Highlights

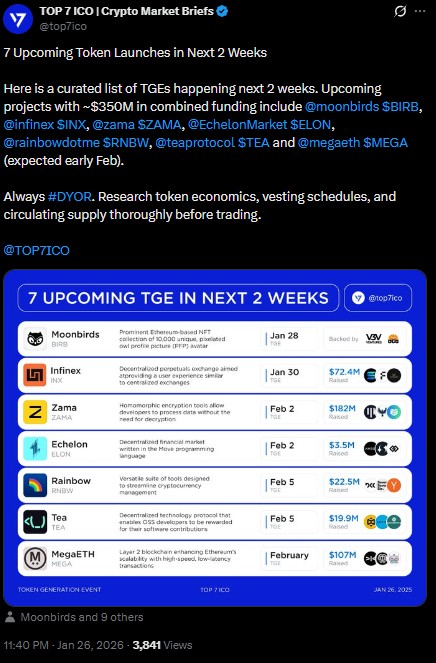

Despite fear, seven large Crypto Token Launches are rolling between January 28 and February 5, 2026.

The next TGEs include NFTs, DeFi, Layer-2 scaling, privacy, wallets, and open-source infrastructure, and total funding is almost $350M.

Although the trend is on the increase, data and teams are still warning traders against making decisions based on FOMO.

The cryptocurrency is set to have a high token launch week in the next two weeks as seven high-profile projects have already confirmed or indicated their Token Generation Events (TGEs). Such launches occur when the overall sentiment is still wary, but developer activity and institutional funding are robust.

NFT ecosystems and DeFi platforms, Ethereum scaling solutions, and open-source infrastructure are all examples of long-term bets that the future TGEs continue to take. Although these launches usually serve as catalysts in the short run in the market, historical evidence reveals that initial price performance can be unstable. Thus, thorough research is necessary.

Source: CryptoMarketBrief X

1. Moonbirds (BIRB)

Moonbirds is releasing its $BIRB token on January 28, 2026, on the Solana blockchain. The team has stressed that this launch is a step and not a finish, and it is time the community would not trade on hype. The tokenomics will be announced soon, and the announcement has already raised the popularity of the Moonbirds ecosystem.

2. Infinex ($INX)

The Infinex TGE will be held on January 30, 2026. The customers will be given INX tokens at a predetermined ratio of 1 Patron = 100,000 INX. Notably, Infinex has assured that the Craterun program and major milestone rewards will remain the same after the TGE.

3. Zama ($ZAMA)

Zama is likely to release its $ZAMA token during this same period. Zama, known as the developer of the fully homomorphic encryption (FHE), is working on privacy-sensitive blockchain applications, and it is among the few privacy-centric projects that are close to launching a token.

4. Echelon Market ($ELON)

ELON is the token of Echelon Market that will be introduced on the Aptos network on February 2, 2026. The project has been proactively involving its community before the TGE by means of partnerships and promotion campaigns, which is a good indication of a strong ecosystem momentum.

5. Rainbow Wallet ($RNBW)

Rainbow Wallet will release $RNBW on February 5, 2026. The airdrop snapshot is already done, and the users will get tokens directly in the Rainbow app without an airdrop checker. A permissionless Uniswap auction starts on February 2 with fair on-chain price discovery.

6. Tea Protocol ($TEA)

On February 5, 2026, Tea Protocol launches $TEA through Aerodrome. The project is also positioning itself as infrastructure-first, open-source sustainability, long-term liquidity, and real utility, as opposed to short-term speculation.

7. MegaETH ($MEGA)

The $MEGA token Launch of MegaETH will take place in early February. The Ethereum Layer-2 project boasts of real-time performance of over 100,000 TPS and has attracted over 107 million dollars in investments from prominent investors. No airdrop has been verified, though traders are paying close attention to pre-market signals.

Such launches are indicative of the direction of capital and development even in the wary market periods. The infrastructure-intensive projects tend to influence the future market cycles rather than immediate price movement, and so this period is significant in terms of more than short-term trading.

High fully diluted valuations and low circulating supply.

Vesting plans and unlocks.

Post-listing volatility in the short term.

Fragmentation in the liquidity between exchanges.

The following two weeks are the most important in the history of cryptocurrency releases in various industries. Although good funding and technology lend some credibility, TGEs are risky events. Investors are advised to pay attention to the fundamentals, tokenomics, and utility in the long term, not to the hype in the industry.

Disclosure: The article is informational only and does not amount to financial advice. The investment in cryptocurrency is prone to market risks. Investment decisions should be made by yourself, not by others.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.