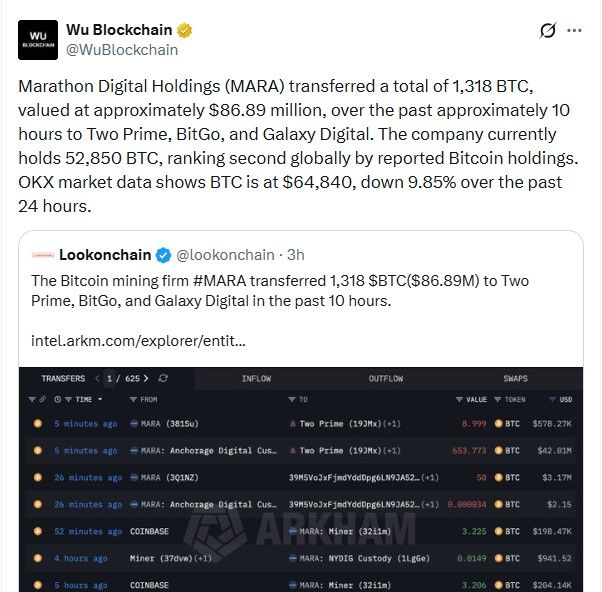

In a development drawing attention across digital asset markets, Mara moves 1318 BTC worth nearly $86 million to three major financial service providers — Two Prime, BitGo, and Galaxy Digital. The transaction comes at a time when Bitcoin is trading at $64,644.47, after dropping up to $60K, reflecting a nearly 9% decline in the past 24 hours, highlighting growing volatility.

Source: X official

Marathon Digital Holdings, widely recognized as the second-largest corporate Bitcoin holder, appears to be adjusting its treasury approach rather than reacting emotionally to price swings. Such repositioning often suggests preparation for uncertain conditions while keeping capital ready for potential opportunities.

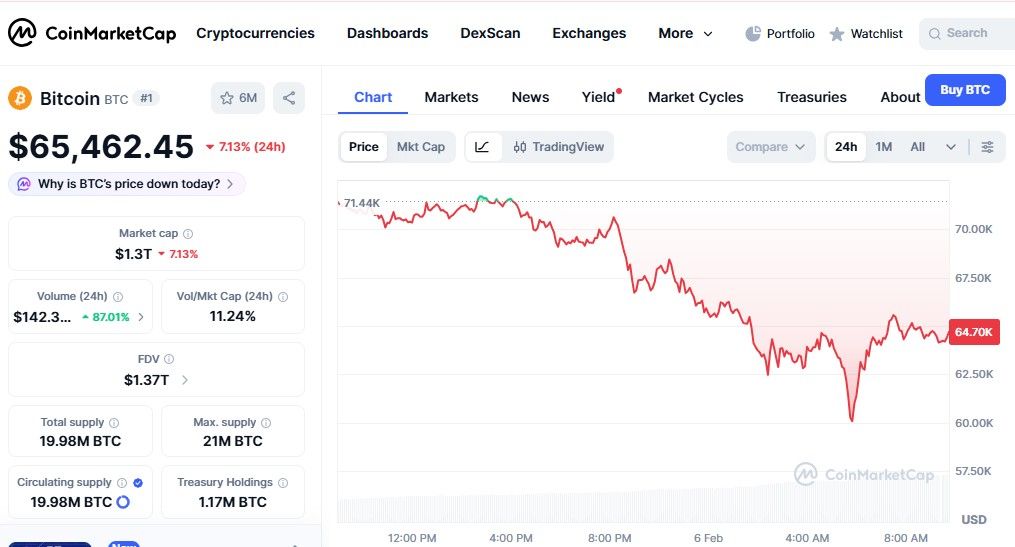

Source: CoinMarketCap official

The decision arrives during a weak phase for the broader crypto environment. Price pressure has forced many large entities to rethink how reserves are stored, financed, or deployed. Instead of allowing coins to remain idle, moving them into structured platforms can help firms enhance liquidity, improve security, or explore institutional financing options.

Executives across the mining sector have increasingly emphasized disciplined balance-sheet management. By acting early, Marathon signals that protecting profits accumulated during previous rallies may be just as important as pursuing future upside.

When Mara moves 1318 BTC, it reflects caution rather than fear. Analysts often interpret such activity as a calculated treasury step — one designed to maintain flexibility if valuations continue fluctuating.

Each recipient plays a distinct role within institutional crypto finance.

Two Prime operates as an asset manager focused on Bitcoin-based strategies. The company helps corporations generate yield, structure exposure, and manage risk through professional investment frameworks.

BitGo is known globally for secure custody infrastructure. It provides insured storage, regulatory-aligned compliance tools, and transaction services used by exchanges, funds, and public companies seeking enterprise-grade protection.

Galaxy Digital delivers a broad suite of financial solutions, including trading, lending, and asset management. Many institutions rely on its deep liquidity network and market expertise to execute large transactions efficiently.

Sending funds to these providers typically points toward structured planning rather than immediate selling pressure.

Strategic Timing in a Bearish Phase

Market cycles often reward preparation. With sentiment weakening, Marathon appears focused on safeguarding earlier gains while ensuring capital remains productive. Industry observers describe the move as a strategic adjustment aligned with long-term operational discipline.

A declining environment can also present attractive entry zones for future investments, acquisitions, or infrastructure expansion. Holding assets within professional platforms allows faster execution if favorable pricing emerges.

For that reason, when Mara moves 1318 BTC, many interpret it as forward-looking treasury management — not a retreat from Bitcoin conviction.

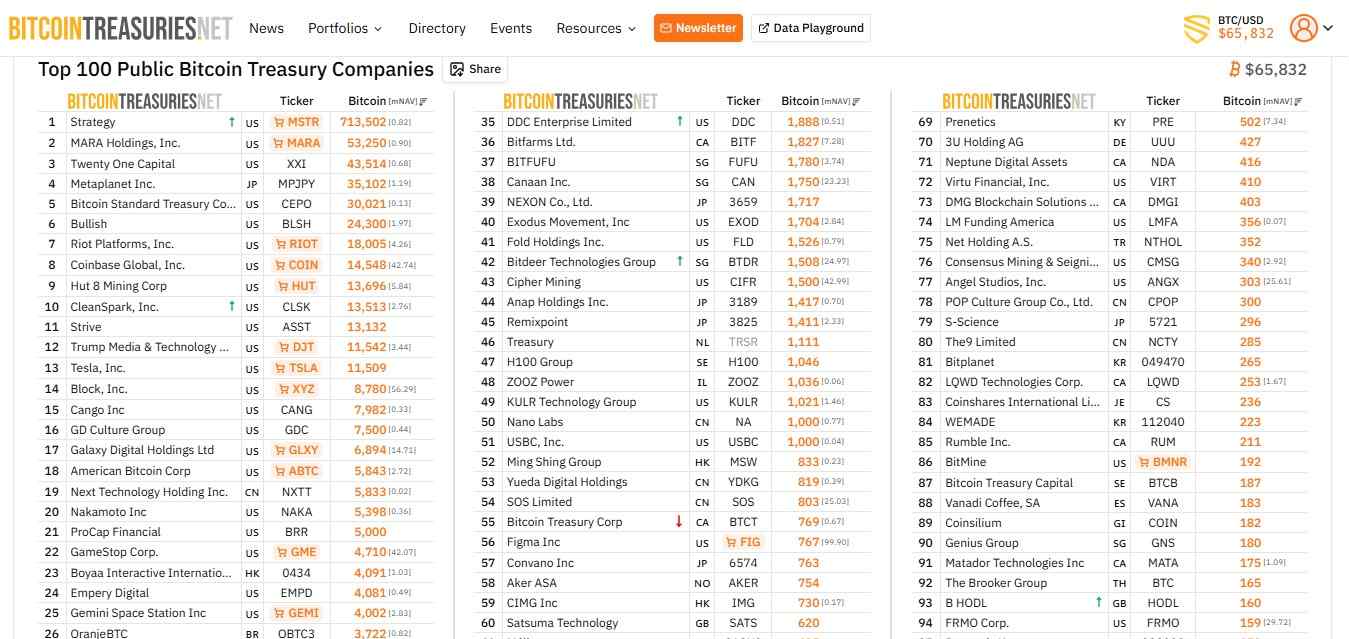

Corporate accumulation continues shaping supply dynamics. Three entities dominate this space:

MicroStrategy remains the largest holder with 713,502 BTC, reinforcing its aggressive accumulation philosophy.

Marathon Digital Holdings follows with about 53,250 BTC after the latest repositioning.

Twenty One Capital ranks third, controlling roughly 43,514 BTC.

Such concentrations highlight how institutional participation increasingly influences liquidity trends and investor sentiment.

Source: BitcoinTreasuries official

YMYL Description: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto markets involve risk and volatility.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.