Highlights:

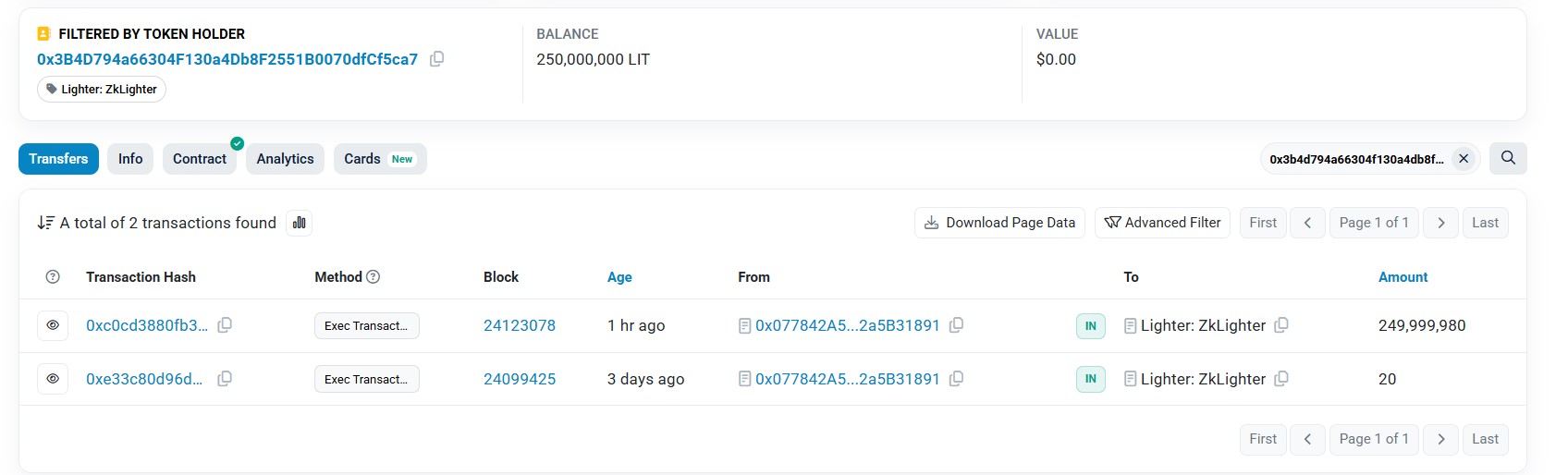

Lighter Token airdropped almost 250 million LIT tokens on-chain to its internal ZkLighter address.

The distribution of LIT tokens has already started, and it does not require users to claim them manually.

Airdropping of 25% of the total supply depends on the number of points gained in the activity seasons of 2025.

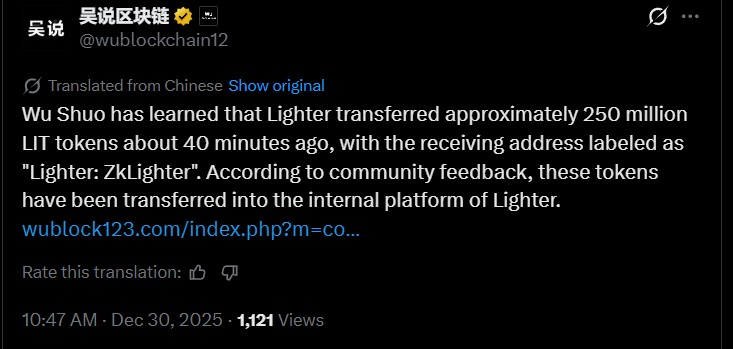

Lighter moved about 250 million LIT tokens to an internal wallet named ZkLighter. Community monitoring proved that the transaction was made approximately 40 minutes before the start of the discussion.

The tokens were not transferred to the external wallets but deposited into the internal system of the platform, according to the feedback.

This action is consistent with the project plan to automatically distribute LIT to qualified users without claims, indicating the beginning of live token distribution.

Source: Wu Blockchain X

On Discord, the distribution of LIT tokens has started, which was confirmed by the lightweight team members.

Users will not have to manually claim tokens, and balances will be displayed on their asset pages.

Its implementation is still in progress, and not all of the users can view their allocations.

According to community reports, the visibility will increase slowly as the distribution process is being completed on the eligible accounts.

Source: X

The supply is fixed and is divided equally between the ecosystem and team/investors.

Using the ecosystem allocation, 25% of the total supply is being distributed today via an airdrop that is pegged to points accumulated in 2025.

The other 25% is set aside for future points seasons, partnerships, and growth initiatives.

The team and investor tokens will have a one-year lock-up period and three-year linear vesting.

The breakdown of the allocation is 26% to the team and 24% to the investors.

Source: Official Account

LIT is used as an infrastructure and fee tokens in the ecosystem of Lighter. It has execution services, access levels based on staking, verification, and market data services. Financial products that enhance capital efficiency and risk-adjusted returns are also available to the holders.

The Lighter Token airdrop will be based on the points program, and the 2025 seasons 1 and 2 will earn 12.5 million points in total. According to community feedback, every point can be redeemed for around 20 LIT tokens.

Distribution is automatic in the platform, which removes gas fees or risks of claims. Sybil filtering has also been used by LIT to make sure that there is equitable distribution and to avoid abuse. The airdrop rollout is still going on,n and the balances are being shown out to users progressively.

Less emphasized partnership with strategic partners and investors, such as Robinhood and LIT on Coinbase. Such alliances are designed to enhance infrastructure creation and connect traditional finance with decentralized trading solutions based on Ethereum.

The Token Generation Event (TGE) is associated with the rollout of the airdrop, which officially introduced LIT as a native asset of the platform. The token is being issued by a C-Corporation registered in the U.S., which enhances regulatory transparency and helps Lighter to pursue its long-term ecosystem expansion strategies and decentralized infrastructure.

The project affirmed that 100% of the protocol revenue of its DEX and future products will be paid to holders. The decision to distribute revenue will be between ecosystem growth and token buybacks, depending on the market circumstances, and all operations can be observed on-chain.

The overall reaction to the launch by the community has been favorable, with the no-claim airdrop model and definite token utility motivating it. LIT's Pre-market trading price is said to have been valued at around $4, and some market participants estimate a fully-diluted valuation of between $1 and $2 billion.

Nonetheless, fake tokens and phishing schemes have also been reported by the users as interest is increasing in the initial Lighter Token listing date and trading stages.

The platform is a core building block to the future of finance, which is the bridge between DeFi and TradFi with verifiable, efficient infrastructure. The project will grow responsibly through transparent revenue sharing and long-term incentives to 2026 and beyond.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.