Let’s be honest—when most Indian cryptocurrency users heard “30% charge plus 1% TDS”, they thought trading was doomed. But here we are, just two years later, and India crypto tax collections have already crossed ₹700 crore.

As a cryptocurrency analyst watching India crypto news, I find this data both impressive and alarming. Impressive, because it shows real investor participation. Alarming, because this might only be part of the actual story.

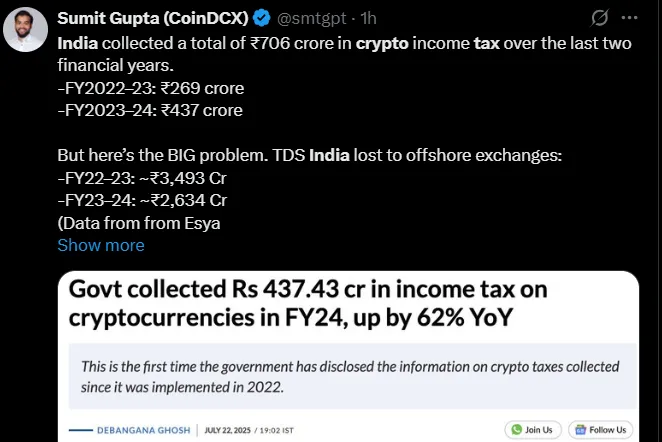

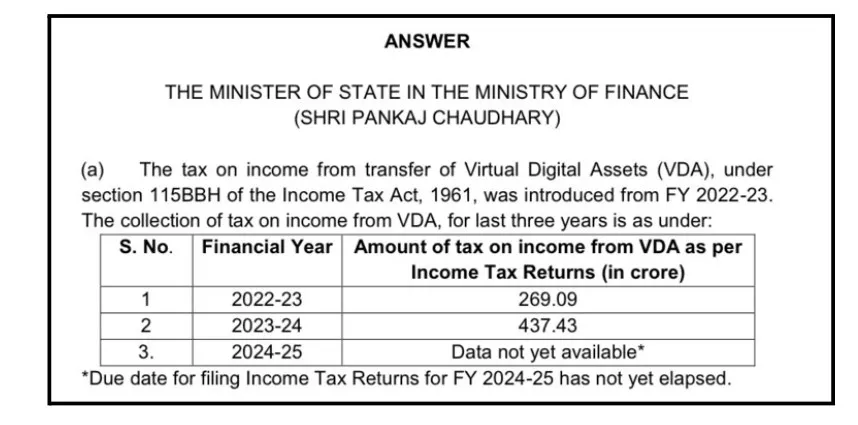

India’s crypto tax revenue has crossed ₹700 crore in just two years—and the pace is accelerating. In a written reply to the Lok Sabha on July 21, 2025, the Finance Ministry confirmed that over ₹706.52 crore was collected from Virtual Digital Asset (VDA) transactions under Section 115BBH of the Income Tax Act.

Source: Sumit Gupta CoinDCX

This milestone shows how deeply its has penetrated the entire economy, despite tough duty rules like 30% on profits and 1% India TDS Tax on every transaction.

On 21 July 2025, the Finance Ministry officially confirmed through a Lok Sabha reply that:

₹269.09 Cr was collected in FY 2022–23

₹437.43 Cr was collected in FY 2023–24

That’s a 62% year-on-year jump—a massive rise in duty filings under the VDA charge collection system introduced in 2022.

It’s clear now: Investors didn’t exit the space… they just adjusted to the new tariff regime.

While ₹700 crore is a big number, many analysts argue it’s just the tip of the iceberg. A huge part of the activity still happens through:

P2P transfers

Foreign exchanges

Non-custodial wallets

According to the Pankaj Chaudhary statement, the government has started using AI/ML tools and data analytics to track tariff evasion in the cryptocurrency news India space.

And still, experts say that countries cryptocurrency tariff evasion crackdown has barely begun. Many investors are still using: P2P trading, Global exchanges, Non-custodial wallets, which often fly under the tariff radar.

There’s a bigger shift in motion. The government is now considering a real-time matching system—where data from Virtual Asset Service Providers (VASPs), TDS filings, and user ITRs can be instantly cross-verified. If implemented well, this could stop duty evasion before it happens.

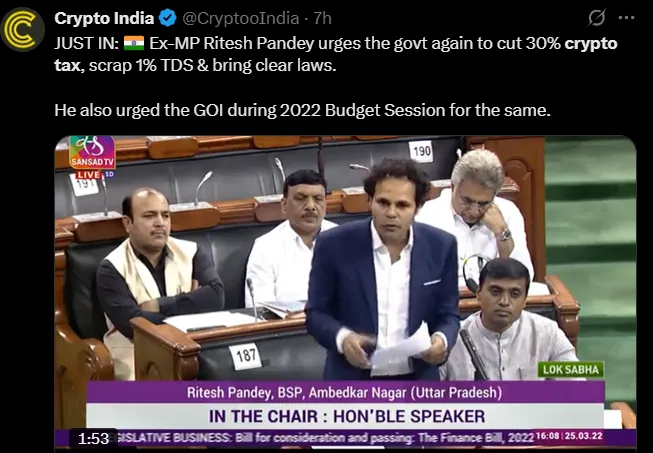

Source: Crypto India X Account

Former MP Ritesh Pandey recently raised this again in Parliament, calling for fair regulation 2025. He also called the currency a “yuva asset class,” urging the government to cut the 30% tax, scrap the 1% TDS deduction, and bring in fair, clear regulations to support the country's Web3 innovators.

As someone who’s observed the global space, India’s current crypto regime is far harsher than most countries.

Yes, ₹700 crore in India crypto tax sounds like a big win for regulators. But from where I see it, this is only the visible part. The real industry economy is bigger, faster, and more complex than current rules can fully capture.

With AI surveillance rising, global regulatory pressure increasing, and country's adoption climbing, this story is far from over.

For every user out there—whether you’re a trader, investor, or builder—the message is clear: report right, plan smart, and watch this space closely.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

A good article to read. The writer has effectively managed the data to make the article engaging. In my opinion, this is an excellent article.