Think about this: You buy Bitcoin, never sell it, and still end up with $14 billion in profit. That is not a wish—it is the reality for Microstrategy Bitcoin holdings Q2 2025.

With the currency reaching $107K, they have reported one of the largest unrealized gains (MSTR BTC profit) in corporate history. Even more impressive, the firm increased its total digital asset value by $21 billion in just one quarter.

So what exactly happened? And why are analysts saying $MSTR could explode past $440? Let’s break down the whole scenario

In Microstrategy Form 8-K July 2025 filing, the firm revealed a staggering $14.05 billion unrealized gain on its asset position. The update was also posted on the company's official X account, reaffirming the power of long-term accumulation.

Source: Strategy Official X Account

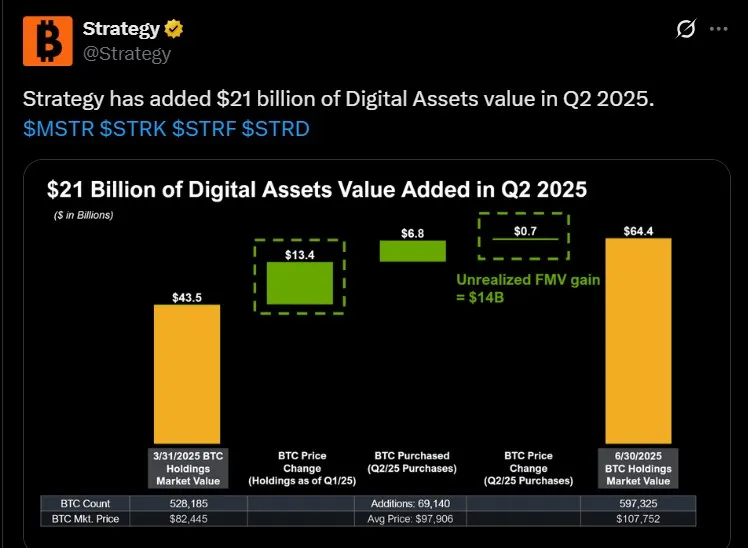

| MicroStrategy Bitcoin Holdings – April-June Period 2025 | |

|---|---|

| Start of Quater2 (March 31, 2025) | Crypto Held: 528,185 Total Value: $43.5B ($82,445) |

| BTC Price Growth on Existing Holdings | Unrealized Gain: $13.4B |

| New coins Acquired in April-June Period | Amount: 69,140 Avg Buy Price: $97,906 Cost: $6.77B Unrealized Gain: $0.7B |

| End of Q2 (June 30, 2025) | asset Held: 597,325 Total Value: $64.4B ($107,752) |

It’s performance wasn't just about profits—it also showcased strategic growth. With a total value increase of $21 billion, the firm is now firmly positioned as its biggest corporate whale.

MicroStrategy Bitcoin Holdings Q2 2025 perfectly sums up how a bold strategy and price rally created historic gains.

Total coins Held: 597,325 tokens

Asset Bought: 69,140 BTC

Microstrategy Bitcoin Average Price: $70,982

Total Carrying Value: $64.36B

Unrealized Profit: $14.05B

Deferred Tax Expense: $4.04B

Funding Method: Equity + Preferred Stock Offerings

This reflects financial discipline and effectively used fair value accounting to report actual digital asset gains.

Even with this historic $14 billion gain, the firm issued a word of caution to investors: Bitcoin price volatility could reverse these gains in future quarters, and impact the company’s financial performance.

Source: TradingView

At the time of writing, the token trades near $108,186, showing a 0.07% dip over the last 24 hours (source: TradingView). Being a crypto analyst, my observation says, these subtle fluctuations highlight how quickly fortunes in the crypto market can shift.

So while Q2 2025 was a massive win, the road ahead still depends heavily on how it performs in the coming months.

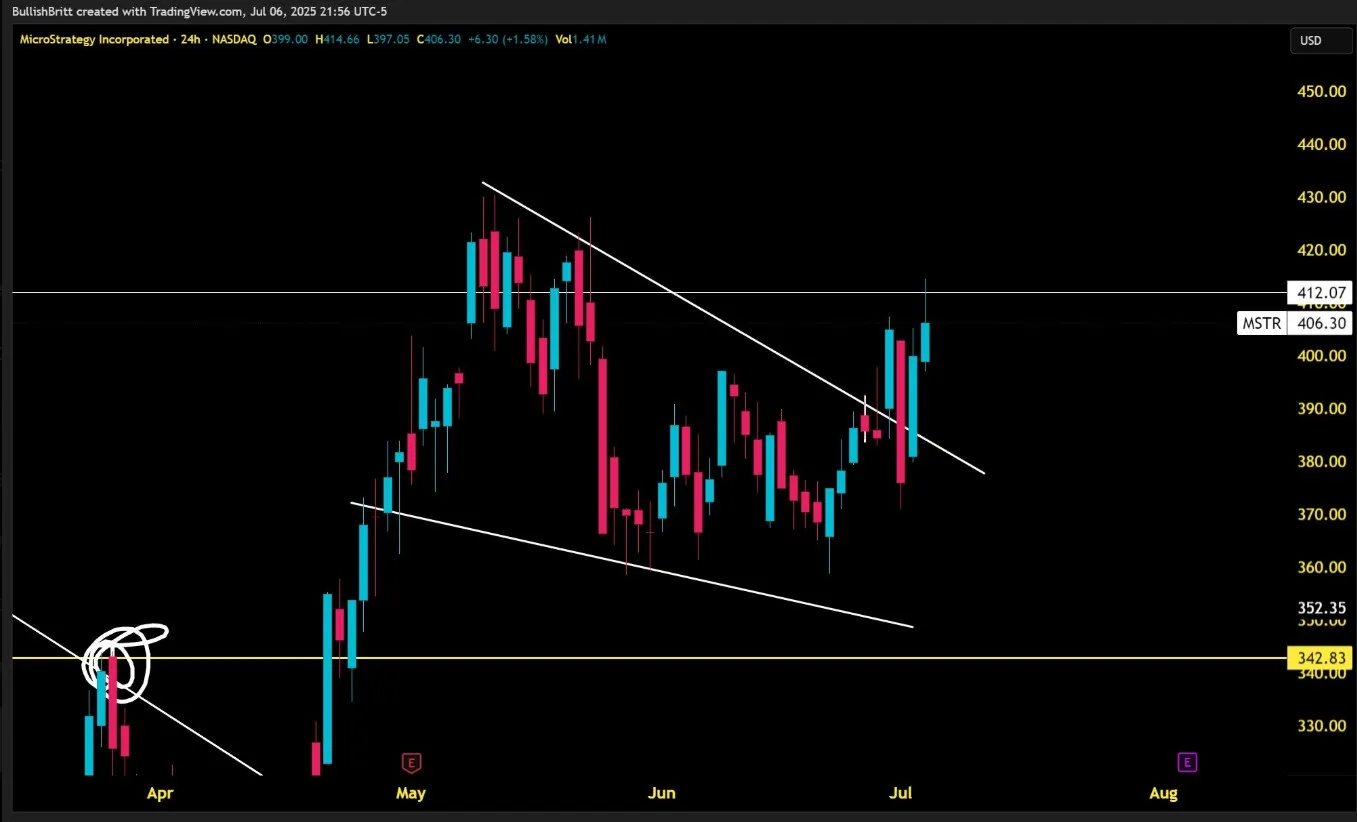

In the latest MSTR news, crypto analyst BRITT recently shared a technical chart on X indicating a “Bull Flag Breakout” pattern for this stock. If this plays out, the MSTR stock forecast for 2025 could easily cross $440 or higher.

Source: BRITT X Account

Given the company’s rock-solid fundamentals and growing position, investors are paying close attention as the company’s strategy continues to align with bullish price action.

Microstrategy Holdings Q2 2025 will go down as a landmark time. The firm’s conviction-driven strategy delivered:

A $14B MSTR Bitcoin profit

Over 69K coins added

No BTC sold

$21B boost in digital asset value

Whether the token goes higher or not, Q2 2025 will be remembered as a breakout quarter in the books of MicroStrategy—and a lesson in long-term belief in crypto.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.