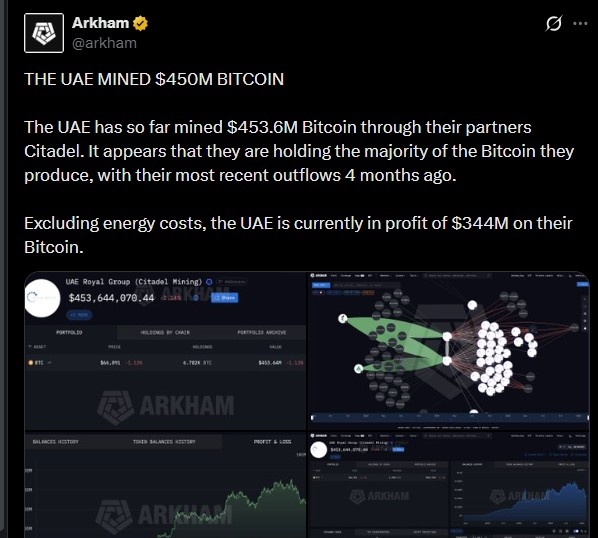

UAE Bitcoin Mining is drawing global attention after Arkham shared a major update on its official X account. The analytics firm stated: The UAE Mined $450M BIitcoin. According to the post, the nation has generated about $453.6M worth of Bitcoin through partner Citadel. The data suggests authorities retain most of the output, with the latest notable outflows occurring roughly four months ago. Excluding energy expenses, Arkham estimates an unrealized gain near $344M, highlighting how UAE Bitcoin Mining has turned into a significant strategic reserve story within digital asset markets.

Blockchain tracking shows sovereign-linked wallets hold about 6,300 BTC, currently valued $700M, depending on price movements. These reserves were produced through industrial operations rather than purchases or confiscations. Total output so far is estimated at 9,300 BTC, generated via Citadel , a publicly connected firm associated with the Royal Group through International Holding Company.

Key infrastructure details:

The facility launched in Abu Dhabi (Al Reem Island) in 2022

Approximately 80,000 square meters developed with Phoenix Group and IHC

Ownership connections point toward Abu Dhabi royal-linked entities, reinforcing the idea that UAE Bitcoin Mining operates as a sovereign accumulation program supported by large-scale energy and infrastructure investment.

The latest discovery positions the country among the largest state-level BTC holders worldwide. Unlike the United States or the United Kingdom, which mainly control confiscated digital assets, this approach focuses on direct production. That distinction signals a long-term national plan centered on converting energy resources into blockchain reserves.

Key significance:

Demonstrates energy-to-digital reserve transformation

Supports institutional confidence in sovereign crypto adoption

This model suggests governments may increasingly view mining as a strategic economic tool rather than purely private industry activity.

Large valuation gains stem from multiple structural factors. Production costs remained lower than prevailing market prices, while appreciation during recent market cycles increased portfolio value. As a result, headlines referencing $453mn generated value versus roughly $344M profit reflect comparative valuation analysis rather than realized income.

Explanation of the numbers:

Historical output converted to USD ≈ $453M

The current valuation of retained holdings is significantly higher

The difference produces about $344mn estimated gain

This figure represents mark-to-market performance because coins remain largely unsold. Mining expansion during 2022–2023 occurred when prices were lower, while industrial-scale infrastructure reduced energy expenses. Subsequent market growth across 2024–2025 amplified unrealized returns.

Arkham data indicates the most recent major movement happened about four months earlier. Estimated transfers reached roughly 2,900–3,000 BTC, valued between $180mn and $240mn depending on pricing. These flows included routing from reward wallets, treasury adjustments, and some distribution toward exchange-linked addresses.

Important interpretation:

Outflows do not automatically indicate liquidation

Transfers often reflect internal operational management

Mining organizations commonly move digital assets between custody solutions, OTC desks, treasury storage, or collateral arrangements. Therefore, the activity suggests financial structuring rather than a large sell-off narrative.

Overall, UAE Bitcoin Mining highlights a sovereign strategy combining infrastructure, energy advantage, and long-term digital reserve accumulation. Arkham data shows strong unrealized gains, controlled outflows, and growing global influence, positioning UAE Bitcoin Mining as a major government-level crypto development.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.