The Starknet-based perpetual DEX, Paradex, was affected by a major glitch in its system on January 19, when its database migration mistakenly valued Bitcoin at $0. This error resulted in automated liquidations of many leveraged positions within a few minutes.

Source: Paradex Official

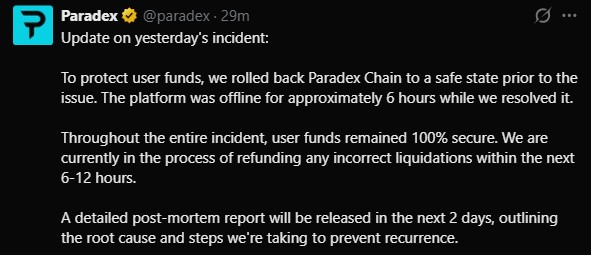

Following the incident, services on the platform were halted for around six-seven hours. In order to counter the losses, the engineering team rolled back the chain to block 1,604,710 to reverse impacted transactions and removed pending trades that users had placed but that were not executed due to the error.

The glitch occurred during routine maintenance when Paradex’s internal pricing system got de-synced with on-chain data. This caused Bitcoin and possibly other assets to display $0 temporarily.

This raised concerns about how “decentralized” exchanges are also under off-chain dependency risks. Community perceptions are also varied where some appreciate the rapid recovery process, while others are nervous on the rollback move, stating it damages blockchain’s natural sovereignty.

$STRK (Starknet token) dipped slightly by 3–4%, the broader crypto market remained mostly unaffected. Experts note that high-leverage trading combined with automated liquidations and reliance on data feeds creates unique risks in DeFi.

Source: CoinMarketCap Data

Starknet native token, STRK, dipped 3–4% with the whole crypto market’s 2% downtrend. However, the broader market mainly suffered due to Trump tariffs news rather than Paradex Bitcoin $0 glitch.

There are a few instances in the past where the price mistakes or oracle issues resulted in a trigger for a liquidation. These are:

October 2025 Flash Crash: A problem with oracles in Cosmos (ATOM) resulted in a crash where its native token price dipped closer to $0 along with other tokens, unleashing

Mango Markets Exploit (2022): The attackers were able to withdraw ~$117M by manipulating oracle pricing.

bZx Flash Loan Attacks (2020 - present): The flash loans were exploited by attacking oracles, causing millions in liquidations.

Although Paradex’s glitch was an internal problem, still, these incidents put light on the risks that can eventually affect the autonomous DeFi space.

The Paradex glitch of $0 BTC matters because it highlights the hidden concerns in Decentralized trading platforms, even in advanced infrastructures. Many users consider DeFi as a well-secured and autonomous space, which it actually is, but some off-chain parameters like databases, maintenance scripts can break this position, as we have seen in some of the above cases.

The rollback also triggered some questions about the finality of the blockchain. An essential benefit of the blockchain technology concept is the fact that transactions are immutable and permanent. However, if the platform reverses the blocks to correct an error, it is almost like “centralized override.”

Knowledge about updates on trading platforms and off-chain dependencies is as essential as market research. Although Paradex compensated for these issues, this is not a feature on all DEXs. Therefore, caution is essential for those trading on high-leverage trading applications and newly created DEXs based on application-chains.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.