DeFi Development Corp. recent purchase of 17,760 more SOLs making their view of enlarging the existing Solana Treasury is clear. The Nasdaq-Listed Company now preserves 626,852 SOLs in total as on date. It is obvious as Stocking of the digital currencies is now seen as a backup policy, but the company does not see vitual currency with this limit, it uses this as its working part.

So, how the company is going to invest or deal with these retention or is there more to come? And what is the role of vitual asset in Company’s existence?

The public sector company works in two sectors or works in the way to join the two different aspects. Talking about Solana’s involvement, the company secures its Solana Treasury by stacking and provides the potential of the blockchain’s backbone by verification of the transactions to make it secure and transparent, putting simply working as a validator on the decentralised system and getting rewarded in the correspondence.

Providing technological solutions to the Real Estate sector with the help of AI powered platforms, ease tools, Softwares, and data, is the second principle working zone of the organisation. So basically, DeFi Development Corp. is the inclusion of Crypto stacking with the Real Estate solutions.

The corporate world is moving towards diversification and not only holds traditional assets like cash, stocks, Fixed assets, etc. but fixing interest in the virtual assets also. As for $SOL, it is a well known and growing ecosystem in the crypto markets. It is a fast, strong, and adaptable blockchain network with promising development and the community over time.

The dedicated organisation sees Solana Treasury as a well preserved approach and earns SOLs through staking and by working as a validator. In addition Solana Treasury connects them to the innovative digital economy and attracts investors (who want Crypto exposure).

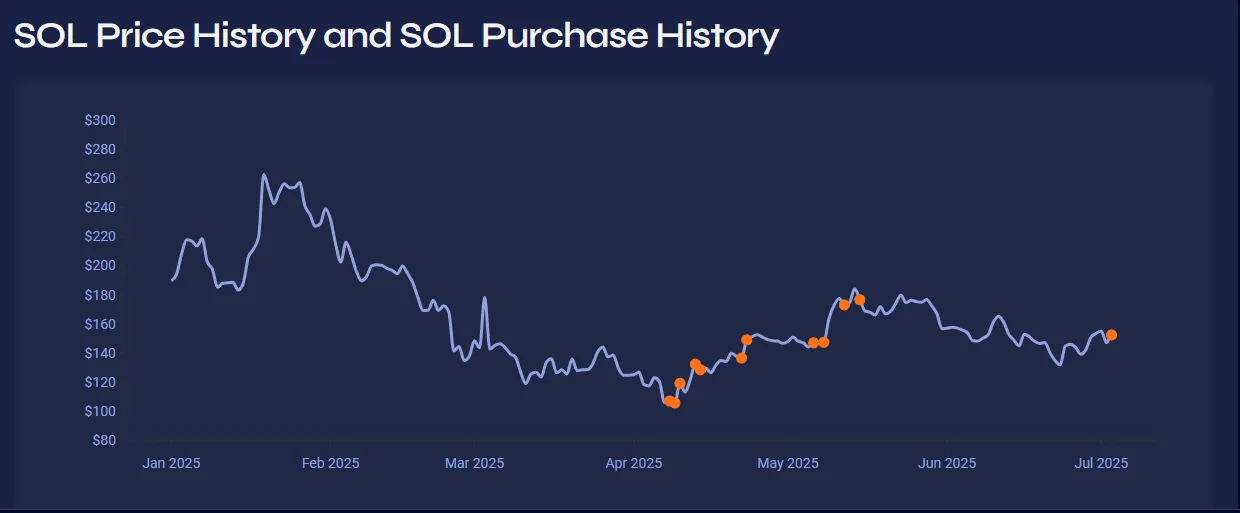

As per the data released by the official corporation, their recent purchasing of 17,760 SOLs cost them $153.10 per SOL on an average with the total expenditure of $2.3 millions. Talking about little back, they made four purchases with the count of 291,995 SOLs last month by spending about $40.1 Millions. As on date they have a total 626,852 SOLs in their Solana Treasury.

Source: DeFi Development Corp.

The First thing is solana is their other income source. They earn through its stacking rewards and working in its ecosystem. The world is also looking forward to the investment of the growing digital asset’s market. This can provide the opportunity to be highlighted in the eye of Crypto-pioneers. The existing investors also indirectly participated in the share of the SOL stockings. The Rising community of the platform adds on in its involvement or selection.

By looking at its buying pattern it shows that the company is very sure about its Dealing in enhancement of Solana Treasury. DeFi Corp frequently adds on SOL in the accounts by several purchases in the last few months. This shows the company's potential for further buying in the future or more briskly.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.