Key Highlights

HeyElsa airdrop listing today on Bitrue extends the access to spots.

The price today is close to $0.20 following the volatility reset.

There is an opinion that it could be stabilized, and then there will be long-term action.

This article breaks down the HeyElsa listing date and price, current market conditions, and a measured price outlook based on available data—not speculation.

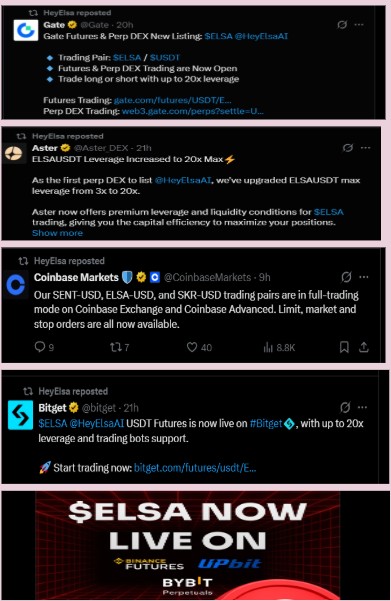

According to the official announcement, this token will list on Bitrue Exchange on January 23, 2026, at 09:00 UTC. This listing adds to a series of already-completed market expansions. HeyElsa token listing today comes after already going live on:

Coinbase Exchange & Coinbase Advanced (Spot)

Binance Futures

Bybit Perpetuals

Bitget USDT Futures

Gate Futures & Gate Perp DEX

Aster DEX (Perpetuals)

These listings collectively improve liquidity access and global exposure for the ELSA coin crypto ecosystem.

Source: Official X

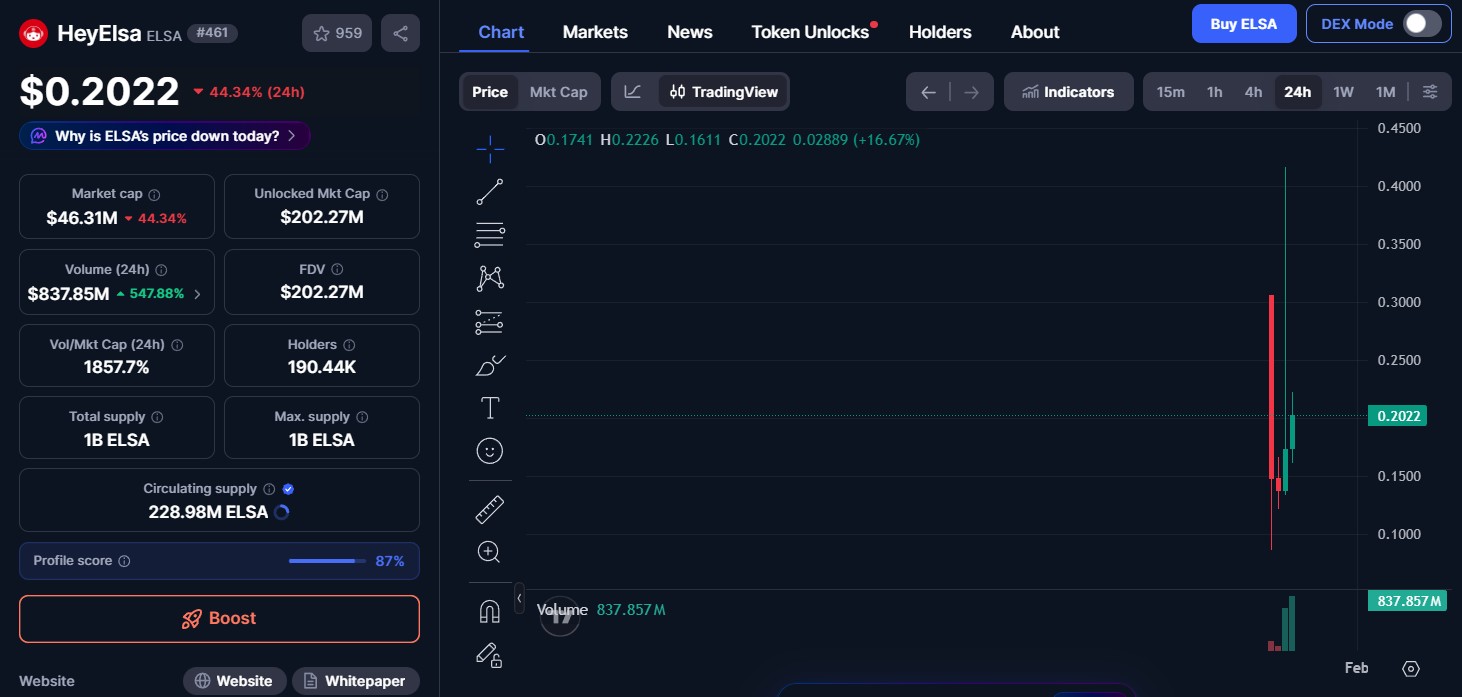

According to CoinMarketCap data, HeyElsa crypto price is currently at about $0.2022, which is a significant drop of about 44% in the last 24 hours.

Key market observations:

Active redistribution is indicated by a heavy volume spike.

High volatility, not low interest, is implied by large wick ranges.

Market cap has changed with the supply expansion in circulation.

The current HeyElsa coin price is an indication of a typical post-listing cooling-off period and not a structural failure.

The recent ELSA token price drop seems to be caused by temporary reasons, rather than a fundamental breakdown:

Taking profits following early fast spikes.

Increasing liquidations in high-leverage futures.

Derivatives volume versus thin spot order books.

Altcoins: The general risk-off sentiment in mid-cap altcoins.

Notably, there has not been any significant negative news about the project in the present crypto news.

Source: CMC

HeyElsa AI airdrop enables users to:

Easy registration of wallet addresses.

Participate without reconnecting existing wallets.

EVM/Base wallets (including Solana users) should be used.

This airdrop is consistent with tokenomics that are aimed at gradual decentralization as opposed to short-term aggressive selling.

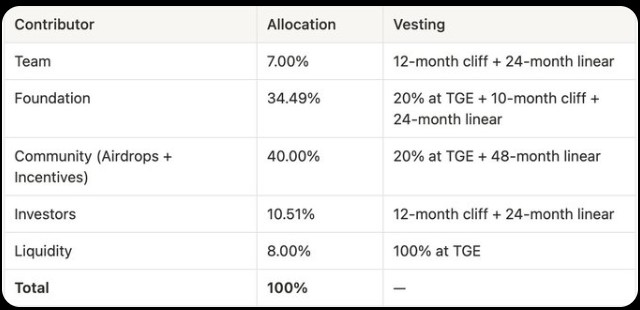

Total Supply: 1 billion

8% unlocked at TGE

40% Community allocation over time. The remaining supply was discharged linearly after 48 months.

Strict team and investor lockups.

This structure reduces sudden supply shocks, an important factor when evaluating Elsa token listing price behavior.

Source: Website

An Assumption-Based Outlook Based on:

Current price near $0.20

Increasing the coverage of exchanges.

Derivatives are high, but the spot is shallow.

Short-term price range assumption (not a forecast):

Support zone: $0.14–$0.16

Stabilization zone: $0.18–$0.22

A price surge to $0.26 – $0.30 (if spot demand improves) would likely depend on:

High volume of spot compared to futures.

Unambiguous utility adoption in the Elsa wallet and AI ecosystem.

Lower leverage-based volatility.

In their absence, the sideways consolidation is a possibility.

The Hey Elsa crypto listing on Bitrue is another move in the growth of the exchange, and price action indicates that the market is yet to find equilibrium. Instead of being an indicator of strength or weakness, the current levels indicate transition and price discovery. To the readers who are following the token, patience and scientific observation are more appreciated than immediate responses.

Disclosure: This article is for informational purposes only and does not constitute financial or investment advice. ELSA coin price, listings, and market behavior are subject to rapid change. Readers should conduct independent research and assess personal risk tolerance before engaging with any digital asset.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.