Is the adoption and investment culture in crypto being silently built by the Indian populace without much fanfare? In the year 2025, the number experienced a substantial increase of upto 60% in Crypto SIP in India, where new investors opted for a small investment approach rather than taking the risks associated with the markets.

According to Crypto India, major Indian exchanges have observed a huge rise in systematic investment plans upto 60%, related to crypto in the past year. The registrations on CoinDCX exchange in the year 2025 are staggering in nature, touching an astonishing figure of 572,000, registering an equally astonishing increase of 600% in such a short span of time. The amount that has been invested, is only ₹100 per month.

Source: Official X

The registration of CoinSwitch SIP increased by 59%, while there was a 220% increase in registrations over Mudrex. Most of the people using the services of Mudrex started with small amounts of less than ₹500, but their average contribution increased to ₹4,000- ₹6,000 per month. For Bybit India, which is a global exchange, there was a 25-30% increase in the number of people using DCA, with an average deposit of $80- $100 a month.

The most popular assets were Bitcoin, Ethereum, Solana, and XRP. At the point of writing, Bitcoin is trading at $93,444.69 with a market cap of $1.86 trillion, while Ethereum is at $3,221.45, as per CoinMarketCap data. Solana is trading at $138.22, and XRP is trading at $2.34, thus explaining why large-cap assets top the list in investments.

Analysts from the industries have reported that the growth is a result of a drastic shift in mindset. Investors have moved beyond focusing on short-term gains through price chasing and shifted their attention to long-term wealth generation. Another reason is that the volatility in the market has encouraged users to engage in cost averaging.

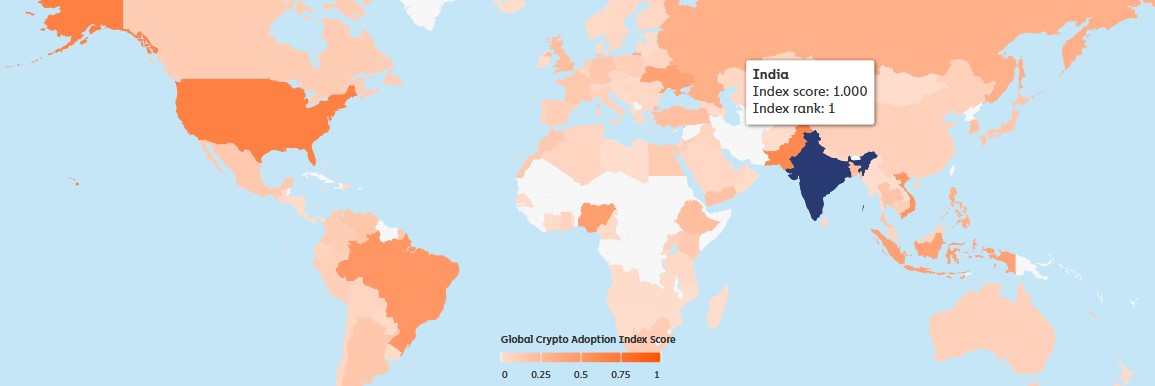

Reflecting the global trend, institutional investment in cryptocurrencies has picked up in India. According to the Chainalysis Global Crypto Adoption Index, the country remains at the forefront of grassroots adoption in the Asia-Pacific region.

Source: Chainalysis data

Though the regulations in the country are stringent, the relaxation in regulations in the US, as well as the evolved global market for digital assets, has increased investor confidence in the nation.

It's very easy to create a SIP account. One needs to select an exchange that is SIP compliant, such as CoinDCX, Mudrex, or ZebPay, and then create an account by completing the KYC procedure by providing proof of PAN card number and residence, linking the bank account, and depositing the required sum of money.

Next, one needs to select the cryptocurrency for the purchase, the investment amount, and the frequency of the investment, then start the auto-invest option of the SIP account.

ZebPay is anticipated to roll out its SIP facility starting from early 2026, thereby offering more alternatives to investors in the Indian market.

The case of Crypto SIP in India proves that adoption does not require hype to succeed. With modest investment per month, growing maturity levels among investors, and synchronization with the global community, India can build acceptance for cryptocurrencies through the legal and gradual method. If that trend persists, India may become an overall participation leader for cryptocurrencies.

YMYL Disclaimer: Cryptocurrency investments involve market risk. The purpose of this article is merely to inform, not to provide financial or investment advice. Readers are advised to consult professionals of their own choosing before taking any decisions on investments.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.