The crypto market has taken a sharp hit, wiping out hundreds of billions in value within weeks alongside US stock markets. While there is no single trigger, growing signs of the US recession are widely estimated as an influencing factor into risk-off mode.

Although there is not any official confirmation of the economic crises in the state, rising layoffs, weak hiring, housing slowdown, and pressure in the bond market are fueling fears that a recession may be near.

Source: X Official

Job Market Weakens

One of the clearest reasons behind economic fear is the job market. In January 2026, companies reported 108,435 job cuts, the highest January figure since 2009, while JOLTS job openings fell to 6.9 million, well below expectations.

When layoffs rise and hiring slows together, it typically leads to weaker consumer spending. This directly hurts economic growth and pushes investors away from risk assets like cryptocurrencies.

Tech Debt Stress

Stress in the Tech credit market increases as many companies are struggling to manage debt:

Tech loan distress at 14.5%, the highest since 2022

Tech bond distress near 9.5%, the highest since late 2023

Around $25 billion in software loans are trading at deep discounts

Previously, both markets, crypto and stock, kept their performance separate from each other. But in recent years, they linked closely, and the crypto space reacts deeply in falls of stocks.

Housing Slowdown

Another point strengthening US recession fear is housing data. Home sellers in the nation are now outnumbering buyers by roughly 530,000, the largest gap ever recorded.

Housing plays a major role in the economy. Weak demand affects construction jobs, bank lending, and consumer confidence.

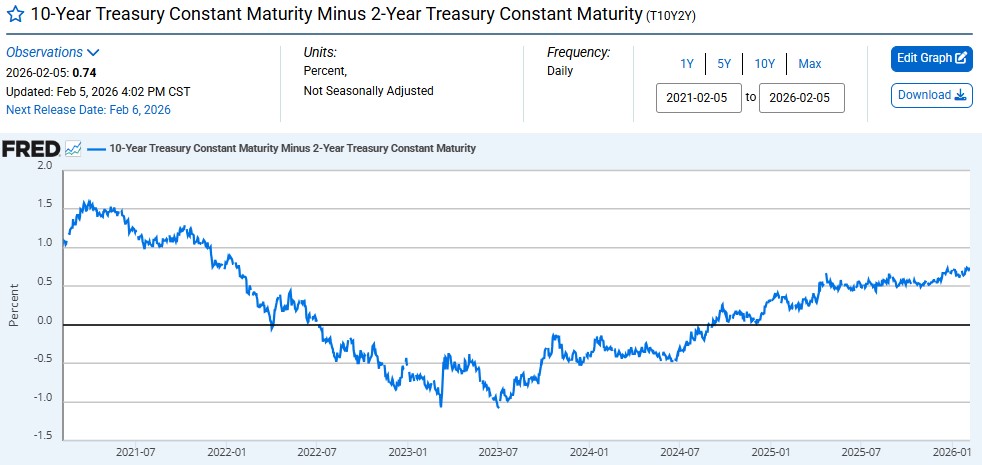

Bond Marketplace

While others are stating concerns, the bond market flashes warning signs. The 2-year vs 10-year Treasury yield spread has moved to around 0.74%, a shift known as bear steeping – long-term yields are rising faster than short-term yields.

Historically, this pattern has appeared before major recessions.

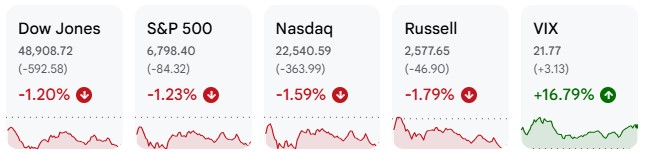

Talking about the U.S. Stock marketplace, it lost nearly $1 trillion. On counting majorly:

S&P 500 lost 84.32 points nearing -1.23%,

Dow & Jones dropped 1.20%,

Nasdaq down with 363.99 (-1.59%), and Russell (-1.79%,)

Source: Google Finance

On the other hand, the crypto market is trading more deeply. In the last 24 hours, the total crypto market cap dropped by about 8%, falling from roughly $2.42 trillion to $2.22 trillion, with an intraday low near $2.2 trillion, confirming the market-wide move, not limited to a single token or sector.

Source: CoinMarketCap

24-hour volumes jumped more than 80%, signaling forced liquidations instead of healthy repositioning. Data shows that over $1.34 billion in Bitcoin positions were liquidated in a single day.

Most of the top 100 cryptocurrencies traded in the red, several large altcoins, including XRP and Solana, recorded double-digit intraday losses, highlighting strong panic-driven selling.

The thing that makes this crash more attention gathering is the crypto’s growing link to traditional markets.

During this drop, crypto showed a 92% correlation with the S&P 500 and an 80% correlation with gold, suggesting the selloff was driven by macro factors such as interest rates, the US dollar, and equity weakness rather than crypto-specific news.

Looking at this, US recession fear can be a major reason behind the damage, though not the only one.

With economic data weakening, the Federal Reserve is now expected to break its rate cuts pauses, and give a clearer path toward easing, which could increase liquidity, reduce pressure on risk assets like equities and cryptocurrencies.

Historically, Bitcoin has fallen sharply during early recession phases but has also recovered strongly when central banks later ease policy. What happens next will depend on how deep the slowdown becomes and how the Federal Reserve responds.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.