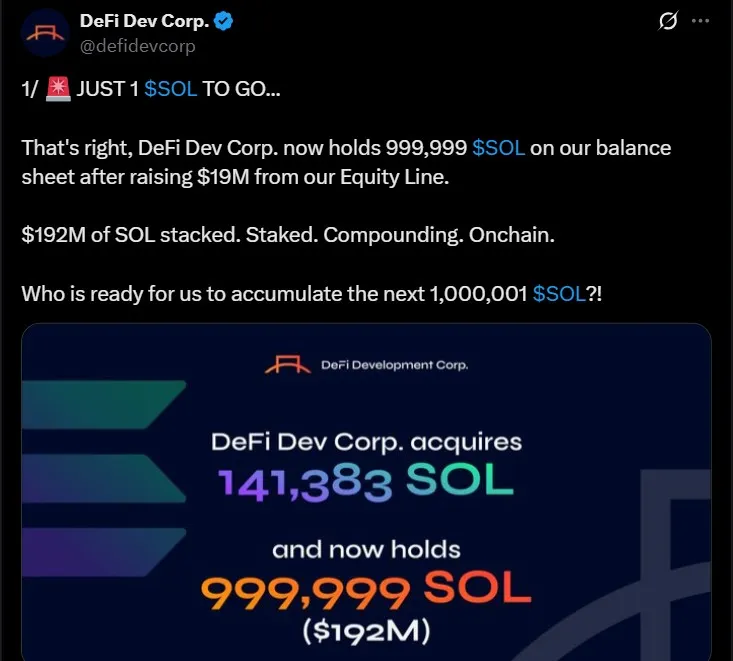

DeFi Dev Corp news has just made a big move—and the crypto market is closely watch Solana price prediction momentum. With a fresh $19 million purchase, the company’s SOL holdings have now reached 999,999.

But this isn’t just about numbers. The defi dev corp sol buy reveals a bigger vision: an aggressive treasury model built entirely on staking, compounding, and long-term conviction in altcoin’s ecosystem

The accumulation happened between July 14–20, funded via the company's Equity Line of Credit (ELOC). Only 0.4% of a $5B facility was tapped, through the issuance of 740,000 common shares—showing there's still massive capital ready to deploy.

According to the company’s filing:

141,383 tokens acquired ($133.53 average)

Total Assets now: 999,999

867 coins earned via validator + staking rewards in one week

SPS: 0.0514, a 13% weekly jump

This structured, long-term model explains why the defi development company is being closely watched by analysts and institutions alike.

While the firm is loading up on on this altcoin, the Solana price is also surging. At the time of writing, it is trading at $195.36, up 7.68% in 24 hours, and boasting a market cap of $105.24B.

Volume has exploded by 92.88%, crossing $10.7 billion—showing serious investor interest.

TradingView Technical indicators show:

RSI at 79.31: Indicating an overbought scenario—positive price action, however, could see some occasional pullbacks.

MACD lines rising: Confirming bullish price action with high selling pressure.

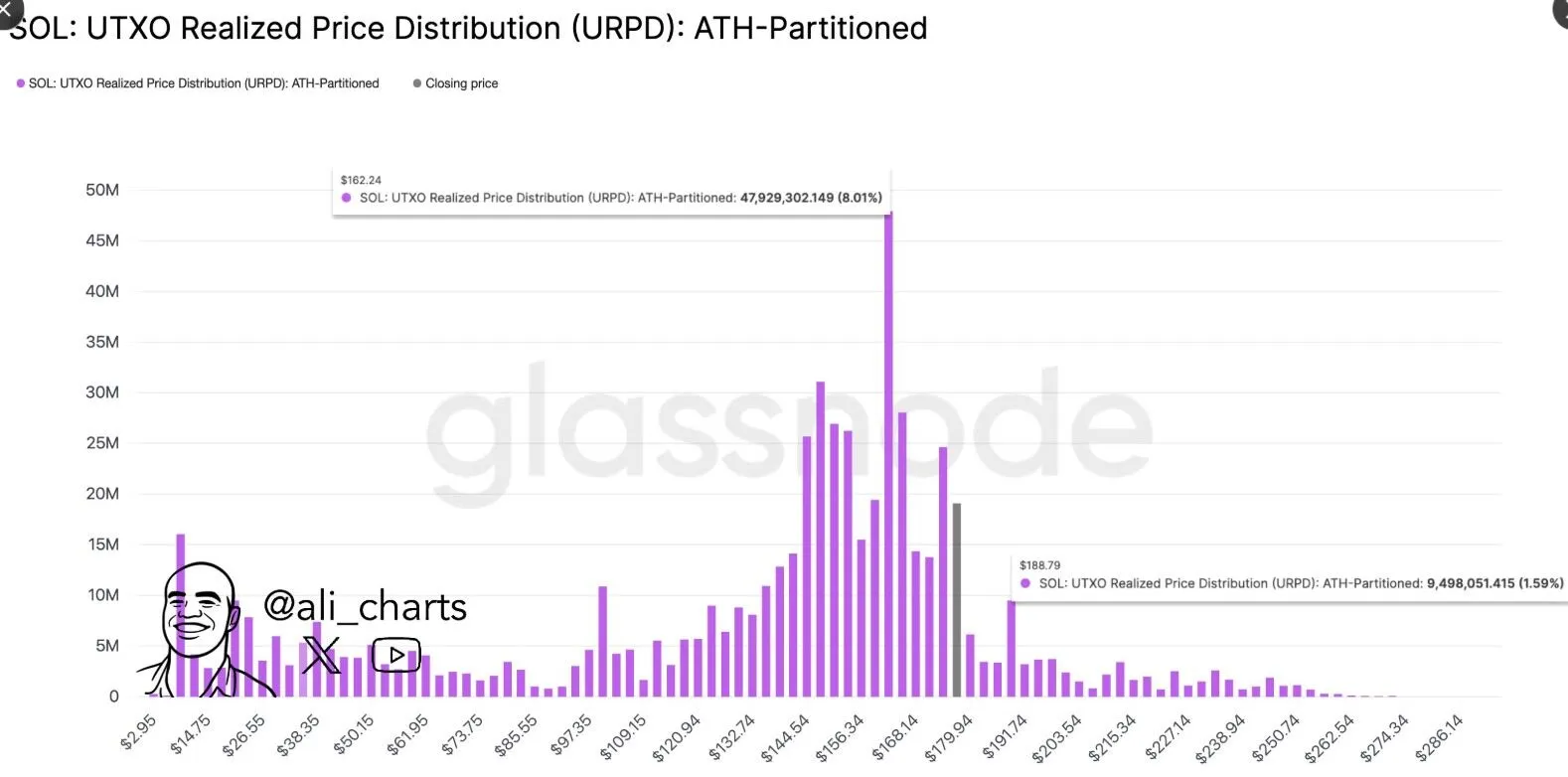

Key break: Analyst Ali chart indicates a clean break above $189 could see “little resistance ahead.”

This means the company’s purchase wasn’t only well-capitalized—it was technically sound, perfectly aligning with the token’s bullish setup.

So, where does this altcoin go from here? With institutional support, rising user activity, and on-chain scalability, the price target bull run is starting to look even more ambitious.

In the short term, analysts predict:

Target Range: $215–$230

Potential for higher valuations as institutional staking strategies grow

Let’s not forget—It just processed 800M non-vote transactions last week, which is 78x more than Ethereum. That’s a clear sign of dominance, not just hype.

This DeFi Dev Corp news isn’t just about quantity—it’s about how they’re using the platofrm. Every token is staked, compounding, and supporting the network’s growth.

The defi dev corp sol buy connects price action with protocol loyalty. With just 1 SOL away from 1 million, and a network that’s already outperforming competitors, the solana price prediction 2025 could be much higher than expected.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

2 months ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is an excellent article.