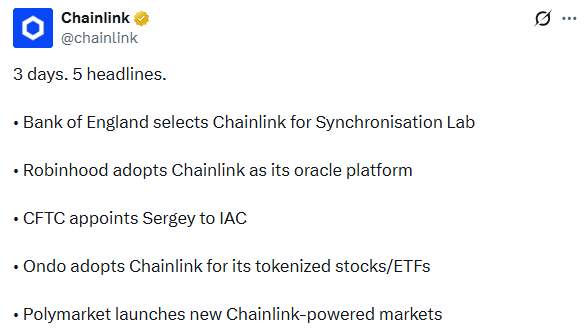

In a rapid 72-hour period, the digital world saw five massive Chainlink news that are changing how money moves. From central banks to retail apps, Chainlink is now the bridge for the global financial system. These updates show that blockchain is moving from a "niche" tech to a core part of the world's economy. By using secure data and cross-chain tools, it is helping to settle big trades and keep markets honest. Whether it is tokenized stocks or high-speed betting, these five headlines prove that the "Chainlink standard" is here to stay.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The technical side of these updates shows a deep shift in how we handle data and value. Each headline represents a new way for traditional finance to use blockchain safely.

1. Bank of England Selects Chainlink for Testing

The Bank of England has picked Chainlink for its new Synchronization Lab. This lab tests "atomic settlement", which means both sides of a trade happen at the same time. The digital asset will help link central bank money with digital assets on the blockchain. This removes the risk of one side failing to pay, making big bank trades safer and faster than ever before.

2. Robinhood Adopts Chainlink for Price Data

Robinhood, the popular trading app, has officially made the digital asset its main data source. By using Chainlink’s oracles, Robinhood ensures that its users see fair and accurate crypto prices. This move helps stop price manipulation and builds trust for millions of retail traders who want a clear view of their portfolio value.

3. Sergey Nazarov Joins the CFTC IAC

In a major win for the ecosystem, Chainlink co-founder Sergey Nazarov was named to the CFTC's Internal Advisory Committee (IAC). This gives the crypto world a seat at the table where new laws like the Clarity Act are made. Sergey’s role will help ensure that future laws understand how decentralized data works, protecting the tech as it grows.

4. Ondo Finance Launches Tokenized Stock Collateral

Ondo Finance is now using LINK to bring real-world stocks like Tesla (TSLA) and the S&P 500 (SPY) onto the blockchain.

Borrow Against Stocks: Users can now use their tokenized stocks as collateral to borrow money.

Live Pricing: LINK provides the live price feeds needed to manage these loans.

Accurate Data: The system even tracks dividends and stock splits, keeping the digital version perfectly in sync with the real market.

5. Polymarket Debuts Ultra-Fast 5-Minute Markets

Polymarket is now using Chainlink Data Streams to launch "5-minute markets". This allows users to bet on very fast price changes. Because LINK can deliver data in seconds, these markets stay accurate even during high volatility. This is a big step for "high-frequency" trading on the blockchain.

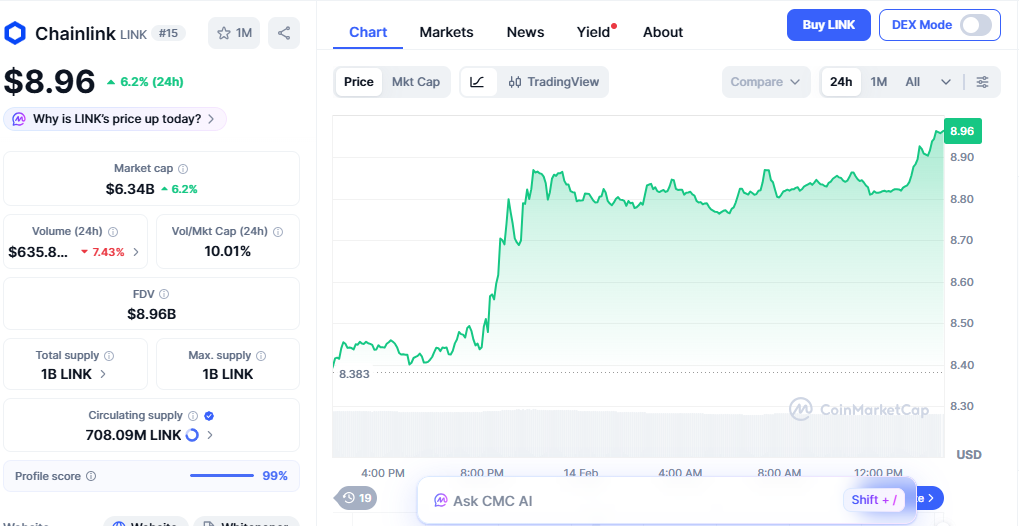

As of February 14, 2026, LINK is trading at $8.96, marking a notable 6.2% increase over the last 24 hours. The asset's market capitalization has climbed to $6.34 billion, securing its position as the #15 largest cryptocurrency by market cap. Despite this short-term daily recovery, the monthly trend reveals a significant 35.53% decline from prices near $14.04 in late January. This recent upward momentum is largely attributed to strengthening protocol fundamentals, including a sevenfold increase in operational revenue and a strategic jump in the Strategic LINK Reserves to over 2 million tokens.

Source: CoinMarketCap Chainlink Price

Source: CoinMarketCap Chainlink Price

The latest news shows that the network is no longer just for crypto. It is becoming the "universal connector" for all types of value.

Industry observers anticipate that by the end of 2026, it's CCIP (Cross-Chain Interoperability Protocol) will be the standard way for banks to talk to each other across different blockchains. As more real-world assets like houses and bonds get tokenized, The digital asset will be the tech that holds it all together, making the global market more open and efficient for everyone.

YMYL Disclaimer: Cryptocurrency and DeFi investments involve high risk. The LINK news reported here involves experimental financial infrastructure. This report is for informational purposes and does not constitute financial advice.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.