Ever wondered why many experts keep saying most cryptocurrencies are risky? Well, fresh debate has been stirred by the former SEC Chairman, Gary Gensler, after he has said that every cryptocurrency, except Bitcoin, is highly speculative and doesn't have strong fundamentals.

His latest remarks instantly became a major Gary Gensler Crypto headline across the crypto market.

His comments come as he teaches at MIT, where he continues to study digital assets closely.

In a Bloomberg interview, he said the wider market is filled with thousands of tokens that do not offer dividends, clear utility, or real economic value. According to him, BTC stands apart because regulators often view it closer to a commodity similar to gold.

Source: X (formerly Twitter)

He noted that BTC is different from the rest because of its structure, decentralization, and proven history. The behavior of altcoins is different; they move sharply based on hype, speculation, and fast-changing narratives.

Examples of High-Risk Altcoins

Memecoins like PEPE, FLOKI, and Trump rise mainly on trends and never fundamentals.

Many new tokens launch without real products, only whitepapers.

Several altcoins lose more than 80–90% after bull market peaks.

This increasing gap between Bitcoin and the rest of the market has fueled discussions around the Gary Gensler Crypto perspective.

Major altcoins like Ethereum, Solana, BNB, Cardano, Chainlink, Litecoin, and XRP offer strong utility and large communities. Many altcoins gained ETF approvals-a sign that investors trust them-but are still more volatile than BTC.

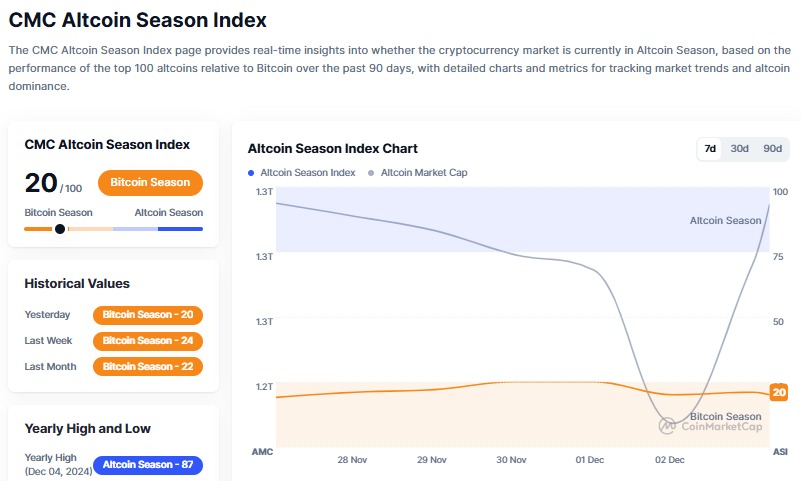

Current market indicators support his warning.

CMC Bitcoin Dominance: 59.09% (+0.33% in 24h)

CMC Altcoin Season Index: 20/100 → “Bitcoin Season”

Source: X (formerly Twitter)

This means investors are choosing BTC over altcoins, showing a “risk-off” mood in the market.

Even strong institutional events are not helping altcoins recover.

For example:

Grayscale’s new Chainlink ETF recorded $89.6M inflows

XRP ETF momentum has built over $756M cumulative inflows

Yet, these inflows are not lifting the broader altcoin sector. The first digital asset continues to lead.

His comments also reflect his term as SEC Chair from 2021 to 2025. During that period, the SEC:

Took action against several digital assets platforms

Increased focus on investor protection

Eventually approved spot BTC ETFs, which now hold billions

He said this was expected because financial markets naturally move toward centralization. Even though digital currency started as a decentralized idea, it is slowly blending with traditional finance.

When asked if crypto has become a political issue after the U.S. elections, Gensler avoided political comments. He said the main focus should remain on keeping U.S. capital markets safe, not on party politics.

His neutral tone adds more weight to the Gary Gensler Crypto debate.

Gensler’s latest comments deliver a simple warning:

Bitcoin may behave like a commodity, but the rest of the crypto market remains highly speculative.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.