The Moonbirds airdrop listing today is one of the most watched events in the NFT and Solana ecosystem. It is expanding beyond NFTs with $BIRB, its native ecosystem token. The project combines meme culture, community power, and scalable on-chain utility.

Moonbirds BIRB listing January 28 is a high-pressure market event where hype, claims, and price discovery collide at once.

Let’s explore the launch details, tokenomics, listing price and 2026 long-term target after multi-exchange debut.

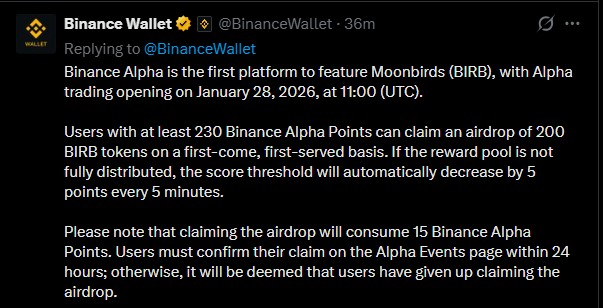

Binance Wallet announced that Binance Alpha will be the first platform to feature the token on January 28 at 11:00 (UTC). Users with at least 230 Alpha Points can claim an airdrop of 200 tokens on a first-come, first-served basis.

This Binance Moonbirds listing setup places the market entry in a high-activity environment. Users who receive free tokens often sell early, creating volatility. That is why the opening hours are expected to be highly active and unstable.

Along with Binance, MEXC and Bybit are also launching the token today with USDT 0 Fee Trading.

Zone Trading: Jan 28, 2026, 11:00 (UTC)

Convert: Jan 28, 2026, 12:00 (UTC)

Bitget debut will go live at 13:00 (UTC). KuCoin is also launching $BIRB with a 1M USDT airdrop from Jan 28, 13:10 to Jan 30, 13:10 (UTC). Traders can earn 0.025% of their position value every hour on new futures listings, with rewards up to 1,000 USDT per day. This equals 2,000%+ APY through hourly USDT airdrops.

Traders should know that the launch also introduces “Birb Game One.” The games are designed to help redistribute unclaimed tokens from the community pool back into the community. This mechanism supports healthier token circulation and rewards active participation.

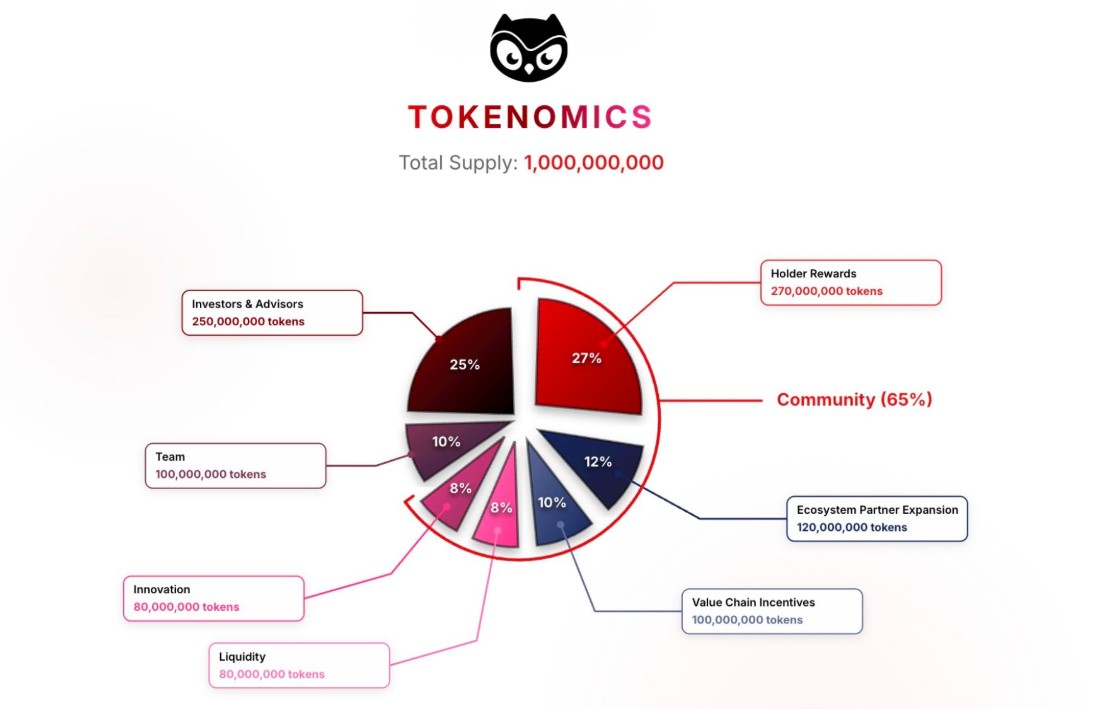

According to the official $BIRB X, the total supply is 1,000,000,000 tokens with a circulating supply of 285M coins at launch. NFTs receive 1/24th of allocations every month on the 28th and all the non-fungible tokens nesting within the first 7 days are treated as full-month participants.

How coins are distributed, let’s see:

65% is allocated to the community.

Holder Rewards: 27%

Ecosystem Partner Expansion: 12%

Value Chain Incentives: 10%

Liquidity: 8%

Innovation: 8%

Team: 10%

Investors & Advisors: 25%

Investor and team tokens are locked for 12 months and vested over the next 24 months. This structure aligns with long-term ecosystem growth while avoiding rushed market behavior.

Given strong exchange support, solid tokenomics, and rising momentum, the Moonbirds listing price could land between $0.10 and $0.15 in the initial hours. Early volatility is expected due to airdrop sell pressure.

If hype and momentum remain strong, price could target $0.20 to $0.50 in the first week. As per top cryptocurrency analysts at CoinGabbar, long-term expansion, innovation, and nesting rewards could support a $1 to $2.50 price range if adoption and partnerships grow steadily.

However, history shows NFT-linked launches usually follow this cycle: Airdrop hype → Claim pressure → Price chaos → NFT floor dips.

The real opportunity often appears after the noise settles.

The Moonbirds airdrop listing date and price marks a major shift for the BIRB NFT brand into full crypto utility. With strong tokenomics, major exchange support, and community-driven mechanics, price starts with momentum. Short-term volatility is expected, but long-term value remains bullish.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risk. Readers should do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.