In a week of high drama for U.S. monetary policy, President Donald Trump has taken bold steps that signal growing pressure on the Federal Reserve.

After Trump Fires the Bureau of Labor Statistics (BLS) Commissioner and responds to the surprise resignation of Fed Governor Adriana Kugler, all eyes are now on Fed Chair Jerome Powell. The big question: is Powell next?

Trump Fires the BLS Commissioner at a critical time.

Just hours before, the BLS reported a major downward revision of U.S. job numbers showing that 258,000 fewer jobs were added than originally reported.

On top of that, July’s jobs number came in weak too. While that might sound like bad news, it actually helps Trump’s case.

The Federal Reserve has clearly said it will only cut interest rates if inflation drops to 2% or if the labor market weakens.

Source: The Kobeissi Letter

This revised jobs report signals that the labor market may be cooling down, increasing the chance of a rate cut.

In fact, the odds of a rate cut in September jumped to more than 80%. Ironically, although Trump Fires the official responsible for this data, the numbers may actually push the Federal reserve to do what the president wants: cut rates.

Just after the Trump Fires incident, Fed Governor Adriana Kugler submitted her resignation from the Federal Reserve Board. He welcomed the move, saying he’s “happy” to fill the vacancy. Notably her Term was to end in January.

Source: The Kobeissi Letter

This gives him a chance to install a new voice that could align more closely with his push for lower interest rates. The timing of her exit only adds to the speculation that the President is preparing to reshape the Central Bank from within.

With Trump Fires the BLS Commissioner, celebrating Kugler’s exit, and hammering Powell publicly, it’s clear he’s building pressure. In a recent post,

He called Powell “Too Late,” “Too Political,” and “a Total Loser.” These attacks aren’t new but they’ve gotten louder. And now, with more influence over Fed appointments, the president may be aiming to force Powell’s resignation without firing him outright.

Source: X (Twitter)

This wave of action comes just days after the July 30th FOMC meeting, where the President had expected a rate cut.

In a private meeting before the announcement, he reportedly said that the interaction with Powell signaled he might lower the interest rates. But he didn’t act. Instead, the Fed chose to keep interest rates steady at 4.50% for the fifth meeting in a row.

What made this meeting unique was how divided the central bank has become. The vote to hold rates was 9-2 the most split vote in over three decades.

Still, Powell stood his ground. He said the Federal Reserve would not be influenced by politics or pressure from the White House.

He emphasized that inflation must come down more clearly before they act. Until then, the Fed will keep rates in a “modestly restrictive” range high enough to cool the economy but not enough to cause a crash.

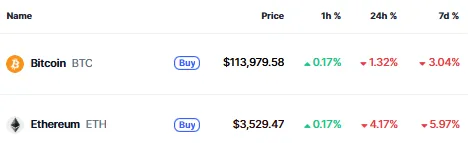

The crypto space has responded to this ambiguity. The global market cap fell by 1.66%. The prices of Bitcoin declined by 1.32% and Ethereum reduced by 4.17% as per the CoinMarketCap.

Source: CoinMarketCap

Investors appear anxious about what the Fed will do next, triggering near-term fear among leading digital assets.

Before the Fed’s decision, markets expected a strong chance of a September Fed rate cut. But after Powell’s comments, that probability dropped to just 43.2% down from 64% just a few days earlier.

Source: FedWatch Tool

However, with the recent labor data now pointing to a slowdown, those odds have surged again, crossing 80% by latest estimates. And thanks to the shift triggered when the president Fires key officials, the pressure is back on the current Federal Reserve Chair.

Whether Jerome gives in or stands firm, one thing is clear: The Trump Fires are no longer just headlines, they're strategic moves. As he tries to steer the economy his way ahead of the election, the phrase Trump Fires is becoming a symbol of his push to reshape U.S. economic leadership.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.