Can calm markets really be the sign before a storm? With CZ talking about a “Cryptocurrency Supercycle 2026” and US stocks hitting new highs, many investors are asking one big question: is the CZ Crypto Supercycle 2026 statement the next major turning point for digital assets?

Source: Ash Crypto Official X

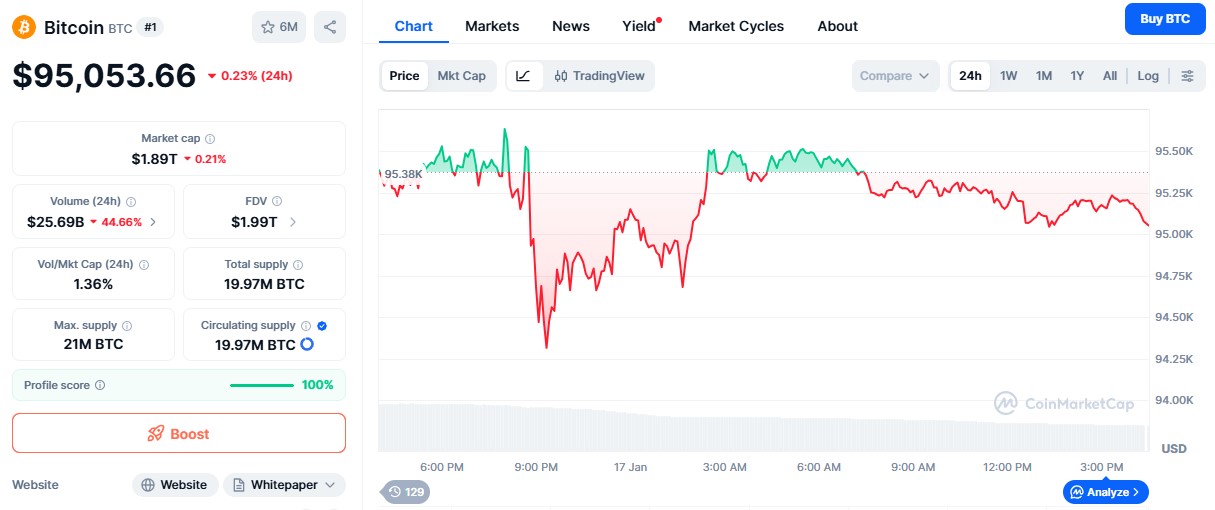

Right now, the cryptocurrency industry is stable, not pumping and not crashing. Total market capitalization stands near $3.22 trillion. Bitcoin is trading around $95,079, while Ethereum holds near $3,294.55.

This quiet phase often comes before strong trends. According to CZ crypto news today, if stocks perform well, digital assets usually follows. With President Trump expected to support stock markets, liquidity could move fast into digital assets.

Crypto Rover on-chain data shows US stocks have already added more than $1 trillion in market value in 2026. Gold and silver are at all-time highs. Tech stocks are also breaking records. This shows strong liquidity in the global system.

History shows capital never stays in one place. It rotates. First stocks, then commodities, and often cryptocurrency comes next.

This is why the supercycle news is gaining attention. When traditional markets become crowded, investors look for higher growth areas. Digital assets fit that role perfectly, especially in a year where risk appetite is returning.

As per the CoinMarketCap chart, the BTC is trading near $95,068, with trading volume falling by 44% to $25.77B. Lower volume during sideways movement usually means investors are holding, not selling.

The short-term Bitcoin price prediction 2026-2030 shows a range between $98,000 and $102,000. But the bigger picture is stronger. With global liquidity cycles and the halving effect, top market analysts project a 2026–2027 target of $180,000 to $250,000. The BTC 250k target becomes realistic if institutional demand and ETF flows remain strong.

The $ETH is trading near $3,294 with volume down 18% at $19.85B. This altcoin benefits from ETFs, Layer-2 growth, and real-world adoption. When Bitcoin dominance drops, Ethereum usually gains faster.

The short-term Ethereum price forecast sits between $3,520 and $4,000. For 2026, Coingobar's experts place a long-term ETH 20k outlook only if altcoin season starts this year.

Altcoins may become the biggest winners. Past cycles show strong growth:

2017–2018: +2,000% to +10,000%

2020–2021: +500% to +3,000%

2024–2026 setup: +300% to +1,500% base case

This supports the idea that the CZ Crypto Supercycle 2026 may create a new wave of big millionaires.

The CZ Crypto Supercycle 2026 statement is shaping a powerful story. This phase is not just about hype; it's backed by ETFs, regulation clarity, strong US stocks' ATH performance, and expanding liquidity.

Trump stock market policies may push capital markets higher, and digital assets usually benefit from that momentum. Experts aligning $BTC $250K, $ETH $20K, and altcoins preparing for another breakout show how big this cycle could be.

Traders should note that the market rewards patience. Those who position early and stay calm may benefit most from this historic phase. The 2026 outlook looks stronger than previous cycles because adoption is now global and institutional.

YMYL Disclaimer: This article is for educational purposes only. It does not provide financial advice. Cryptocurrency markets are highly volatile, so readers should DYOR before making investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.