Is the Federal Reserve finally ready to ease? According to Goldman Sachs, the answer could be yes—and soon. As a crypto analyst closely watching the macro landscape, I can tell you—things are shifting fast.

This investment bank just released a bold projection: a total 50 bps Federal Reserve cut in 2025, with the first move likely in September. This isn't just speculation. Major prediction markets like The Kobeissi Letter, and Kalshi show rising confidence in this outcome.

Source: The Kobeissi Letter X Account

Currently, the most probable scenario includes two interest yield reductions, supported by improving inflation numbers. The Goldman Sachs Fed rate cut forecast is now viewed as a benchmark across trading desks.

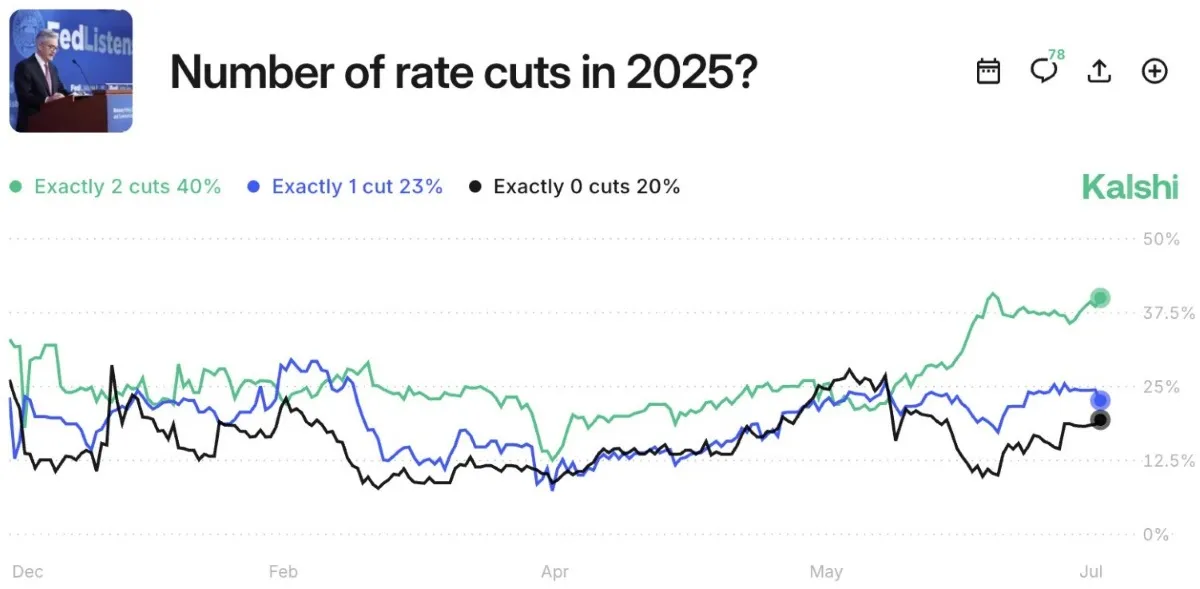

The Kalshi odds model, often used by institutional players and retail investors alike, is painting a clearer picture of what lies ahead.

Here’s how traders see the year playing out:

20% chance of no easing

23% odds for a single move

40% probability of two cuts

13% chance of three adjustments

Just 8% for anything beyond that

These figures suggest that the FED yield cut September 2025 prediction is firmly on the radar—it's a carefully calculated market position.

Helping to support these predictions is one important factor—inflation is cooling. According to the latest consumer survey, 1-year inflation expectations in the U.S. fell to 4.4% in July, the lowest since February this year. That’s a huge 2.2% drop in just two months.

Meanwhile, 5-year inflation outlooks have also eased, down by 0.8% over the last three months to 3.6%. Even though this is still above the 30-year average, the trend is moving in the right direction.

With the American inflation rate easing, central bankers have more flexibility. The Federal Reserve can now explore policy easing without fearing a sudden rise in consumer costs.

From a digital asset perspective, this is big. Lower borrowing costs often translate into greater risk, especially for speculative markets. Past cycles have shown that crypto tends to surge during periods of monetary loosening.

If the Goldman Sachs Fed rate cut expectation of 50bps 2025 turns real, it could fuel fresh capital inflow into Bitcoin, Ethereum, and emerging altcoins. We may even see Altseason 2025 earlier than expected.

This isn’t just theory—it’s something we've seen in past cycles. And this time, the crypto news world is watching more closely than ever.

The upcoming meeting could shape everything. Investors are hoping for clear signals. Even a subtle shift in tone could strengthen bets for Goldman Sachs September FED rate cut forecast.

For traders in both traditional and decentralized finance, this is the moment to watch. With the Fed rate cut news today and declining US inflation expectations, the upcoming month is shaping up to be a turning point for the entire crypto economy.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.