Key Highlights:

The overall Crypto Market Update shows drops of 1.4%, lower than yesterday.

Bitcoin falls 2.32%, Ethereum falls 1.34%, fear index remains at extreme fear (9).

ARTX and BTR are on the rise, and ZRO and XMR are on the fall.

Cryptocurrency news, 13 Feb 2026: The cryptocurrency fell 1.4% to $2.34 trillion as Bitcoin and Ethereum fell. The sentiment of fear remains high, and select altcoins have posted strong returns amid macro and regulatory trends.

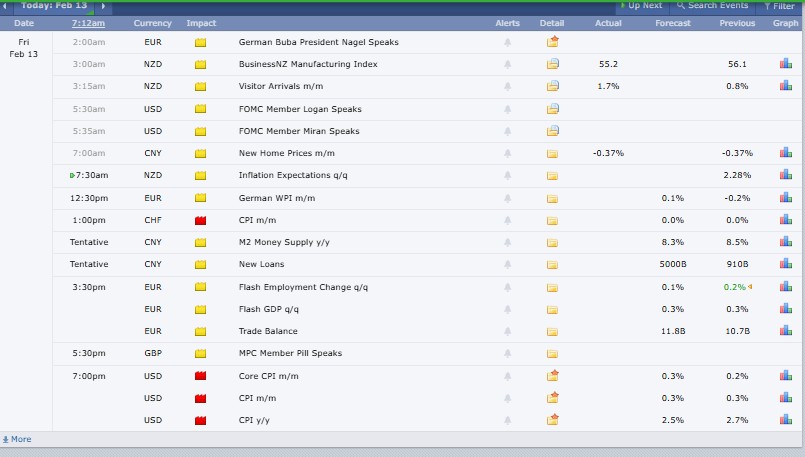

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.34 trillion, noted 1.4% downward trend in the last 24 hours, whereas Total trading volume was recorded at $112.3 billion.

Bitcoin’s (BTC) dominance over the industry remains intense with 56.4%, while Ethereum (ETH) carries 9.9%. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $66386.74, declined 2.32% in the last 24 hours, with a trading volume of $44.54 billion and a market cap of $1.32 trillion.

Ethereum (ETH) price today is at $1947.3, dips 1.34% in 24-H with a trading volume of $19.96 billion and a market cap of $235 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Ultiland price (ARTX): $0.3077, up 33.25% in the last 24 hours, trading volume (TV): $1.28B.

Espresso price (ESP): $0.06889, down 13.02% in the last 24 hours, TV: $234.15M.

Bitcoin price (BTC): $66,279.98, down 2.13% in the last 24 hours, TV: $44.7B.

BSquared Network price (B2): $0.6920, down 1.33% in the last 24 hours, TV: $506.01M.

Bitlayer price (BTR): $0.1378, up 50.35% in the last 24 hours, TV: $75.92M.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

River price today (RIVER): $21.65, surges 27.66%, trading activity $44.45 million.

Kite price today (KITE): $0.1938, climbs 17.89%, trading activity $127.83 million.

Humanity Protocol price today (H): $0.1672, gains 10.57%, trading activity $41.15 million.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

LayerZero price (ZRO): $1.93, down 8.66%, trading activity around $262.38 million.

JUST price (JST): $0.04016, lower by 4.25%, with trading volume near $25.78 million.

Monero price (XMR): $334.64, slipped 4.18%, trading activity close to $71.55 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% negative change over the past 24 hours, with a market capitalization of $309.9 billion and trading volume of $84.9 billion.

The Overall (Defi) Decentralized Finance market escalated 1.2% over the last 24 hours, recording a market cap of $47.9 billion and trading volume (TV) at $4.4 billion. Defi dominance globally marked 2%.

Source: Alternative Me

Crypto Fear & Greed Index from Alternative.me shows extreme fear at 9 today, up from yesterday’s 5, matching last week’s 9, far below last month’s 48. Selling pressure, volatility, and macro uncertainty drive investor caution across cryptocurrency markets globally today.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. LSEG Intends to Settle On-Chain: London Stock Exchange Group declared LSEG Digital Securities Depository, an on-chain settlement of tokenized bonds, equities, and private assets, to be launched in 2026 worldwide.

2. Fed Paper Flags Crypt Margin Risks: In a Federal Reserve working paper, crypto assets are suggested to be treated as a distinct asset class, with initial margin requirements increased because of the volatility risks in derivatives markets.

3. CFTC Establishes Innovation Advisory Committee: The Commodity Futures Trading Commission appointed 35 professionals, such as Brian Armstrong, Hayden Adams, and Brad Garlinghouse, to lead blockchain and AI policy in derivatives markets around the world.

4. Coinbase Reports Q4 Loss: Coinbase Global Inc. posted $667 million loss as Bitcoin's slump cut trading, while Gemini Space Station Inc. and Robinhood Markets Inc. struggled financially.

5. SEC Flags Prediction Market Oversight: During a hearing of the Banking Committee at the U.S. Senate, prediction markets were discussed by Paul Atkins, who stated that the prediction markets should be regulated and coordinated with CFTC Chairman Michael Selig on joint regulation.

6. Aave V4 Proposal Requests DAO Funding: Aave Labs is offering the Aave V4 framework, with all the revenue of Aave products going to the Aave DAO treasury, requesting funding of 25 million, 75,000 AAVE tokens, for milestone development funding.

Compared with yesterday's crypto market cap of $2.38T and Fear Index at 5, today’s market shows slight stabilization in sentiment at 9 but continued capitalization decline to $2.34T. Trading activity remains active, indicating cautious participation, while altcoin volatility persists alongside Bitcoin’s strong dominance in uncertain conditions.

Macro uncertainty and regulatory headlines should continue to cause short-term volatility to users. The hegemony of Bitcoin implies cautious movement of capital, whereas the altcoin spikes imply the presence of speculative trading. Risk management, liquidity awareness, and diversified exposure remain essential in such emotionally sensitive conditions.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on the investment.

Currently, high short-term risk due to extreme fear and declining capitalization. While selective gains offer trading opportunities, overall conditions favor cautious strategies. Long-term investors may observe accumulation zones, but short-term participants should manage exposure carefully amid volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.