Ethereum is starting to move like it has its own path, not just following Bitcoin.

The market is paying attention to it in a different way.

Bitcoin is still stuck near heavy resistance, but this altcoinis spending time building support.

Some traders are comparing this phase with periods when money shifted toward gold during uncertain markets.

There are also early signals coming from on-chain activity and large holders.

Ethereum Price Prediction 2026 is no longer only about tech upgrades. It is slowly turning into a question of where capital prefers to stay next.

This sideways action does not look like weakness; it looks more like a pause before the next move.

The real question is simple.

Is Ethereum starting to play a bigger role in this cycle?

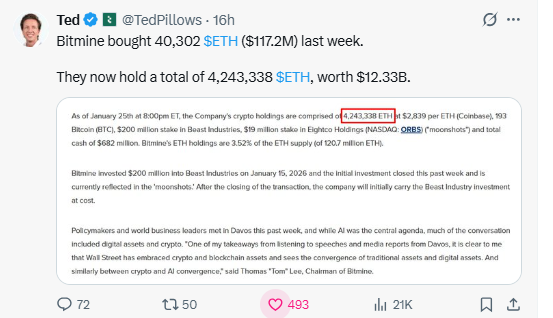

Bitmine’s recent ETH buying shows that large players are adding exposure during consolidation, not during rallies. Last week alone, Bitmine bought 40,302 ETH worth around $117 million, taking its total holdings to about 4.24 million ETH valued near $12.33 billion.

Accumulation at this scale usually reflects long-term positioning, not short-term trading.

It fits the idea that coin is being treated as a strategic asset, not just a speculative one.

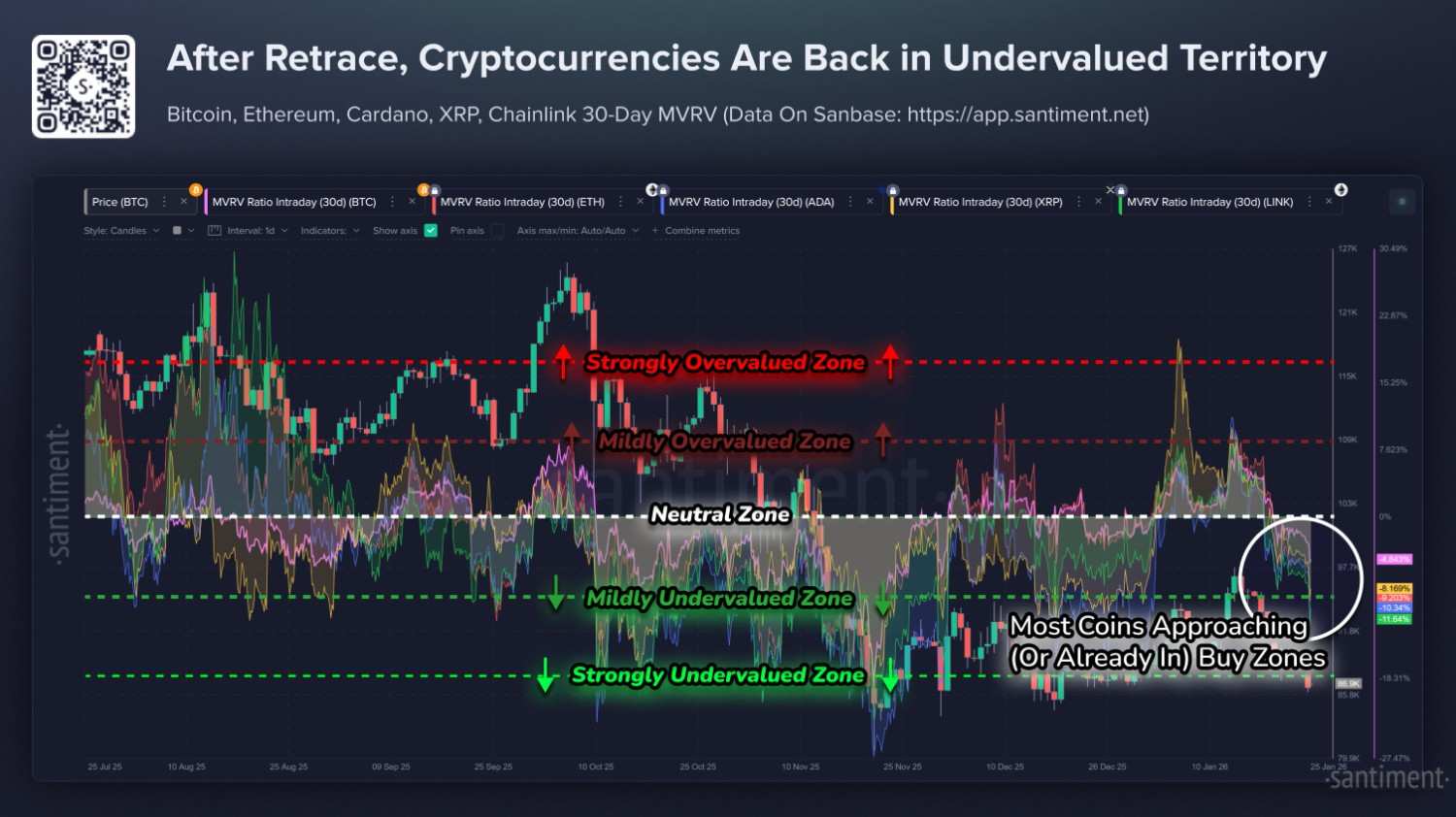

On-chain analytics firm Santiment says Ethereum is now sitting in the “undervalued” zone based on its 30-day MVRV ratio.

This metric shows whether recent buyers are in profit or loss. For world second biggest coin, the value is around -7.6%, meaning many short-term holders are still underwater.

Assets in this range are seen as lower-risk compared to overvalued phases.

Bitcoin, in comparison, is only mildly undervalued near -3.7%, while ETH is deeper into the discount zone.

This suggests coin is resetting its valuation while price continues to move sideways.

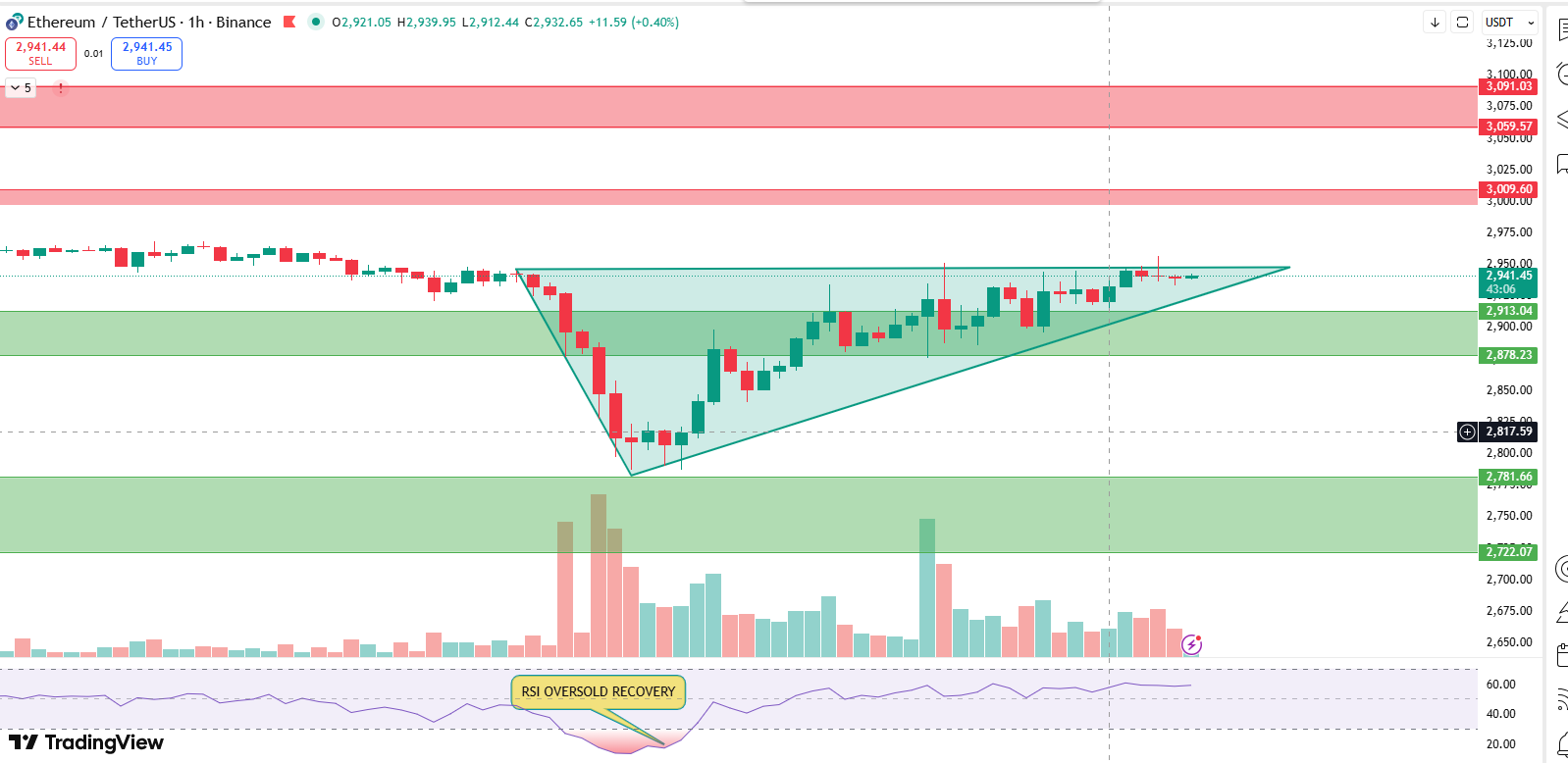

Ethereum is sitting near the top of an ascending triangle on the TradingView 1-hour chart. Price bounced from the $2,780 area and did not roll over after that. Dips are getting bought instead of pushed lower.

RSI has come back from oversold levels, so the selling wave looks tired for now. Price is also trading above the 21 EMA, which is starting to behave like short-term support.

If price holds above the $2,780–$2,820 zone, the structure stays intact. A clean move above the triangle could drag the price toward $3,000–$3,050.

If price slips back under $2,780, this whole setup loses its meaning.

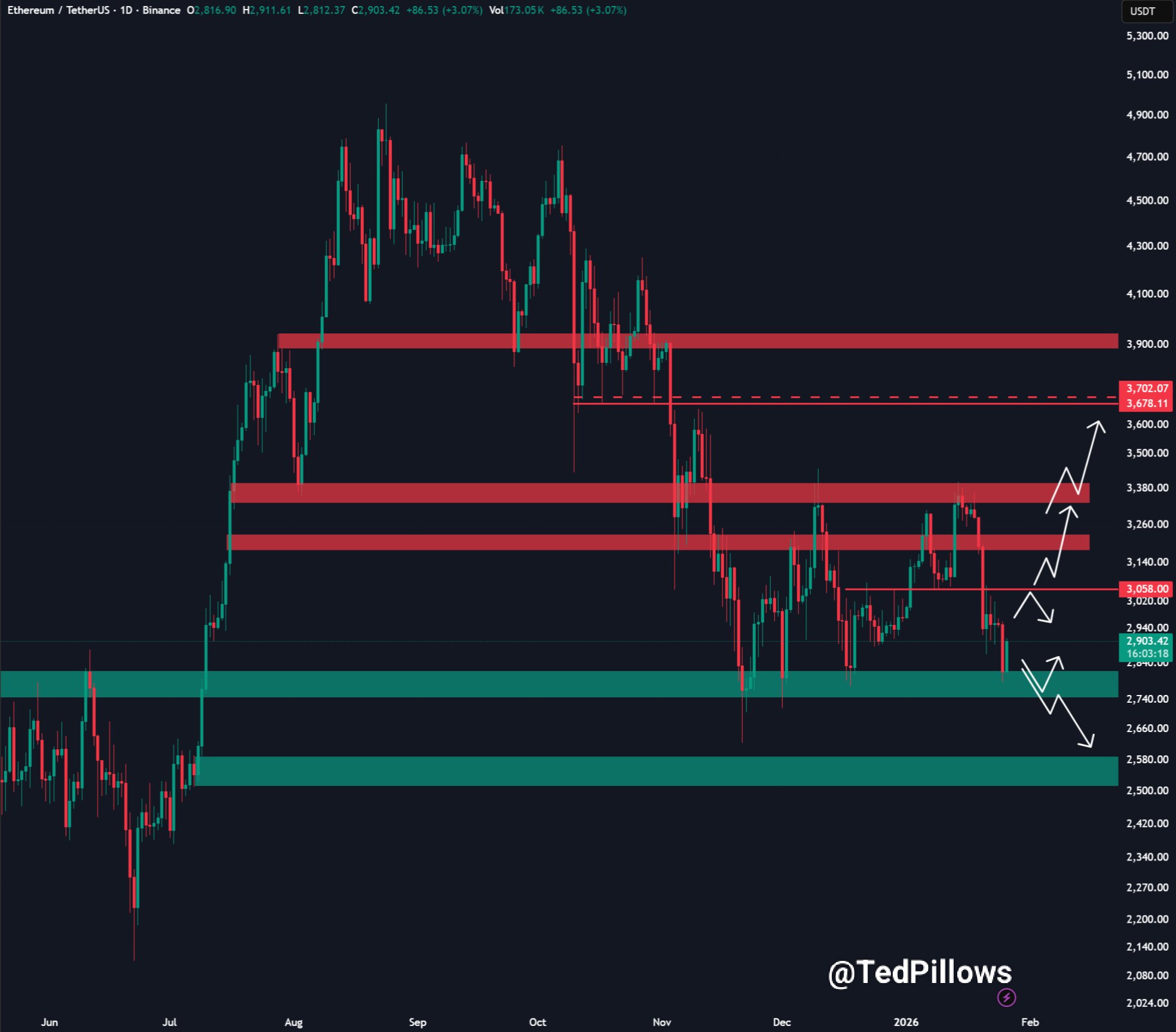

Analyst Ted Pillows on X says Ethereum has already tested the $2,700–$2,800 support area he pointed out earlier. Price has bounced from there, but the move still looks careful, not aggressive.

He also warns that downside risk is not gone yet. For ETH to really turn higher, it needs to get back above $3,050 with real spot buying.

If that happens, the next places traders will watch are around $3,200–$3,250, and then closer to $3,400.

Until that breakout shows up, this bounce still feels like a reaction, not a full trend change.

According to a technical analyst, MaxCrypto’s tweet on X Gold spent months building a rounded base before breaking its upper trendline and pushing higher. That breakout eventually carried gold to a fresh high near $5,110 per ounce on January 27, 2026.

Ethereum’s long-term chart is now showing a similar structure. Price has been forming higher lows while pressing against a rising resistance line, much like gold did before its move.

If ETH manages to break above this upper trendline with strength, the setup starts to look like a transition phase rather than a top.

In that case, the market may begin to look toward much higher zones.

From a structural view, a clean breakout keeps the $8,000–$10,000 range on the table over time, if momentum builds the same way it did for gold.

Ethereum Price Prediction 2026 is starting to reflect positioning more than hype. Institutional buying, discounted on-chain levels, and price holding key support all point to a market that is preparing rather than breaking.

In the short term, ETH still needs strength above $3,050 to confirm upside. On higher timeframes, the structure remains under pressure but not damaged, keeping the bigger picture open.

YMYL Disclaimer: This cryptocurrency article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.