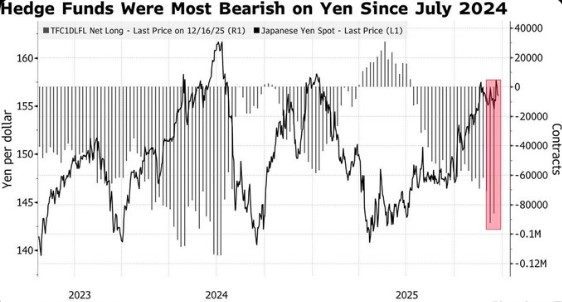

Hedge funds are positioning themselves more and more against the Japanese yen weakness, with about 85,000 net short contracts by the middle of December 2025, which is the second-highest number since July 2024. Just a week before this, the bearish positioning was 92,000, indicating that the investors are expecting the yen to devalue even more.

Source: Kobeissi Letter

The question is, what is driving this strongly bearish stance, and what will be its impact on everyday investors and cryptocurrencies like Bitcoin and Ethereum?

A short position is an investment strategy where a trader borrows, sells, and then buys back an asset (in this case, a currency) at a lower price after its value has dropped. When many traders do this, the total is called a net short position, showing widespread negative sentiment toward the currency.

In Japan’s case, hedge funds are shorting the domestic currency because:

The dollar has been gaining strength against the yen in recent months, hence the yen has become less attractive.

The interest rate gap between the U.S. (approximately 3.75-4.00%) and Japan (0.75%) is still very wide, discouraging investors from holding yen-denominated assets. They rather earn more yields in the dollar-based markets.

Despite inflation in Japan being above 2% (around 2.90% as of November 2025), Japan’s real interest rates remain deeply negative because policy rates are low, reducing the currency's appeal.

It somehow reminds the situation of last year, when the USD/JPY rate reached above 160, prompting the Japanese government intervention to defend the domestic money. The current build-up of bearish positions suggest renewed pressure on the currency.

The Bank of Japan is becoming more hawkish. In Q3 2025, BoJ withdrew ¥61.2 trillion from its balance sheet through QT (Quantitative Tightening), where BoJ aims to reduce its assets in an effort to strengthen its currency and combat inflation.

Core information on Japan’s current policy:

The policy interest rate of the BoJ is 0.75%, which is the highest level seen in 30 years but is still below the neutral level.

Inflation in Japan has broken the 2% threshold for four years.

Some members of the BoJ argue that further increases may be necessary periodically to support the yen.

The Bank of Japan still holds 52% of Japanese Government Bonds (JGBs), indicating that it is one of the major players in the financial markets.

The higher rates and QT make the yen volatile, meaning it fluctuates in value. In the past, the level of volatility within a country’s currencies led to investors looking at other options, including gold, silver, and cryptocurrencies.

A currency that is either depreciating or experiencing high volatility can cause investors to switch their interest to alternative places of value, such as:

Gold and silver, traditional hedges against currency weakness

Cryptos such as Bitcoin and Ethereum which are not bound by any geographical region or central bank

Adding to this, the country is moving to cut crypto taxes from the existing 55% to a fixed rate of 20% by 2028. The key features of the new taxation includes:

Profits from crypto trading are taxed separately.

Losses can be carried over for three years, enabling investors to offset their gains with the losses from past years.

Crypto profits are taxed the same way as stocks, making it easier and more predictable.

The proposed tax changes could potentially lead to a surge in cryptocurrency usage in Japan and enhance the operations of prominent exchanges like SBI, GMO, and Coincheck.

A weak yen, increasing interest rates, and favorable tax systems for cryptos are factors that create an attractive environment for cryptos.

Bitcoin, Ethereum, XRP, as well as other risk assets, could witness renewed buying as traders look for an alternative to the falling yen.

Moreover, if the yen’s value steadily remains low, it will be detrimental to the Japanese economy and currency. Even if crypto can be of some use to the country, the Japanese economy may be under pressure as a result of the value of its currency.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.