Illinois has introduced a new proposal that could mark a significant move in US state-level Bitcoin adoption. The state recently proposed the bill, named as Community Bitcoin Reserve Act (SB3743), which aimed at the exploration of Bitcoin as a strategic asset, and put the asset’s regulation under compliance.

Source: BitcoinNews Official

This Bitcoin Reserve Act builds on earlier Illinois efforts, such as the 2025 Strategic Reserve proposal, which failed to advance. This updated version places stronger emphasis on transparency, local engagement, and risk control.

The Community Bitcoin Reserve Act proposal, outlines a framework for Illinois to acquire and hold the coin under strict security and governance rules. It establishes a state-managed program to hold BTC in multi-signature cold storage which reduces the hacking or misuse risks.

A key feature of this Reserve Act is its long-term approach. The bill prohibits selling or trading of the coin unless entirely new legislation is passed, signaling caution and commitment rather than short-term speculation.

It also includes provisions for proof-of-reserve reporting, community oversight, and budget-neutral funding, meaning no added burden on taxpayers.

The proposal names the Altgeld Bitcoin Reserve as the first specific place to store Bitcoins, connecting it to local community-focused development in the Altgeld Gardens area of Chicago.

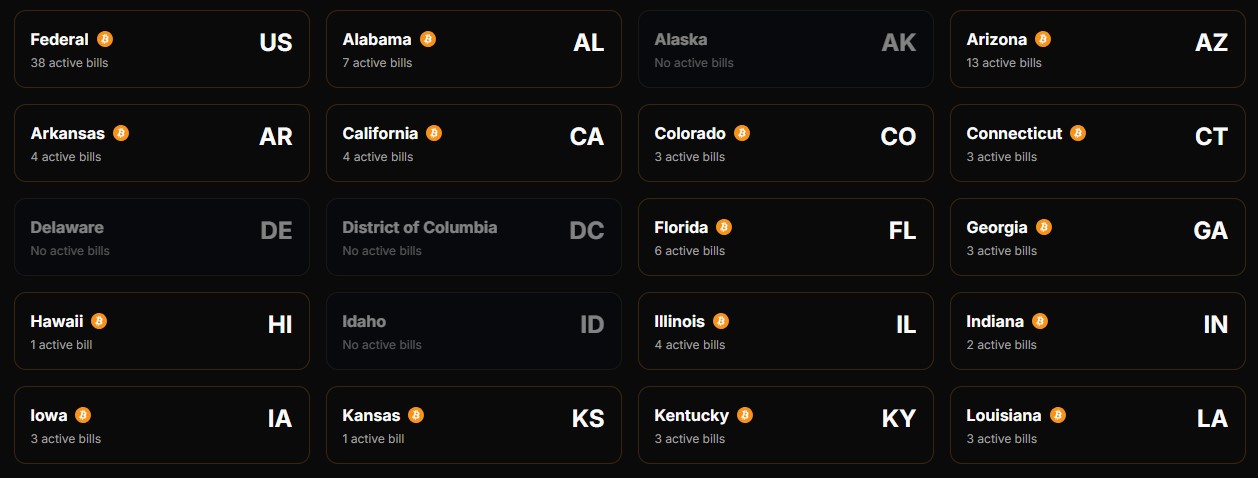

Illinois is not alone in this initiative to accept the crypto coin at regulated stores of money. More than 16 US states have introduced or advanced BTC reserve-related legislation since 2025. Texas and New Hampshire have already moved forward with Bitcoins exposure, while states like Arizona, Missouri, and Ohio are actively debating similar frameworks.

Source: BitcoinLaws io

This isn't stopping at state-levels only, the central Federal already established the BTC fund in 2025, which further encourages states’ action.

The proposal arrives when BTC is facing heavy downturns since its 2025 all time high. The digital coin slipped below the key level of $65K and is currently trading at near $64,887 with a 8.52% value loss in the last 24-hours.

Source: CoinMarketCap

While the BTC is not the only currency falling, but the whole market is turning into red, stating the first crypto market crash of 2026.

The market, around-the-clock, dropped 7.07% to $2.24 trillion cap, where top 100 tokens and altcoins are struggling, and Greed & Fear index showing heavy fear with rating at 5 (extreme).

For now, market experts are portraying this crash as a result of rising geopolitical tensions like tariffs, recessions, sanctions, and war situations.

Here, in this situation, Illinois proposal underscores two possible conditions: Confidence in the currency’s long-run player by taking these downfall as a short-term temporary effect, or a state-level strategy to acquire the asset at the possible lowest price.

In both cases, one thing is clear: The state-based BTC fund.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.