The financial world is in total shock because one of the metals just had a "Christmas Miracle." On December 27, 2025, Silver broke all its old records and jumped to over $79 per ounce.

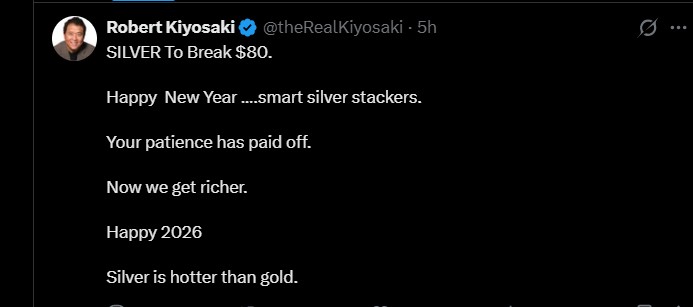

This huge move has everyone talking, especially because of the new Kiyosaki 2026 Silver Forecast. Robert Kiyosaki, the famous author of the book Rich Dad Poor Dad, went on X to celebrate.

He said, "SILVER TO Break $80. Happy New Year... smart metal stackers. Happy 2026."

Source: Robert Kiyosaki X Account

The asset moved from $78 to $79 in just 90 minutes! Now, everyone wants to know: Will Bitcoin price follow the same rally?

In his new post, Robert Kiyosaki Silver price prediction has been incredibly bullish. He thinks $80 is just the start and believes it could even reach $200 in 2026. This jump to $79.33 is a big deal because it shows how the metallic asset is ruling the safe-heaven asset rally, and becoming more valuable than even gold.

If you look at its price history as per the World of Statistics chart, it has been on a wild ride. It was only $5.52 in the year 2000, hit $49.80 in 2011, and now it is at $79.40. The metal is on its best annual run in nearly half a century.

Right now, the Kiyosaki 2026 Silver forecast, and BTC 2026 target are the hot topics because both of the assets are moving opposite on the charts. Let’s have a look at the TradingView price graph.

White Metal Price Surge

It is currently showing a strong bullish momentum. Experts use a tool called the RSI to see if a price is moving too quickly. Its RSI is at 89, which means it is "overbought."

It is trading above the upper Bollinger Band, signaling strong buying pressure.

This is a sign that the price might take a small break or drop back to $76.50 before it tries the $80 goal again.

Support Levels: $78.00 – $76.50

Resistance Levels: $80.00 – $82.00

Bitcoin Consolidation Phase

As per the latest btc price update, the official Tradingview price chart shows it is currently trading around $87,500. While commodity is "running," Bitcoin is "walking" sideways. For a BTC $90,000 breakout to happen, the trading volume needs to surge with the same energy they have for metallic assets.

RSI is near 48 -50, which means the token is neither overbought, nor oversold.

MACD is flat and slightly negative

Support Levels: $86,000 – $85,500

Resistance Zone: $88,800 – $90,000

At the moment, Bitcoin is not showing the same strength as other assets. According to the Kiyosaki 2026 Silver Forecast, it is in a strong breakout phase, while BTC is range-bound and waiting for a clear trendline.

If $BTC starts the same rally, here is what could happen:

Short-Term: As per crypto expert’s analysis, if it breaks above $90,000, it could hit $94,000 in just a few days.

Mid-Term: If the excitement continues, we could see a btc 2026 target of $105,000.

Long-Term: Over the next year, the price could even reach $120,000 to $150,000.

A well-known expert named Titan offered a unique bitcoin price analysis, suggesting a rotation strategy: “ "Sell white metal at $75. Buy Bitcoin at $89,000. He thinks $BTC is the better choice for the next ten years.

As 2025 ends, the Robert Kiyosaki 2026 silver forecast has changed how people think about money. The asset has already entered its breakout phase, proving that $80 can break anytime soon now.

Meanwhile, Bitcoin is sitting still, waiting for its turn to jump. So whether it follows the same style breakout or not, one thing is certain: 2026 is shaping up to be a historic year for hard assets.

Disclaimer: This article is for informational purposes only. Price predictions are based on current market trends and can change anytime as sentiment shifts. Always DYOR before making any investment decision in the cryptocurrency market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.