The long-awaited U.S. crypto market structure bill, known as the CLARITY Act, is now facing serious trouble. As scams and policy battles reshape the crypto industry, a new conflict has emerged between the White House, banks, and Coinbase.

Source: Official Reporting

Sources say the White House may pull its support for the CLARITY Act entirely after Coinbase stepped away from negotiations. Could this delay U.S. crypto regulation once again?

At the center of the CLARITY Act debate is stablecoin rewards, also called yields. The bill aims to bring regulatory support by defining SEC and CFTC oversight and setting rules for stablecoins, tokenized assets, and DeFi.

Taking the new rule as base, traditional banking groups want to restrict crypto platforms from offering yields on stablecoins like USDC. The CEO of Bank of America, Brian Moynihan, explained that the concern is over maintaining financial stability. He noted that yield-bearing stablecoins could shift large, up to $6 trillion, deposits away from banks, significantly affecting lending and credit availability across the economy.

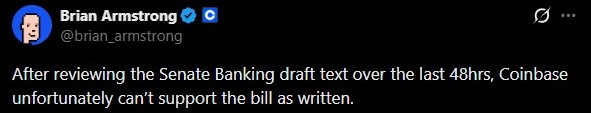

In response, Coinbase strongly opposes these limits. The exchange currently offers about 3–4% yield rewards on USDC deposits, which works as a major rewarding system for users and a key revenue stream for the platform. Coinbase argues that restricting rewards would hurt the crypto community, limit competition, and damage the sovereignty of the innovation.

Earlier this week, Coinbase CEO Brian Armstrong publicly withdrew support for the CLARITY Act, calling the draft a “bad bill.” He said he would rather have no law than a harmful one, accusing banks of protecting outdated business models.

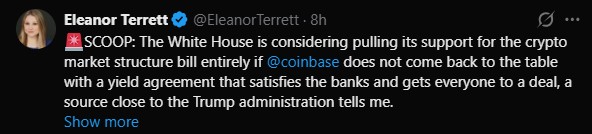

According to sources close to the Trump administration, the White House was furious over Coinbase’s move, calling it a “unilateral rug pull.” Officials stressed that the CLARITY Act is “President Trump’s bill,” not one company’s decision.

The White House is now pressuring the exchange to return to talks and agree to a compromise on stablecoin yields that satisfies banks. Until then, Senate Banking Committee action on the new bill has been postponed indefinitely.

If the bill fails, this would leave the country under continuous regulatory uncertainty, which could move digital asset investors to offshore, places where clear rules make things easy. It could also bring volatility in the broader digital assets’ market especially when stablecoins already surpass the $310 billion market cap.

So, the outcome of the CLARITY Act debate matters in different ways, and could also shape the future of US crypto policy in 2026.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.