Right now, we’re watching a massive wave of Ethereum institutional adoption that’s honestly less of an experiment and more of a total structural reset. We aren't just talking about small startups anymore; giants like JPMorgan, Google and Fidelity have stopped just "looking into" the tech. They’re actually rolling up their sleeves and building their core, everyday systems right on top of the Ethereum network.

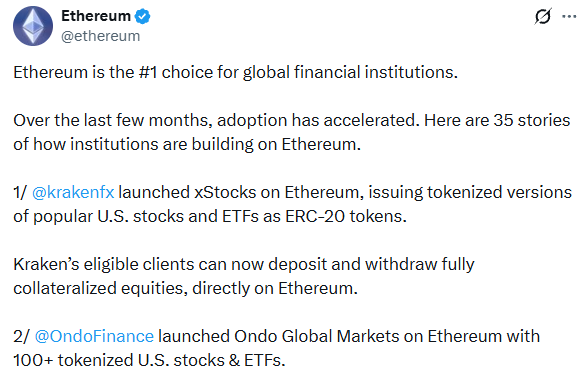

Source: X(formerly Twitter)

Source: X(formerly Twitter)

Think of this shift like the early days of the internet: Ethereum is moving from being a "speculative digital asset" to the essential plumbing that keeps the global economy running.

This isn't just about hype; it's about real money moving in a big way. Take BitMine Immersion, for example. Led by Tom Lee, the company recently staked a staggering 1.77 million ETH a hoard worth over $5.66 billion. In one single, bold move, they locked up 86,848 tokens, effectively taking them off the market.

For BitMine, this isn't just a "buy and hold" strategy. It’s a genius move to generate a steady paycheck (native yield) to pay down corporate debt and fund their upcoming MAVAN operations. When a player this big locks up billions of dollars, it sends a loud message to the rest of the world: Ethereum is a safe, productive place to park capital.

From the high-stakes meetings at Davos to the trading floors of Wall Street, the evidence of Ethereum institutional adoption is everywhere you look. Here’s a quick breakdown of the four big pillars changing the game:

The Tech Titans: Google didn't just show up; they brought the future. Their new "Agent Payments Protocol" (AP2) lets AI bots pay each other automatically using stablecoins on Ethereum. Plus, Google Search is now using Polymarket (a crypto prediction market) as a trusted source of truth for its results.

The Banking Powerhouses: JPMorgan has officially moved its digital deposit product (JPMD) over to the Base network (an Ethereum "Layer 2"). Meanwhile, Fidelity and BlackRock are doubling down. BlackRock is even pushing for a "Staked ETH ETF" so regular investors can earn the same rewards the big guys do.

The Global Plumbing: SWIFT, the network that moves money between 11,500 banks worldwide, is currently building a bridge to ETH. They want to make sure global payments can happen 24/7, in real time, without the old-school delays.

Everyday Shopping: Stripe now lets businesses handle subscriptions in USDC (digital dollars), and Mastercard is making it easier for people to use their own digital wallets safely through their "Crypto Credential" program.

All this ETH institutional adoption has created a bit of a problem: there simply isn't enough Ether to go around. As companies like BitMine, SharpLink, and ETHZilla snatch up every available token and lock them away in staking or long-term vaults, according to CryptoQuant, the amount of ETH left on exchanges has hit a record low of just 16.3 million.

Imagine a popular toy at Christmas everyone wants it, but the shelves are nearly empty. That’s the "supply vacuum" we’re seeing now. For anyone watching the markets, this suggests that ETH is shifting from a simple currency into the world’s most valuable "productive asset."

Ethereum has become the "gold standard" for governments and big business. Whether it’s Sony building a new gaming world on an Ethereum-linked network or Africa’s M-Pesa helping 60 million people move money faster, the trend is clear. The world is moving onchain, and they’ve chosen Ethereum to be the foundation.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.