Galaxy Digital, headed by Michael Novogratz, announced the $100 million Crypto Hedge Fund, marking the initiation of the next phase of institutional acceptance in the crypto markets. The proposed Crypto Hedge Fund may hit the markets in the first quarter of 2026. It will target family offices, affluent clients, as well as institutional investors, seeking well-balanced investments in the virtual asset markets.

Source: Coin Bureau

This strategy emerges when cryptocurrency exchange-traded funds (ETFs) and other hybrid models are on the rise, providing investors with greater safety while preserving potential benefits associated with volatile cryptocurrency markets.

Founded in 2018, Galaxy Digital has expanded into a $17 billion asset manager, trading, lending, asset management, and venture services for digital assets. Both organizations also have a history of connecting the traditional financial system with cryptocurrencies and are continuing with this tradition with the launch of the hedge fund.

But, does this new initiative actually work?

Under this, the crypto hedge fund will allocate up to 30% directly in cryptocurrencies like Bitcoin, Ethereum, and other selected tokens. The remaining 70% will go into equities linked to the cryptocurrency ecosystem, such as miners, exchanges, blockchain infrastructure firms, and financial service companies influenced by digital assets.

Galaxy’s approach balances risk with tokens and equity exposure, and that’s how the funds work – offers a more balanced risk profile than traditional crypto-only investments.

Crypto hedge funds are investment vehicles that combine cryptocurrencies with equities, derivatives, or venture investments in pursuit of risk-managed returns. Most funds still keep direct crypto allocation below 50%, reflecting caution among institutional investors.

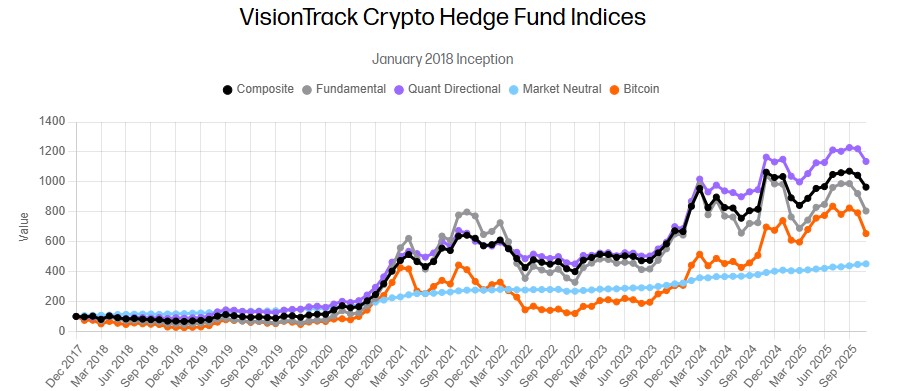

Source: Vision Track

In the latter half of 2025, there are in excess of 400 active hedge-funds operating worldwide, with the overall money under management estimated to range between $82-$136 billion. This is an average of $132 million each per fund. More so, traditional hedge-funds have increased exposure to digital assets, as presently, 55% hold some cryptos and intend to increase the allocation over time.

While the acceptance and trend is this much high in the marketplaces, many other major firms are already in it, leading the space a way before. Some of the famous similar launches include:

BlackRock – Cryptocurrency investment products combining digital assets with blockchain-related equities.

Pantera Capital – Multi-strategy fund blending liquid tokens and venture investments in blockchain startups.

Multicoin Capital – Venture-hedge hybrid with early-stage tokens and public equities in ecosystem players.

BlockTower Capital – Quantitative strategies mixing DeFi tokens, liquid cryptos, and equity stakes.

As in the Galaxy case, these funds are institutional in focus, seeking to provide diversification between direct crypto investment and equity or infrastructure investments.

This development has brought about positive reactions on social platforms. Investors perceive Galaxy’s fund as an element of indirect capital entry into the cryptocurrency market. This move symbolizes confidence in the digital currency market despite the volatility that the market is facing.

Though a small fraction of the $5 trillion overall hedge funds market, virtual assets have increasingly adopted exchange-traded funds, exchange-traded products, or hybrid strategies which pair cryptocurrencies with equity or mining.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.