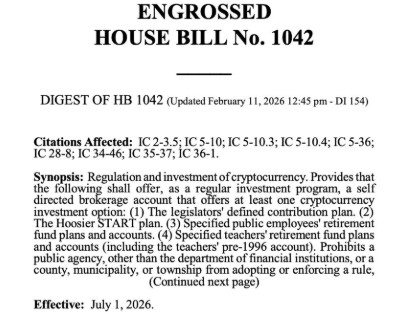

Indiana has taken a cautious but notable step toward crypto adoption after a Senate committee advanced HB1042, a bill that could allow cryptocurrency retirement funds exposure through regulated investment options.

Source: Coin Bureau

The proposal moved forward on February 11–12, 2026, after clearing the Indiana Senate Insurance and Financial Institutions Committee with a “do Pass” recommendation. The move reflects a growing interest among U.S. states to cautiously test cryptocurrency exposure, while still keeping tight controls in place.

However, the risks from crypto’s volatility keep the bill under scrutiny of market analysts, even though the regulators have amended the bill to make it more secure.

Under HB1042, Indiana would require self-directed brokerage accounts to be offered within certain state retirement and saving programs. These include:

the Hoosier START 529 education plan,

legislation’s defined contribution plans, and

specific public employee and teacher retirement accounts.

Importantly, the bill limits cryptocurrency retirement funds exposure to crypto ETFs only, explicitly excluding payment stablecoins.

Earlier versions of the bill allowed direct ownership of cryptocurrencies, but lawmakers amended the bill to remove that provision, shifting all risk and decision-making to individual participants.

This ETF-only structure is designed to reduce volatility and custodial risks, making the approach more acceptable for conservative superannuated savers.

However, cautious optimism still remains.

Despite the safeguarding, risks remain. Digital asset markets have been highly volatile in late-2025 and continue in 2026, and ETFs tied to them, are not resilient with this. US Bitcoin spot ETF has been facing $693.18M in monthly outflow, where Ethereum Spot ETFs measure $337.23M outflow as per SoSoValue Data.

Altcoins, like XRP and SOL, are comparatively performing better while recording positive inflows on a monthly basis.

Aside from this, there are also concerns around financial literacy, behavioural risks like panic selling, and broader regulatory uncertainty at the federal level, which possibly affect ETF liquidity or availability.

Indiana’s approach appears driven by two forces: rising mainstream acceptance of crypto ETFs and pressure to modernize investment options without exposing public pensions to excessive risk.

With roughly $40 billion managed across public pensions to excessive systems, even limited participant-led exposure could eventually bring modest institutional flows into regulated crypto products.

At the same time, the ETF-only structure signals restraint. Lawmakers are not forcing crypto into retirement portfolios but allowing optional access for those who actively choose it.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.