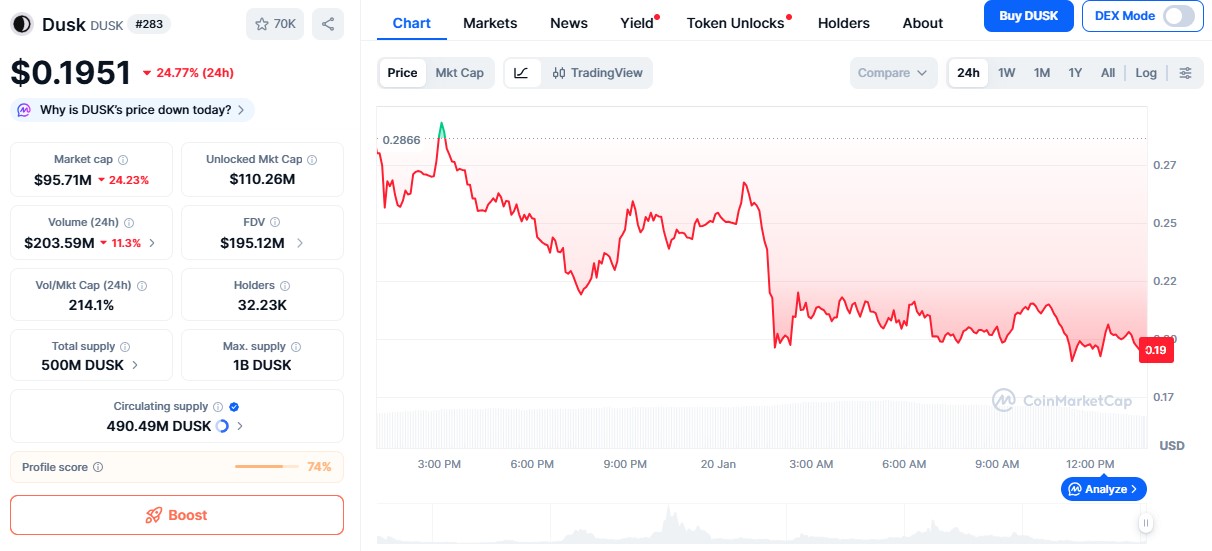

The sudden Dusk price drop has shocked many traders. In only 24 hours, the asset lost around 25% of its value and dropped near $0.195. Many watched heavy selling, but the chart tells a different story.

The explanation of Dusk price drop reasons is a mix of technical breakdown, stop-loss triggers, liquidity flush, and profit taking. Today, as per CoinMarketCap on-chain data, the asset trades near $0.195 with market cap close to $95M and very high volume near $203M, a sign of strong participation on both sides.

Now, let's uncover everything from crash to prediction 2026.

The project didn’t crash only because of random selling, instead it's a mix of fundamental and technical reasons.

1. Support Breakdown: The Dusk price drop started when it failed to stay above the $0.22–$0.23 support zone. Once it broke, many stop-loss orders hit together, and traders who used leverage were forced out. This panic selling caused a quick crash toward $0.19.

2. Liquidity Flush: The big red candle on the CMC chart shows a classic liquidity flush. When leveraged traders get stopped out. When liquidations happen, prices fall fast and volume spikes.

3. Profit Booking After Recent Rally: Right before the fall, the price went up after offical Foundation account shared on X that “Trillions will be tokenized. Privacy included.” Once the price hit those higher levels, a lot of traders decided to sell to lock in their profits. All that selling added extra pressure.

This answers a big question: what’s behind the 25%crash? It is not bad news. It is traders locking profits after a strong rally.

As per the TradingView price chart analysis, "the RSI is around 43, which shows the price is a bit weak but people aren't panic-selling for now. The MACD is below zero, which means the downward push is losing its momentum.

Right now, the price is just moving sideways between $0.18 and $0.20, trying to find a solid floor. This Dusk technical analysis suggests the price might be starting to build a new base."

In the next few days: If the price stays above $0.18, it could bounce back to $0.21 or $0.22. This is where people stopped selling last time and started buying again.

In the next few weeks: If that $0.18 floor holds steady, the ongoing Dusk price drop might reverse, and climb towards $0.24 or $0.30.

In the end of 2026: If more people actually start using the network and the rest of the crypto market looks good, price prediction could target $0.40 or even $0.65, especially if the $BTC price performs well.

The crash looks more like a fresh start than a total crash. High volume, technical indicators slowing down, and holding strong around $0.18 suggests buyers are slowly starting to buy again. If key level holds, project might become one of the biggest early 2026 crypto topics.

Traders should keep a close eye on its support levels to confirm a clear trend on the chart.

YMYL Disclaimer: This article is for informational purposes only, and does not give any financial advice. Crypto investing carries risk. Always do your own research,and take the expert's advice before making trading decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.