The Chainlink Blockchain continues to quietly expand its reach, strengthening its role as core infrastructure for onchain finance. In its February update, the network rolled out new integrations across multiple blockchains, unlocking a more convenient path for its user-base, and network utilizers.

Source: Official Announcement

The Chainlink blockchain expansion is less about hype and more about giving users and builders stronger tools. Instead of focusing on price action, this update shows what the users can actually do more of in 2026. So, let's decode it in an easy way.

The latest blockchain update focuses on widening access to its key services.

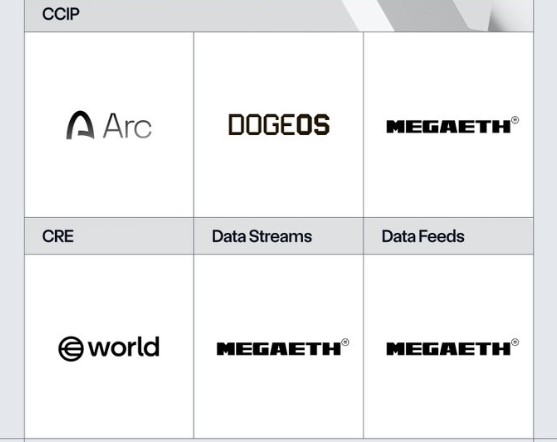

The platform’s Cross-Chain Interoperability (CCIP) is now integrated on Arc, DogeOS Chikyu, and MegaETH. Arc is Circle’s stablecoin-focused test environment launched in late 2025, while DogeOS Chikyu supports the growing Dogecoin application layer. MetaETH, launched in February 2026, is a high-performance Ethereum Layer-2 targeting real time applications.

With these integrations, users can move tokens and data across chains more securely. This reduces reliance on risky bridges and makes multi-chain DeFi easier to use.

Adding on, Chainlink Runtime Environment (CRE) expansion to World Chain, enables automated, identity-aware cross-chain workflows. This is especially important for institutions exploring tokenized assets, yield automation, and complaint DeFi strategies.

At the same time, Data Streams and Data Feeds went live on MegaETH, delivering ultra-low-latency market data through native precompiles. These feeds support high speed DeFi protocols like Aave and GMX, with access to roughly $14 billion in assets via its Scale program.

Real-time market data: Ultra-low-latency Data Streams and Feeds on MegaETH power fast, accurate pricing for trading, lending, and derivatives.

Broader DeFi access: Chainlink Scale connects MegaETH users to billions in assets across major protocols like Aave and GMX.

Automated efficiency: CRE enables seamless cross-chain workflows such as yield optimization and tokenized asset management, reducing risk and manual effort.

$LINK, the platform's native token, showed positive trend following the blockchain expansion news. $LINK rose 2.28% to around $8.87 in 24 hours, outperforming a flat Bitcoin and the broader altcoin market.

Its fundamentals also continue to improve, where its $LINK Reserve holdings are above 2.17 million coins. This treasury model uses real protocol revenue to buy and hold tokens, creating long-term structural support.

Along with that, the platforms also deepened ties with major players. Robinhood’s new blockchain relies on Chainlink as its core oracle provider while CME Group’s move toward 24/7 crypto derivatives trading, including LINK futures.

The broader picture shows the Chainlink blockchain becoming harder to replace. With over 2,500 protocols, 75+ blockchains, and more than 80 major financial institutions using its technology, the network sits at the center of the tokenization and real-world asset movement.

The recent updates may spark immediate rallies which could be neutralized once hype ends, but in the long-term, they steadily reinforce LINK’s role as the backbone of onchain finance, especially as tokenized assets move from pilots to full production in 2026.

Note: This content is for informational purposes only and not financial advice. Crypto markets are volatile, always do your own research before investing.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.