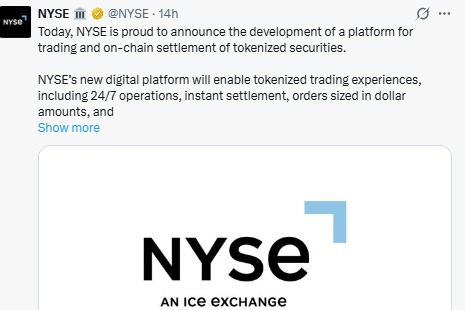

The New York Stock Exchange has made a powerful move that could reshape global trading. With its new NYSE Blockchain platform, the stock market is stepping into a future where trading never sleeps, settlements happen instantly, and stocks work like digital assets. This is not a small upgrade. It is a complete shift in how markets are built and how money flows.

For the first time, one of the world’s most trusted financial institutions is openly building on blockchain rails. It shows that traditional finance is no longer watching crypto from a distance. It is now adopting its technology.

The NYSE Blockchain platform will allow U.S. stocks and ETFs to be traded 24 hours a day, seven days a week.

Source: X (formerly Twitter)

Investors will be able to buy fractional shares, fund trades with stablecoins, and get instant settlement.

But the most important part is this: ownership does not change.

Investors will still own real shares.

They will still receive dividends.

They will still have voting rights.

Only the system that moves money and confirms trades is changing.

Instead of waiting one or two days for settlement, trades will be completed almost instantly.

This reduces risk, saves time, and opens markets to people across all time zones.

Tokenized stocks are regular shares represented as digital tokens on a blockchain. Under this model, these tokens are fully regulated and connected to real securities.

This brings big advantages:

Faster trading

No settlement delays

Access outside banking hours

Easier global participation

Lower operational friction

This is not crypto trying to fit into Wall Street. This is Wall Street choosing blockchain.

NYSE’s parent company ICE is working with major banks like BNY and Citi to move money and collateral on-chain. This allows institutions to manage funds even when banks are closed.

Stablecoins will be used to fund trades. This gives the NYSE Block-chain true 24/7 functionality. Money can move at any time, across borders, without waiting for traditional banking hours.

This is exactly how crypto markets already work. Now stock markets are adopting the same structure.

When markets never close, price updates must never stop. It depends on high-quality, real-time pricing coming directly from institutions.

This is where systems like Pyth become important. Pyth is built for always-on markets and provides accurate prices from real market sources. With support from partners like Blue Ocean, which supplies U.S. equities data beyond normal hours, Pyth helps make 24/7 trading possible.

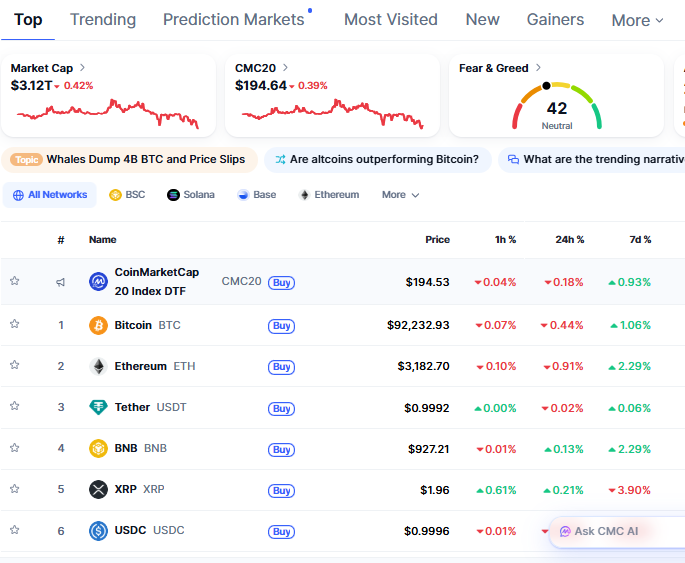

The current crypto market shows calm but steady confidence. The total market cap is around $3.12 trillion, slightly down by 0.42%. The Fear & Greed Index is at 42, showing a neutral mood.

Source: CoinMarketCap Data

Bitcoin is trading near $92,200, while Ethereum is around $3,180. Prices are stable, and there is no panic in the market. This kind of environment is perfect for big institutions to build long-term systems like the NYSE Blockchain.

Right now, the NYSE Blockchain runs on permissioned blockchains. This means access is controlled for safety and regulation. It makes sense at this stage because financial laws must be followed strictly.

But history shows that systems evolve. Just like Bitcoin ETFs came after years of indirect exposure, public blockchains may become part of NYSE’s system in the future once rules allow it.

YMYL Disclaimer: This article is for informational purposes only, kindly do your own research before investing in the crypto markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.