Can the Bybit Japan exit be seen as an indicator for the crypto exchanges that operate within strict regulation regimes? In a major compliance move, Bybit has confirmed it will gradually discontinue services for residents of Japan starting in 2026. The announcement has raised concerns among users, traders, and market watchers across the crypto industry.

According to Bybit, the move forms part of its efforts to comply with regulations. It has not been registered as an exchange by Japan’s Financial Services Agency (FSA), which mandates that all crypto exchanges work to obtain registration from the FSA. Therefore, the withdrawal will be conducted in stages by restricting user accounts.

The primary cause behind this is regulation compliance. The country has one of the toughest crypto regulation frameworks in the world today. There are rising enforcement risks for unapproved crypto exchanges.

Source: Exchange Official Page

As per the government’s update, users found to be residing will have their account access limited gradually after 2026. Users with incorrect residence classification have to undergo Identity Verification Level 2 (KYC2 with address proof) before 22nd January 2026; otherwise, they will be considered as users by default.

The warning issued illustrates the larger trend of global operators being forced to localize or exit highly regulated regions.

Another critical element that is related to the exit is the change in monetary policies being adopted by the country. This is clearly demonstrated by the Bank of Japan rates decision, which recorded an increase to 0.75%, which is the highest since 1995.

Former BOJ board member Makoto Sakurai forecasts further rate hikes in the BoJ, perhaps reaching 1.0% by June-July 2026, targeting a long-run rate of around 1.75%. This policy reversal on keeping very low interest rates may boost the yen and will significantly affect digital asset transactions.

Such signals in the interest rates decision by the BOJ add complexity for exchanges that are already faced with the cost of strict compliance.

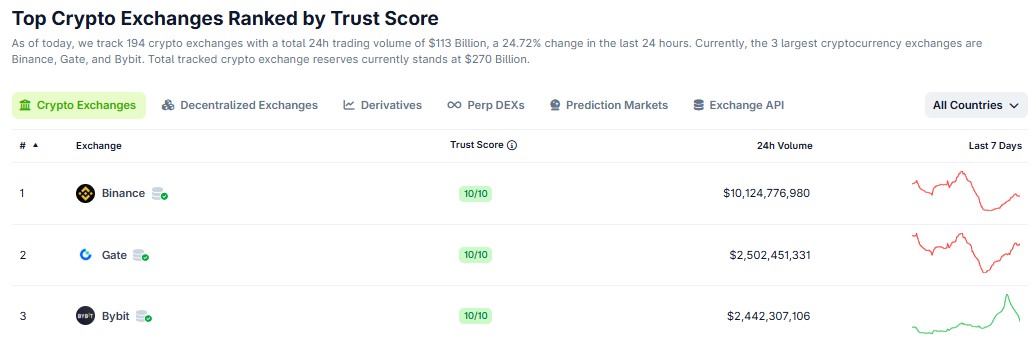

However, the exit of Bybit does not in any way affect the strong international positioning the exchange enjoys. Based on the information provided by CoinGecko, it has a score of 10 out of 10 in terms of trust, and its average trading volumes within the last 24 hours amount to $2.44 billion, ranking it in the third position in the world in terms of trading volumes.

Source: CoinGecko Platform

Additionally, it has more than 70 million users and is one of the leading crypto exchanges in the world. This shows the trust towards the platform.

The Bybit Japan exit setup is an indication of compliance strategy. Even as the users face restrictions, the exchange is establishing itself in other parts of the world. The implications of regulation and central bank policy in crypto are redefining the future of cryptocurrency exchange platforms.

Disclaimer: Note that the following page is only for informative purposes and not for financial/investment or legal advice. There is always risk in trades related to cryptocurrencies.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.