Overall Crypto Market Update:

The global cryptocurrency market cap stands at $3.24 trillion, reflecting a 2.6% increase in the past 24 hours.

Total crypto 24-hour trading volume is $150.2 billion.

Bitcoin dominates 56.8% of the market, while Ethereum holds 12.3%.

As per CoinGecko, currently tracking 19,201 cryptocurrencies.

The largest gainers right now are tokens from the Options and XRP Ledger Ecosystem.

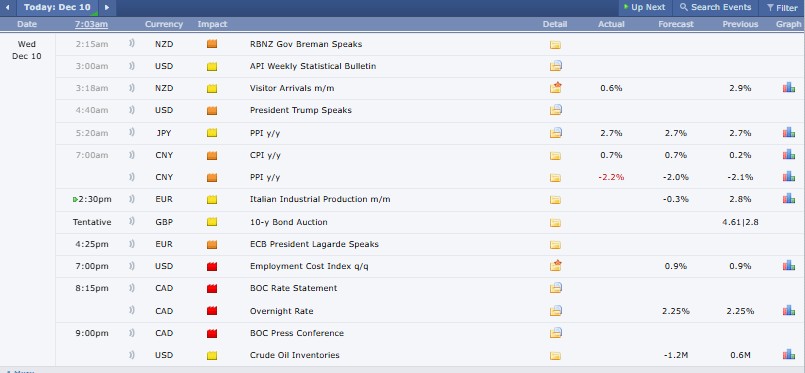

Source: Forex Factory

Bitcoin (BTC) and Ethereum (ETH) Price:

Bitcoin (BTC) is trading at $92263 up 2.68% in the last 24 hours, with a trading volume of $67.7 billion and a market cap of $1.84 trillion.

Ethereum (ETH) is priced at $3298.7, rising 6.28% in 24 hours with a trading volume of $32 billion and a market cap of $398.4 billion.

Top 5 Trending Coins in 24 Hours:

Bitcoin is trading at $92,083.22, up 2.08% in the past 24 hours, with a strong TV of $66.35B.

Ethereum stands at $3,292.05, gaining 5.89% in 24 hours and recording $32.1B in TV.

XRP is priced at $2.08, rising 1.23% over the last day, with a TV of $3.64B.

Solana trades at $137.87, posting a 3.64% 24-hour increase and generating $6.01B in TV.

Official Arox sits at $0.00002626, jumping 15.18% in the last 24 hours, backed by $15.29K in TV.

Top 3 Gainers in 24 hours

Pudgy Penguins’ PENGU is trading at $0.01253, up 10.28%, with a trading volume of $317.9 million.

Artificial Superintelligence Alliance’s FET stands at $0.2597, rising 9.07%, with a trading volume of $115.1 million.

Cardano’s ADA is priced at $0.4644, gaining 8.23%, supported by a strong trading volume of $1.40 billion.

Top 3 Losers in 24 hours

HYPE (Hyperliquid) is priced at $28.02 and shows a 4.45% drop, with a trading volume of about $403.28 million, marking it the biggest loser among the three.

Canton (CC) trades at $0.07303, losing 3.38% in the last session, supported by a trading volume of around $18.85 million.

Kaspa (KAS) stands at $0.04993, falling 3.31%, with an easily readable trading volume of about $51.64 million.

Stablecoins and Defi Update:

Stablecoins recorded no change in the past 24 hours, with a market cap of $312 billion and trading volume of $104.5 billion.

The Decentralized Finance (DeFi) market rose 3.8% in the last 24 hours, reaching a market cap of $116.6 billion, while total value locked (TVL) stands at $6 billion.

Source: Alternative Me

Today’s Fear & Greed Index sits at 26 (Fear), slightly higher than yesterday’s 22 (Extreme Fear) but below last week’s 28 and last month’s 29. The mild improvement suggests reduced panic, though markets remain tense due to recent volatility, profit-taking, and macro uncertainty keeping sentiment cautious.

1. SEC’s Atkins Backs Limited Oversight for ICOs

SEC Chair Paul Atkins said many ICOs shouldn’t be treated as securities, urging they fall under CFTC oversight. His stance could reopen ICO fundraising in the U.S. without new laws.

2. Coinbase Adds Hyperlane and Humidifi to Spot Trading

Coinbase announced spot trading for Hyperlane on December 10 and launched Humidifi trading on December 9. Hyperlane enables cross-chain messaging, while Humidifi is a Solana-based AMM DEX.

3. Real Finance Raises $29M to Boost RWA Tokenization

RWA network Real Finance secured $29M in private funding, led by Nimbus Capital’s $25M. Magnus Capital and Frekaz Group joined. The funds will expand compliance, build RWA tech, and support $500M asset tokenization.

4. France Eases Crypto ETN Rules

France’s AMF has softened its stance, allowing retail sales of crypto index ETNs and removing warning labels for eligible products, following the UK’s similar move in October.

5. Tajikistan Criminalizes Power Theft for Crypto Mining

Tajikistan now treats electricity theft for crypto mining as a crime, Asia-Plus reports. Offenders face fines of 15,000–75,000 somoni or 2–8 years in jail.

6. Zcash’s Optional Privacy Model Gains Attention

Zcash optional privacy design resurfaced as SlowMist founder Yu Xian said its traceable t-addresses aid regulation, while limited use of shielded addresses shows modest user demand.

7. JPMorgan Stays Bullish Despite Bitcoin Dip

JPMorgan says Bitcoin’s fall to $81,000 hasn’t broken the bull trend, citing rising stablecoin supply and a healthy ecosystem, even as Standard Chartered cuts its 2025 target.

8. Tempo Testnet Goes Live for Global Stablecoin Payments

Stripe and Paradigm’s payment chain Tempo has launched its public testnet, enabling low-fee stablecoin payments. Major firms, including Visa, Mastercard and Klarna, joined, setting up competition with Circle’s Arc.

9. HSBC Says US Debate on Tokenized Stocks Heats Up

HSBC reports rising tension in the US over regulating tokenized stocks, as Citadel seeks strict oversight while crypto leaders push decentralized rules. The SEC may consider a tighter framework or sandbox.

10. Debot Shifts Funds After Japan Server Security Alert

Debot warned users after detecting a security threat on its Japan server, moving funds to a secure Singapore wallet. While assets remain safe, users are urged to stop using old wallets immediately.

Given the current market sentiment of Fear (26) and ongoing volatility, investors should remain cautious. While strong gains in major assets like ETH and select altcoins show opportunity, rapid shifts and rising trading volumes suggest uncertainty. Short-term investments carry higher risk, but disciplined, research-backed positions in quality assets may still offer reasonable benefits.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.