Apple Bitcoin investment is gaining attention after Michael Saylor, chairman of MicroStrategy, publicly recommended that this tech giant buy this top crypto instead of continuing its $110 billion stock buyback program. This bold statement came after financial analyst Jim Cramer criticized Apple’s buyback strategy for its lack of results.

“Apple should buy Bitcoin,” Saylor tweeted on June 10, responding to Cramer’s remark that “the buyback is not working right now.”

Source: Bitcoin Magazine

The tech giant stock is down over 17% in 2024, while it has gained 17% during the same period. Over the past five years, it has risen more than 1,000%, while the top tier firm's stock has gained around 137%, sparking discussions on whether the crypto king is a better long-term asset.

This tech powerhouse had announced a buyback strategy to give value back to shareholders in May 2024, but with its stock in a funk, Saylor's suggestion that this currency could return higher dividends is worth considering—especially with volatility and inflation in today's market environment.

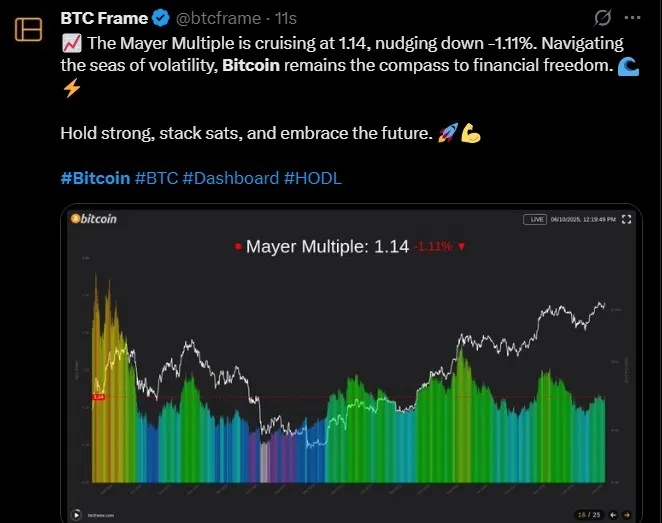

Meanwhile, the analytics platform BTC Frame highlighted that the Mayer Multiple—a tool for tracking if it is overvalued or undervalued—is sitting at 1.14, slightly down by -1.11%. Historically, this range signals a healthy opportunity for long-term accumulation.

Source: X

“Navigating the seas of volatility, it remains the compass to financial freedom,” BTC Frame posted alongside a colorful chart of Bitcoin’s Mayer Multiple performance.

Saylor's idea isn't completely new. On May 28, GameStop announced that it had bought 4,710 BTC for about $513 million, funded by a $1.3 billion offering of convertible notes. This relates to a trend of using tthe largest cryptocurrency as a treasury asset, particularly as a hedge against inflation and devaluation of the fiat currency.

MicroStrategy led by Saylor, now holds over 580,955 BTC , proving that corporate investment can yield impressive long-term gains.

If this top tier company were to follow Saylor’s advice, it could trigger a massive shift in how large corporations view treasury management. With growing institutional interest, declining returns on traditional stock buybacks, and solid long-term growth, this investment idea might not be as far-fetched as it seems.

As this currnecy sits in a favorable Mayer Multiple zone and companies like GameStop take the plunge, Saylor’s call could shape the future of corporate finance.

The world is watching to see whether Apple will make history—and make an Apple Bitcoin investment that could change everything.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.