Indian billionaire and Zerodha co-founder Nikhil Kamath recently revealed that he has never invested in Bitcoin or other cryptocurrencies, surprising many in the crypto community.

Source: X Official

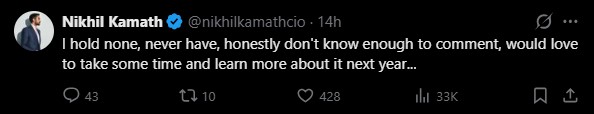

In a discussion with CoinDCX CEO Sumit Gupta on X, Kamath admitted he currently holds zero Bitcoin and described his knowledge of cryptocurrecny as limited. He added that he plans to learn more about blockchain and cryptocurrency in 2026.

Despite engaging with high-profile global leaders, Kamath remains cautious about directly investing in digital assets. “I hold none, never have, honestly don’t know enough to comment,” he said.

Kamath’s stance reflects broader trends in India, where regulatory uncertainty and high taxation remain barriers for crypto adoption. Cryptocurrency gains in India are taxed at 30%, and clear rules around trading and usage are still evolving.

Although the country ranks in crypto adoption or transaction, mainly on a retail basis. SB Seker, head of APAC at Binance, also emphasized that regulatory clarity is key for institutional crypto adoption in India.

Now as the government is gradually moving towards a safer way in digital assets, the fear among the organization could be less intensified. Adding on to the rally, the growing demand and craze of the decentralized products also attracts users worldwide.

Globally, cryptocurrencies like Bitcoin are seen as hedges against inflation, digital stores of value, and tools for cross-border transactions. Where largest economies are exploring stablecoins and digital coin reserves, companies are entering with ETFs, and their own trust asset’s reserves.

Global cryptomarket cap soared to $2.95 trillion, with volume reaching $65.86 billion. ETFs saw millions of transactions in daily routine.

As for individuals, top key figures are openly involving and promoting cryptocurrencies. From one of the richest people – Elon Musk to the U.S. President Donald Trump, they all admire and accept the growing growth.

Nikhil Kamath revelation underscores the reality that even prominent investors are taking a measured approach to cryptocurrencies. While digital assets like Bitcoin continue to gain popularity worldwide, regulatory clarity, risk assessment, and personal understanding remain critical.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.