President Donald Trump has wasted no time reshaping the Federal Reserve’s leadership, and it’s putting Fed Chair Powell under more pressure than ever. With new nominations, hints at his next pick for the role, and public criticism, Trump’s actions are already shifting market focus away from Fed Chair Powell well before his term ends in May 2026.

In a recent post on X, The Kobeissi Letter warned that Trump could soon make Fed Chair Powell “powerless” by naming a “Phantom Fed Chair.” Once a successor is announced, markets would shift their attention to the new voice, cutting more than 90% of his influence long before his official exit date.

Source: The Kobeissi Letter

Markets believe it’s only a matter of time before he names his preferred successor to Powell. If that happens, Powell guidance-the most important tool- could lose nearly all of its market influence.

Analysts call this effect: once a new name is out, investors will start reacting to the future chair’s statements instead of Powell’s. It’s like a substitute teacher being ignored because everyone knows the permanent teacher is already on their way.

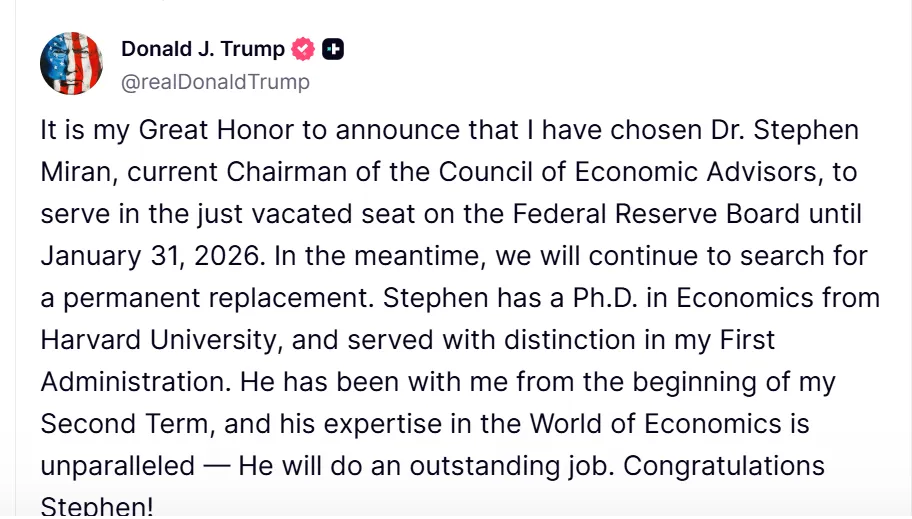

This week, Trump nominated Stephen Miran, current head of the Council of Economic Advisors, to join the Federal Reserve Board of Governors. He takes over from Adriana Kugler, who resigned suddenly, and will serve until January 31, 2026.

Miran is known for his pro-crypto stance and support for looser monetary policy to encourage innovation. His appointment signals Trump’s desire for a central bank more in tune with his economic vision, including boosting growth and backing digital assets such as Bitcoin and Ethereum.

Source: X

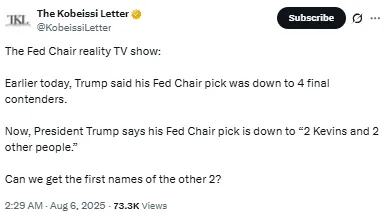

Trump also revealed his shortlist for the next leader, saying it’s down to “two Kevins and two others.” The Kevins are believed to be Kevin Hassett, former White House economic adviser, and Kevin Warsh, a past Federal Reserve Governor with hawkish inflation views.

Other likely candidates include Christopher Waller, a current Governor known for conservative policy positions, and Larry Kudlow, Trump’s former top economic adviser. Some insiders add Scott Bessent, a longtime Trump ally with Wall Street ties, as a potential pick for a top financial role.

Source: X

Trump has escalated his criticism of him, labeling him “too political” and “too late” on rate cuts. While the president cannot fire him directly, these public jabs are seen as a clear effort to push him aside.

So far, he has stood firm. At the July 30 FOMC meeting, the central bank voted 9–2 to keep rates at 4.50%—the most divided vote in over three decades. He defended the move, insisting that decisions will only change once inflation shows clear signs of cooling, regardless of political pressure.

Investors are watching closely because a Trump-aligned successor could mean earlier rate cuts, which might weaken the dollar and lift crypto prices. Markets are already adjusting, with some traders treating Fed Chair Powell’s influence as if it’s fading months or even years before his term actually ends.

In the high-stakes world of monetary policy, the real question is whether markets will still be listening to Powell by the time 2026 arrives.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.