Clarity Act Approval Gains Support as Bitcoin Falls, Senate Eyes Vote

The possibility of Clarity Act Approval is drawing major attention in Washington as the crypto market faces one of its toughest phases in months. Treasury Secretary Scott Bessent has openly backed the Digital Asset Market Crypto Bill, signaling that U.S. regulators may finally move toward clearer crypto rules.

The bill already passed the House in 2025 as H.R. 3633 and is now expected to get Senate floor time this spring. Senator Cynthia Lummis confirmed bipartisan talks are ongoing, stating lawmakers are working “every single day” to push digital asset market structure across the finish line.

Source: X (formerly Twitter)

For investors watching Clarity act news today, the message from Washington is clear, regulatory clarity could be closer than ever.

What Clarity Act Approval Could Change?

If Clarity Act Approval happens, it would redefine how digital assets are regulated in the United States. The proposal classifies digital commodities on mature blockchains as non-securities and gives the Commodity Futures Trading Commission authority over spot markets.

It also introduces protections such as asset segregation and stablecoin oversight, measures designed to increase investor safety and reduce confusion between regulators.

Bessent showed frustration toward industry groups opposing the bill, warning that some players prefer no regulation at all. He called the proposal “very good regulation,” emphasizing the need to move forward.

Meanwhile, investor Mike Novogratz suggested the bill has strong political backing, noting that crypto-focused political action committees hold significant financial influence.

Market Crash Raises Stakes for Clarity Act Approval

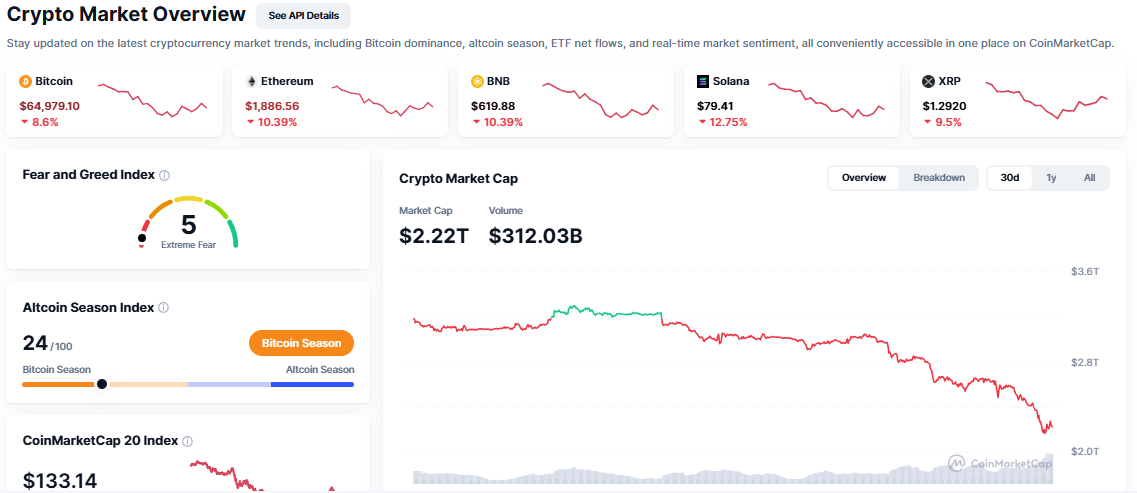

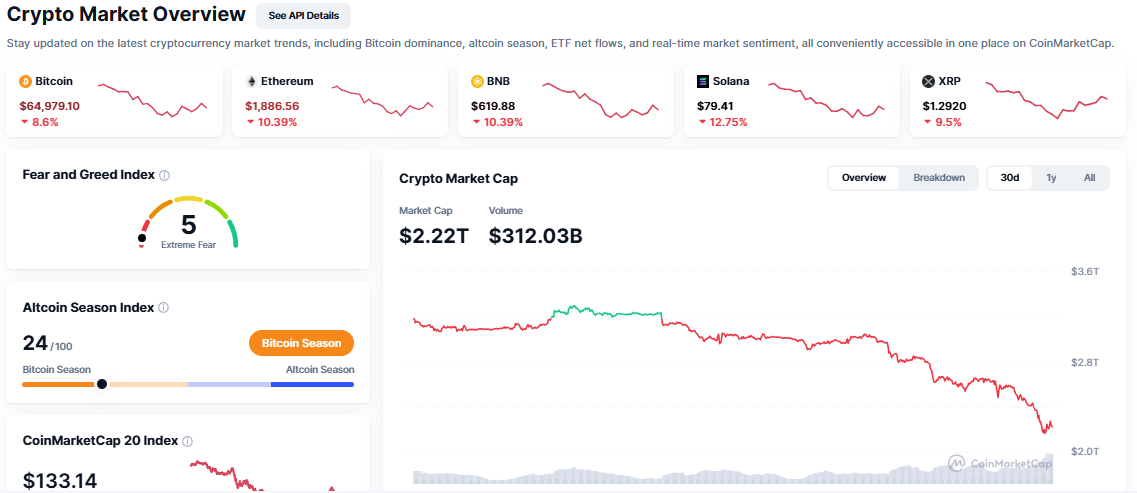

The sense of urgency in relation to Crypto market structure bill approval developed as the crypto market crashes and cryptocurrency prices continue to fall today. Bitcoin traded as low as $60,074, which is the lowest it has traded since October 2024, as Ethereum traded below $1,800, with altcoins such as XRP, Solana, and BNB falling by over 13%.

Currently, Bitcoin is trading at about $64,693. The price of the digital currency has dipped 10% during the last 24 hours. Trading volume has been reported at $19.98 billion. It is worth noting that the digital currency is trading at 48% less than its historical high of $126,198.

Source: CoinMarketCap

The broader crypto slump mirrors weakness in global equities. The Nasdaq hit its lowest level since November, while the S&P 500 and Dow Jones also declined. Asian markets followed the trend.

Analysts describe the current phase as “capitulation,” where traders remain stuck in fear, uncertainty, and doubt.

Prediction Markets See Higher Odds

Confidence around Clarity Act Approval is rising beyond political circles. Prediction platform Polymarket, indicates odds of that approval jumping to nearly 72%, suggesting traders expect progress.

Some market participants view transparencey in regulations as potentially benefiting digital assets. Calls like “Stop the bleeding: we need this Clarity Act passed now” on social media portray frustration among investors.

However, not everyone is convinced. Critics argue macro pressures, weak economic data, and continued selling may outweigh regulatory optimism in the short term.

Stablecoin Debate Remains the Final Hurdle

One major issue still blocking Clarity Act Approval is the debate over stablecoin yields. The White House has set a February 28, 2026 deadline for banks and crypto firms to resolve whether platforms should be allowed to offer interest on stablecoin holdings.

Crypto companies say yield-bearing stablecoins could attract capital and boost adoption. Banks warn the move could pull deposits away from traditional accounts.

This clash has become the biggest obstacle to final stamp.

Could Clarity Act Approval Save the Crashing Crypto Market?

Despite the downturn, long-term investors may see opportunity. Analysts identify $55,500 as a strong support level for Bitcoin and $70,000 as key resistance.

If the Approval moves forward, it could reduce regulatory uncertainty and encourage institutional participation, a factor many believe is essential for the next bull cycle.

For now, markets remain volatile, but one question dominates investor conversations: will approval arrive in time to restore confidence, or will crypto continue navigating uncertainty?

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are highly volatile, and regulatory developments may impact prices. Always conduct your own research and consult a qualified financial advisor before making investment decisions.