launched BTC ETFs, which attracted more than $10 billion in early inflows.

A same but stronger pattern followed the Grayscale Ethereum Trust approval in mid-2024, with ETH rising over 25% pre-approval and ecosystem tokens outperforming after launch, reinforcing positive spillovers across the broader altcoin market.

A similar structure for Binance Coin could unlock new institutional capital, making the BNB price to $900 scenario more realistic.

VanEck remains the first mover among BNB ETF providing firms. It filed its initial S-1 for its product named VBNB in May 2025, nearly eight months before Grayscale.

Notably, VanEck removed staking from its fund's structure in late 2025. This decision is widely seen as an effort to reduce regulatory complexity and improve approval odds.

In contrast, Grayscale’s staking-enabled design could attract investors, but also raise additional SEC questions.

While many compare them as competitors, in reality it's not VanEck vs Grayscale, but VanEck and Grayscale.

Together, these filings raise issuer confidence in the digital token as an promising institutional asset. This togetherness in BNB-ETF providing firms strengthens the broader case for long-term price growth.

However, it has to be noted that both BNB-ETFs are still under review, and neither has received final approval yet.

Despite growing BNB ETF news, regulatory concerns remain a key risk. Binance’s past legal issues, including a large U.S. settlement in 2023, continue to influence how regulators view the asset.

The SEC is expected to closely examine custody arrangements, market manipulation risks, and whether Binance Coin qualifies clearly as a non-security. These factors may extend the review timeline and add uncertainty to the ETFs approval prospects, similar to VanEck’s filing.

However, the market experts are suggesting that the approval will come out soon given President Trump’s strong efforts to develop America as a crypto capital.

For now, Binance Coin faces a balance of opportunity and scrutiny, making the coming SEC decisions a critical signal for the future of altcoin ETFs in the U.S.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency markets are highly volatile, and do not guarantee any specific price outcome or approval. Readers should conduct their own research and consult a qualified financial advisor before making any investment decisions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.