In a surprising turn, President Donald Trump revealed that his search for the next Fed Chair is down to four finalists.

Speaking earlier today, he said the final list includes “two Kevins and two others.” While he didn’t share the other two names, insiders and political watchers have started guessing.

Source: Wu Blockchain

Who Could be the Nominees?

The two Kevins are likely Kevin Hassett, former White House economic adviser

Kevin Warsh, a former Federal Reserve Governor known for his hawkish views.

As for the mystery candidates, the top guesses include Christopher Waller, a current Federal Reserve Governor aligned with conservative monetary views.

Larry Kudlow, Trump’s former top economic adviser.

Some also mention Scott Bessent, a President's ally with financial experience, as a long-time favorite for the Treasury post.

Trump's announcement follows a series of bold steps targeting the U.S. central bank. Last week, Trump fired the Bureau of Labor Statistics (BLS) Commissioner after weak job data.

The BLS had revised previous reports, showing 258,000 fewer jobs than first stated, and July’s job numbers were weaker too.

Ironically, while he removed the official responsible, the soft labor data actually helps his case for easier monetary policy.

The Federal Reserve has said it will only cut rates if inflation drops or the job market weakens.

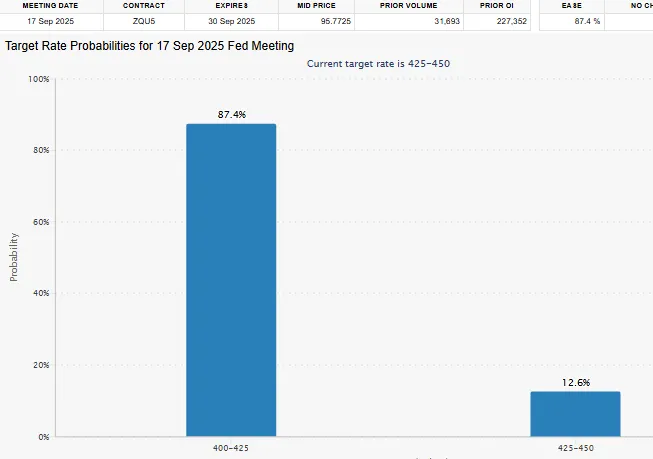

With job growth slowing, markets are now betting there’s a 87% chance the next Fed Rate cut in the September meeting as per the Fed Watch Tool.

Source: FEDWatch Tool

The pressure didn’t stop there. Shortly after the BLS firing, Federal Reserve Governor Adriana Kugler resigned. He welcomed the resignation, noting her term wasn’t supposed to end until January.

This now opens another seat on the bank's Board giving him more power to reshape the central bank in favor of lower rates and looser monetary policy.

Trump’s strategy is clear: gain influence over the Fed Chair and key positions to guide interest rates downward, especially ahead of the 2026 election cycle.

All of this raises one big question: is Fed Chair Jerome Powell next to exit? President has stepped up attacks against Powell, calling him “Too Political” and “Too Late” in a string of recent posts.

The President can’t fire Powell directly, but these moves are seen as an effort to force him out.

Despite this, Powell hasn’t moved. In the last FOMC meeting on July 30, the central bank voted 9-2 to keep interest rates at 4.50%.

It was the most divided vote in over 30 years. Powell stood firm, saying the Federal reserve would not be swayed by politics and would only cut rates when inflation clearly drops.

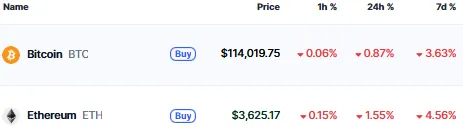

Markets are watching the Fed Chair pick closely, specifically the crypto market. A Trump-friendly chair could push for earlier rate cuts, which would weaken the dollar and help assets like Bitcoin and Ethereum rally.

Currently the crypto market cap stands at $3.72 Trillion with a decrease of around 1%, where Bitcoin is trading at $114,019, while Ethereum is trading at 1.55% as per the coinmarketcap.

Source: CoinMarketCap

With the central bank possibly cutting rates in September, crypto bulls are already gearing up for a strong finish to 2025.

As the US President builds influence inside the Federal Reserve, a new era of monetary policy may be on the way. For now, all eyes remain on who he names as the next Fed Chair and how fast they’ll move to cut rates.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.