While the media was calling the halting of the CLARITY Act a setback, Brian Armstrong views the Crypto Bill Delay as a necessary defense of consumer rights. According to Armstrong, the draft legislation was filled with "giveaways" to traditional finance (TradFi).

Source:X(formerly Twitter)

The core issue? Banks are terrified of stablecoins. Brian Moynihan, CEO of Bank of America, recently noted that nearly $6 trillion in deposits could potentially flee traditional accounts for stablecoins. Why? Because stablecoins offer higher rewards. Brian argued that instead of trying to ban the competition through a "bad bill," banks should simply pay their customers more interest to stay competitive.

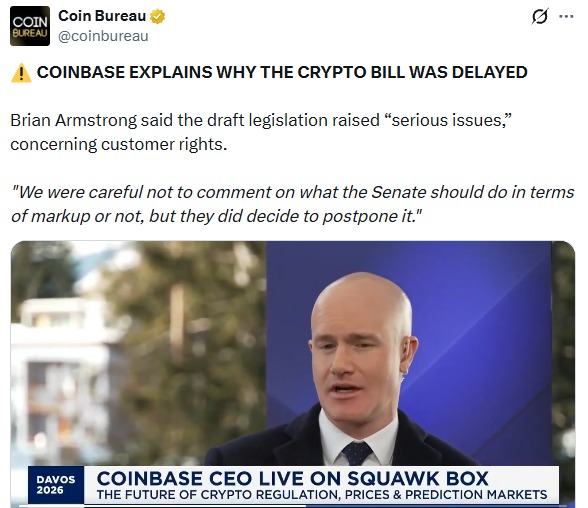

The Crypto Bill Delay wasn't planned; it was a reaction to a last-minute ambush. Armstrong revealed that Coinbase only saw the final text at midnight on a Monday just hours before it was due for a vote. After a quick review, the team found 3 or 4 "red line" issues that they couldn't ignore.

When D.C. lawmakers told Armstrong that these issues couldn't be fixed later, he pulled the plug. "I have zero tolerance for banning competition," Brian said. He believes Americans deserve a level playing field where they can choose the best financial products, whether that’s a bank account or a digital wallet.

One of the most interesting parts of the Davos interviews was Armstrong’s response to bank CEOs who claim crypto companies should have bank licenses. Armstrong's argument is simple: Coinbase isn't a bank because they don't play by "fractional reserve" rules.

Traditional Banks: They take your money and lend it out. If everyone wanted their cash at once, it wouldn’t be there. That’s why they have a high regulatory burden.

Crypto (Coinbase): Armstrong insists on a 100% reserve model. Your money is always there, which eliminates the risk of a "bank run" and, in his view, the need for a traditional bank license.

The "blow up" in Washington didn't just stay in D.C.; it sent a shockwave straight through the charts. As news of the CLARITY Act delay hit the wires, Bitcoin took a tumble, slipping under the $90,000 mark as traders reacted to the sudden legislative drama.

It was a classic "buy the rumor, sell the news" moment, but with a regulatory twist. Despite the short-term dip and the "risk-off" mood in the air, Brian Armstrong isn't sweating it. He’s staying loud and proud as a massive bull, sticking to his guns with that bold prediction: Bitcoin is headed for $1,000,000 by 2030. For him, this week's price drop is just a small speed bump on a very long, very profitable road.

Despite the drama, the Crypto Bill Delay isn't the end of the road. Armstrong noted that this is a core part of Donald Trump’s crypto agenda and that bipartisan support remains strong. He spent his time at Davos meeting with bank CEOs to find a "win-win" outcome.

For now, the message to Washington is clear: the industry wants a bill, but they won't accept one that protects the "old guard" at the expense of the American consumer.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.