Key Highlights:

Cryptocurrency market capitalization worldwide is down to 2.42T, with fear sentiment intensifying.

Bitcoin and Ethereum fall, and some altcoins demonstrate mixed results.

The development of blockchain settlements, institutional adoption, and stablecoins is ongoing.

Overall Crypto Market Update, 11 Feb 2026: Cryptocurrencies falling 2% as Bitcoin and Ethereum dropped, fear increased, altcoin activity was mixed, and institutional developments and stablecoin projects indicated future expansion.

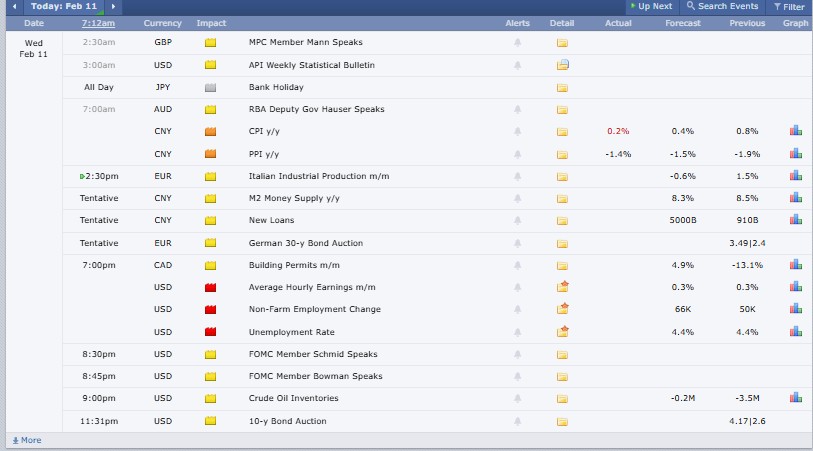

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.42 trillion, noted 2.0% downturn in the last 24 hours, whereas Total trading volume recorded at $109 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57%, while Ethereum (ETH) carries 10.1%. The largest gainers in the industry over the past day are Polkadot and XRP Ledger Ecosystem.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $68971, slides 2.05% in the last 24 hours, with a trading volume of $40.71 billion and a market cap of $1.37 trillion.

Ethereum (ETH) price today is at $2019.26, slips 4.65% in 24 hours with a trading volume of $23.63 billion and a market cap of $243.89 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Warden price (WARD): $0.1106, dips 17.81% in the last 24 hours, trading volume (TV): $328.45M.

Power Protocol price (POWER): $0.3747, climb 46.86%, TV: $61.25M.

Aster price (ASTER): $0.6552, jumps 7.13%, TV: $313.04M.

Monad price (MON): $0.01935, gains 6.59%, TV: $160.34M.

Zama price (ZAMA): $0.02207, slips 20.87%, TV: $430.26M.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Pippin price today (PIPPIN): $0.3917, skyrockets 41.17%, trading activity $65.34M.

River price today (RIVER): $18.02, climbs 35.67%, trading activity $99.52M.

LayerZero price today (ZRO): $2.15, jumps 15.91%, trading activity $340.95M.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

MYX Finance price (MYX): $5.56, down 10.54%, trading activity around $17.77 million.

Decred price (DCR): $24.01, lower by 10.30%, with trading volume near $6.78 million.

Curve DAO Token price (CRV): $0.2349, slipped 7.36%, trading activity close to $80.34 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% Negative change over the past 24 hours, with a market capitalization of $310 billion and trading volume of $85.3 billion.

The Overall (Defi) Decentralized Finance market declined 2.9% over the last 24 hours, recording a market cap of $48.37 billion and trading volume (TV) at $3.6 billion. Defi dominance globally marked 2%.

Source: Alternative Me

Today’s Crypto Fear and Greed Index stands at 11, signaling extreme fear as investors avoid risk amid falling prices and weak sentiment. Yesterday scored 9, last week 14, and last month 27, showing a gradual sentiment decline despite short-term volatility in markets.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. Crypto fundamentals Are Healthy: Dragonfly partner Haseeb Qureshi declares that the crypto sentiment is not as poor as the FTX collapse, with good fundamentals, institutional adoption increasing, DEX volume, and growth of stablecoins all continuing.

2. HIP-3 Records Huge Volume: The HIP-3 perpetual markets of Hyperliquid reached their peak of volume at $5.2 billion per day on February 5, with silver contracts dominating the precious metals volatility and TradeXYZ leading.

3. Etherium implements ERC-8004 on mainnet: AI agents can gain universal identity, reputation, and verification to make payments, discover, portable trust, and hold themselves responsible using on-chain historical records.

4. Coinbase Adds ETHGas to Listing Roadmap: Coinbase exchange has ETHGas (GWEI) as a new listing on its roadmap. Launching of trading requires support and technical infrastructure availability, and the date of listing is announced later.

5. Saylor Dismisses Bitcoin Sale Fears: Michael Saylor says Strategy faces no pressure to sell Bitcoin, plans quarterly purchases forever, calling BTC digital capital expected to outperform traditional assets over time.

6. Japanese Banks Investigate Securities Stablecoin Trading: Nomura and Daiwa collaborate with the three megabanks of Japan to pilot securities trading in stablecoins with the goal of 24/7 blockchain settlement and pilot launch shortly after the notification to the regulators.

The fear index is higher today at 11 compared to the sentiment score of 27 last month, and the volumes of trading are also high, which means that people are actively involved despite falling prices of Bitcoin, Ethereum, DeFi, and altcoins. Institutional developments keep the structure stable.

A further decline in prices with a high level of trading can be seen in the future for crypto users. The sentiment of extreme fear implies that people are more cautious in their choices, whereas institutional developments, adoption of stablecoins, and blockchain settlement projects may signify the expansion of the ecosystem in the long term among investors and developers in the global markets.

Risk Context: It is not a long-term condition and is only informational commentary, not indicating the direction in which the price is heading or to indicate that an action has been taken regarding investment.

The short-term crypto investment is risky because of declining prices, high levels of fear, and market corrections, but long-term investors might find opportunities since the institutional adoption, innovation, and trading activity are still supporting the overall ecosystem confidence to disciplined participants who are observing the daily market trends.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.