The global crypto market is under pressure today. As of June 27, 2025, the total market cap has dropped by 0.16% to $3.39 trillion, while trading volume has slumped 6.02% to $96.3 billion.

If you’re wondering why crypto market is falling today, it’s not just one event — it’s a mix of four major updates. From inflation data to court rulings and legal troubles, all signs are pointing toward short-term crypto trouble. Let’s break down exactly what’s going on.

Here are the four biggest reasons behind the market drop.

XRP is down 1.17% in the past 24 hours, now trading at $2.09 as per TradingView Data. Volume has jumped 7.37% to $2.94 billion — but most of it is selling pressure.

Source: TradingView

The reason? A U.S. judge rejected Ripple and the SEC’s joint request to reduce the $125 million fine and lift restrictions on institutional XRP sales. This sudden legal roadblock has triggered a selloff, disappointing those who expected a smoother settlement and a potential boost to XRP’s price.

The U.S. Core PCE inflation: Federal Reserve’s preferred inflation gauge — climbed to 2.7% in May 2025. That’s higher than the 2.6% expectation and marks the hottest reading since February. Month-over-month, it rose 0.2%, beating the 0.1% forecast.

This matters because it has a direct impact on crypto, the Core PCE is the inflation number the Federal Reserve watches most closely. When price rise is high, the Fed is less likely to cut interest rates.

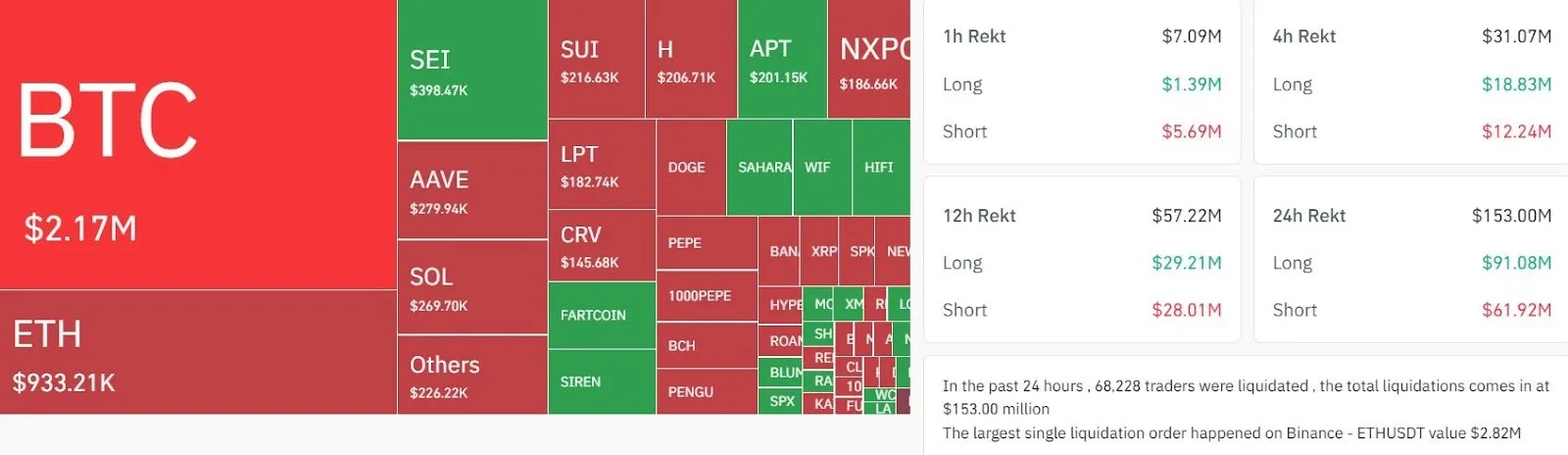

According to Coinglass, more than 68,000 traders were liquidated in the last 24 hours, totaling $153 million in losses. The largest liquidation order happened on Binance — a $2.82 million position in ETH/USDT.

Source: Coinglass

These forced liquidations accelerate sell-offs and amplify price drops. With lower confidence and macro uncertainty, traders using leverage are getting wiped out.

MicroStrategy is known for holding a lot of Bitcoin — but now it’s in legal trouble. At least five different law firms have filed class action lawsuits against the company. They claim MicroStrategy misled investors about the risks of its Bitcoin investments, which are currently showing around $6 billion in unrealized losses.

Law experts say it’s common for multiple law firms to file separately before the cases are merged. Still, this legal pressure is adding to fear around corporate Bitcoin holdings.

The market isn’t reacting to just one headline — it’s the sum of four serious concerns:

Ripple didn’t get the legal relief investors hoped for.

U.S. inflation is still too high, delaying possible interest rate cuts.

Traders using too much leverage got wiped out.

MicroStrategy is under legal fire for its Bitcoin strategy.

So if you’re asking why crypto market is falling, this is your answer: All of this has made investors cautious, and short-term losses may continue. And until clarity returns on inflation, regulation, and liquidity, volatility is here to stay.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.