The International Monetary Fund (IMF) has renewed global attention by warning that stablecoins are becoming powerful enough to impact the global financial system and now need clear regulation.

In a recently released report, the IMF said stablecoins can make global payments faster and cheaper, but must be regulated carefully to protect financial stability and national sovereignty.

The discussion comes as stablecoin adoption accelerates worldwide, especially in crypto trading and global transfers.

According to the report “Understanding Stablecoins”, the stablecoin market nearly doubled in two years. Currently the market sits at around $307 billion market cap which was around $130 billion in 2024 as per DefiLlama, making a significant gain in a short time. USD-backed stablecoins dominate the sector, with USDT and USDC controlling about 90% of the market.

The IMF noted that stable coins are already widely used as a bridge between fiat money and crypto assets. In the future, they could play a major role in cross-border payments, remittances, financial inclusion, and asset tokenization,

especially in regions where banking systems are slow or expensive.

However, the international organisation also highlighted serious concerns.

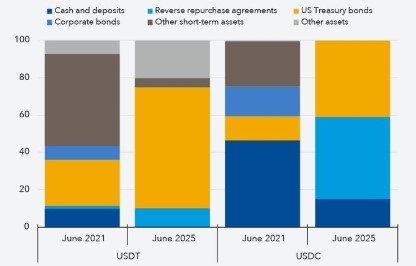

The IMF raised concerns after new audit data from BDO and Deloitte showed that 70–80% of USDT and USDC reserves are now invested in US government bonds.

This makes stablecoin more stable, but also tightly links them to the US financial system.

According to the monetary organisation, this could:

Increase financial stress during market shocks

Push sudden capital flows in emerging economies

Reduce control of local central banks over their own currencies

In simple terms, heavy use of dollar-backed stable coins could weaken local currencies and increase dependence on the US dollar.

The discussions are getting more fueled as new data showed Tether earned nearly $10 billion in profit in the first nine months of 2025. The company invested around $137 billion of USDT reserves into US Treasuries, benefiting from high interest rates while paying users no yield.

If treated like a country, Tether would rank among the largest holders of US government debt, ahead of several major economies. This highlights how big stable coins have become systemically important.

The IMF is not pushing for a ban on stablecoins. Instead, it wants governments to bring clear and common rules. This includes defining how the digital coins operate, protecting user funds, and applying strict oversight.

Because stable coins move money across borders quickly, the IMF says countries must coordinate globally to avoid risks. It also wants the coins treated like payment systems, with rules similar to banks and payment firms.

In short, stablecoins can support global finance, but only with proper regulation in place.

Note: The article above is for informational purposes only.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.