The June CPI report crypto investors feared is finally here—and it’s sending shockwaves across the market. Inflation in the U.S. is proving more stubborn than expected, and crypto didn’t take it lightly.

Just hours after the CPI data release today Bitcoin price tumbled nearly $2,000, triggering what analysts are already calling a mini bloodbath.

Now the question dominating every investor and reader is: Will altcoins survive or sink deeper with BTC?

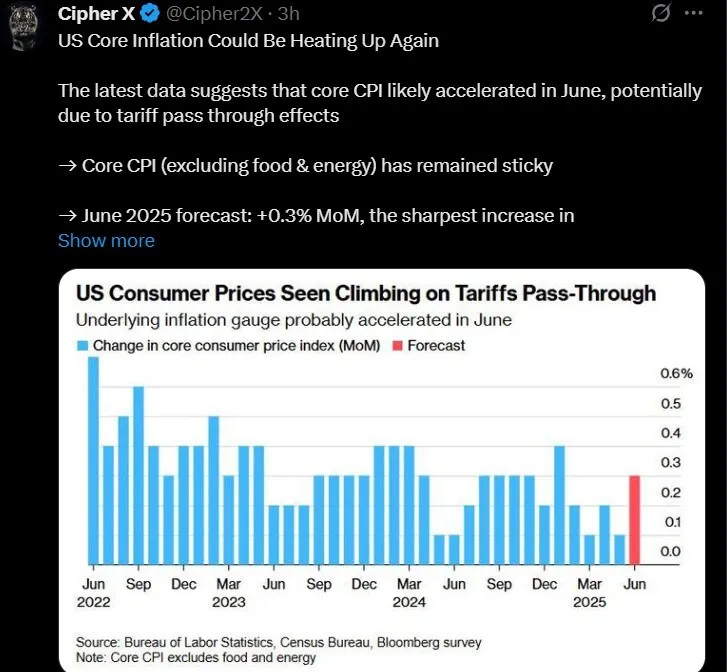

The U.S. consumer price index for June showed a 0.3% month-on-month increase, pushing the year-on-year rate to 2.7%, its highest since February.

This came just as many expected inflation to stay contained. But a closer look at the core data—which strips out food and energy—shows the real story. It rose by 2.9% annually, signaling deeper price pressure.

Analysts Cipher X pointed to signs that tariffs imposed by Donald Trump might be quietly seeping into consumer costs. Apparel and furnishings—both tariff-sensitive—saw monthly increases.

Core inflation’s unexpected acceleration now raises the odds that the Federal Reserve may delay any future rate cuts, tightening the noose on risk assets like crypto.

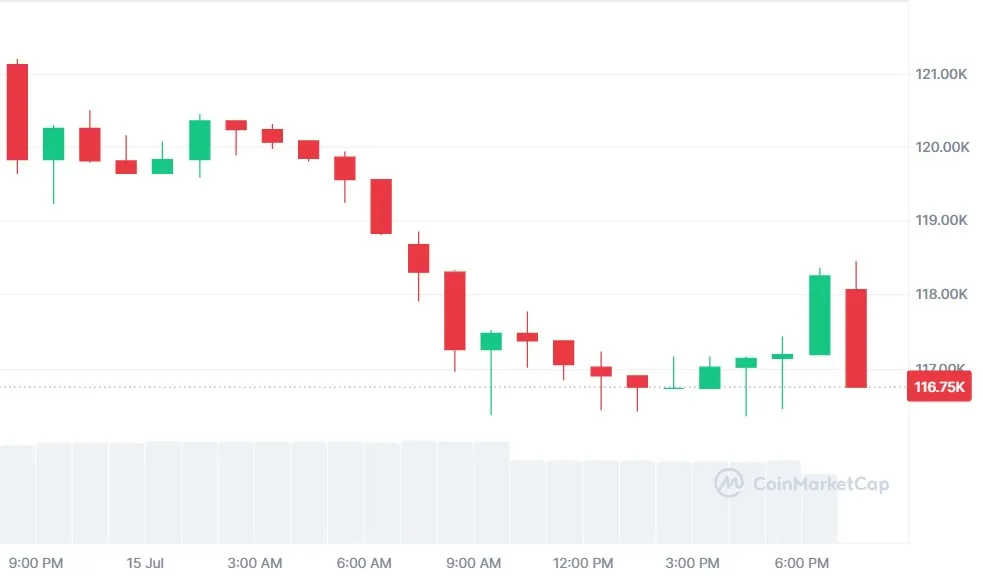

The CPI data crypto market today’s response was immediate. Bitcoin, which was trading at $118,000 ahead of the data drop, fell sharply to around $116,000, marking a nearly 4% slide as per CoinMarketCap. Volume also dried up, with a 47% plunge in daily trades, showing weak buyer interest.

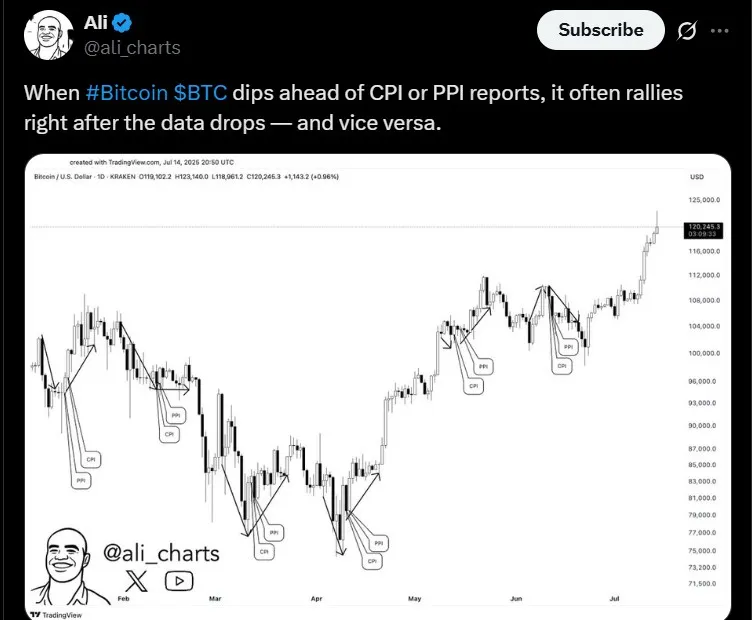

Before the data, popular analyst Ali had posted on X that Bitcoin typically rallies after CPI reports, especially when it dips ahead of time. But this time, that theory didn’t hold.

The $116K level is now being watched closely — if it fails, charts suggest a quick dive to $114K or even $112K could be next.

This isn’t just about charts. The June CPI forecast has changed the mood across all risk assets, and the pain is spilling over into altcoins.

Moments after Bitcoin's fall, the sentiment on X shifted. CryptoELITES boldly posted that this is the beginning of altcoin season, predicting explosive gains for projects like $ALT.

But the actual price boards tell a different story. Ethereum is down nearly 2%, while Solana, XRP, and Cardano all dropped over 5%. Traders are calling it a “fakeout altseason.”

The truth is, when Bitcoin bleeds, altcoins crash harder—especially when macro data like the US CPI inflation rate raises concerns over tighter financial conditions.

So, will altcoins rise soon? Not unless Bitcoin finds stability and macro uncertainty eases. Right now, fear is stronger than faith.

Markets are no longer reacting to just charts—they're watching Jerome Powell. With the CPI data affect BTC and altcoin prices so clearly, the Federal Reserve’s next move could redefine the short-term future of digital assets.

If inflation continues climbing in July, rate cuts could be pushed back further into 2026. That alone could make the crypto market more volatile, especially for altcoins. Investors are bracing for more pain unless clear bullish signals return.

And this time, the pressure isn’t just technical—it’s monetary policy, geopolitical tension, and trade-driven inflation all colliding into one.

The June CPI report crypto traders awaited has become a turning point. Inflation is back in the spotlight, and Bitcoin is struggling under the weight. The dream of a summer rally is fading fast, while altcoins face their own identity crisis.

Whether this marks the start of a longer downtrend—or a final shakeout before a rebound—will depend less on market sentiment and more on the Fed, inflation data, and global risk appetite. For now, it’s survival mode.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.