After several days of weak sentiment, Bitcoin’s rebound from the $60,000 level has changed the mood in the market.

What looked like another downside move quickly turned into a sharp recovery, forcing many short-biased traders to step back.

Over the last 24 hours, Bitcoin has surged nearly 10%, trading close to $71,300 at the time of writing.

The broader crypto market has also reacted, with total market capitalization moving above $2.4 trillion, up around 8%.

This kind of fast bounce brings relief after a prolonged decline, but experienced traders remain cautious.

Sudden recoveries like this often appear when short positions get liquidated, not when fresh long-term demand enters the market.

Is this recovery real strength returning to the market, or just a brief flash before sellers step back in?

Market analysts at CryptoReviewing note that Bitcoin’s drop below $60,000 was a liquidity-driven move, not a breakdown.

The dip triggered nearly $2B in long liquidations, clearing crowded positions.

Price then flipped higher, reclaiming $70,000 and wiping out another $1B in short positions.

This back-to-back liquidation shows the move was driven more by positioning than fresh demand.

Leftover liquidity sits around $65,000–$68,000, keeping a short-term retest possible.

Bigger liquidity clusters remain higher at $72,000–$80,000, which could attract price if momentum holds.

According to Ted Pillows, on-chain and exchange data shows Binance aggressively accumulating Bitcoin during the rebound.

This activity coincided with a sharp move higher, forcing heavily leveraged short positions to unwind.

Rather than organic buying, the price jump looks driven by short liquidations triggered by rising spot demand.

Whether intentional or not, the result was the same: shorts were caught offside as price pushed higher.

For now, this adds momentum, but it also raises questions about how much of the move was structural versus reactive.

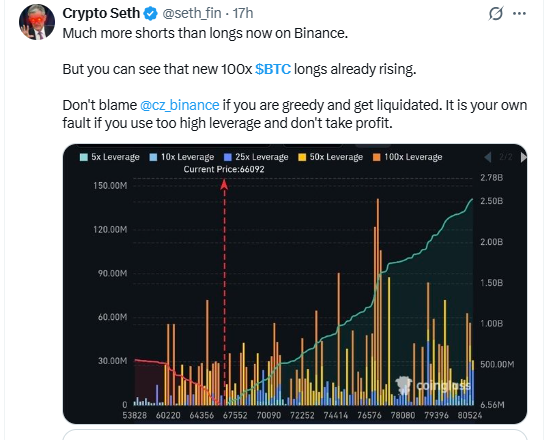

Data shared by Crypto Seth shows a clear imbalance on Binance, where short positions still outweigh long positions.

This imbalance made the market vulnerable to sharp upside moves once the price started pushing higher.

At the same time, new high-leverage long positions, including 100x trades, are already building up.

This creates a fragile setup where both sides remain exposed, increasing the chances of sudden volatility rather than a smooth trend.

For now, price action looks more reactive to positioning than conviction, keeping the market sensitive to liquidation-driven moves.

As highlighted in our previous Bitcoin price prediction, a reaction from the $60,000 support zone was expected.

BTC has now reversed from this level, confirming it as a strong psychological and technical base.

As per the TradingView 4-hour chart, the bounce was supported by oversold RSI conditions, which often trigger relief moves.

However, price is still trading below the 0.5–0.618 Fibonacci retracement zone, drawn from the January high to the February low.

This keeps the current move in a corrective phase rather than a trend shift.

The 50 EMA near $74,647 is acting as dynamic resistance.

Unless Bitcoin breaks above this zone and sustains, the move can still be treated as a short-term pullback or liquidation trap.

Upside levels to watch: $74,647 → $80,714 → $90,000

Key supports below: $66,980 and $60,000

After trading inside a falling channel for several days, BTC briefly broke below the channel and then reversed sharply from the $60,000 support zone.

This bounce has pushed price back inside the falling channel, showing that buyers are active near key support, but control is not fully back yet.

On the daily timeframe, the 9 EMA and 20 EMA are still acting as overhead resistance, keeping pressure on the upside.

The recent decline also came after a bearish EMA crossover, and until a bullish crossover forms, broader sentiment remains cautious.

For now, the recovery from $60,000 looks more like a technical reaction within a bearish structure rather than a confirmed trend reversal.

Bulls will need sustained strength above the EMAs to shift the daily outlook.

This Bitcoin price prediction shows that the rebound from $60,000 has helped sentiment cool down, but the structure still feels fragile.

The move looks more like a reaction to liquidations and positioning resets than a wave of fresh conviction buying.

Until Bitcoin can stay above the $72,000–$74,000 zone, upside strength remains questionable.

A sustained hold above $74,647 could open the door toward $80,714 and later $90,000, though selling pressure is likely to appear along the way.

On the downside, $66,980 is the first level that matters, with $60,000 still acting as the line bulls cannot afford to lose.

For now, this rebound feels like strength being tested, not confirmed.

Whether this Bitcoin price prediction turns into a real trend shift or fades into another liquidity-driven trap will become clearer as the price reacts around these levels.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.